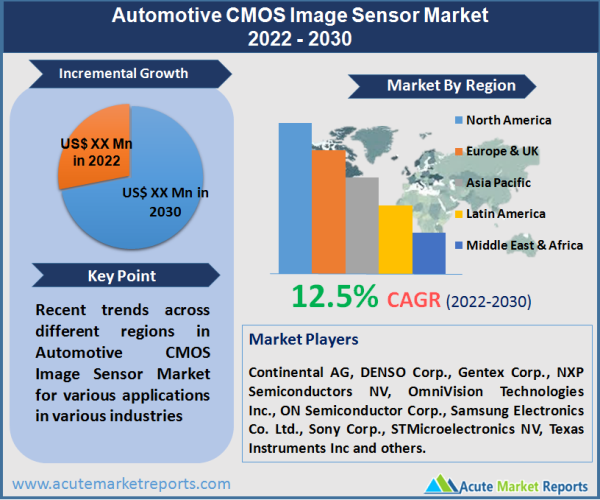

The automotive CMOS image sensor market is anticipated to grow at a CAGR of 12.5% during the forecast period of 2026 to 2034. The CMOS image sensorsare increasingly being installed in automobiles in order to provide fool proof security and safety. The growing popularity of advanced driver assistance systems (ADAS) is also driving up the need for image sensors to be used in automobiles. Several companies that specialise in the development of sensor chips are launching innovative solutions to meet the increasing needs for safety and convenience.

Rising Demand for ADAS Remains as the Largest Driver

One of the most important factors contributing to the expansion of the market is the rising sale of ADAS technologies in automobiles. The governments of various nations all over the world are gradually developing regulatory regulations, with the goal of encouraging the adoption of a variety of different ADAS systems in the automobiles that are being manufactured. For instance, in the U.S., 33 states proposed laws relating to autonomous vehicles in the year 2017, while in the year 2018, 15 states adopted 18 bills connected to the same topic. As a result, the encouraging actions made by the governments of many countries are contributing to the rising need for sophisticated camera sensors.

Rear View ADAS Dominating the Market In terms Of Revenues and Growth

Rear view ADAS dominated the market in 2022 and is also anticipated to grow at the fastest pace during the forecast period 2026 to 2034. CMOS advanced driver-assistance system (ADAS) refers to the semiconductor systems that help the driver with sophisticated safety systems including parking control and road safety by providing a secure human-machine interface. These systems do this with the assistance of high-quality CMOS image sensors. Semiconductor systems are usually included in ADAS systems. These systems may include electronic controller units, microcontroller units, or electric power devices. The COMS sensors are utilised for the purpose of detecting objects, the condition of the road or parking lot, potholes, and any other obstacles that may impede the passage of an automobile. The CMOS sensor ADAS is now being developed to incorporate for the detection of the car from all sides. The Front-View ADAS system provides the driver with assistance for the front outside section of the vehicle, which is beneficial not only while driving but also when parking the vehicle. The same is true for ADAS systems that provide a view to the side as well as those that provide a view to the rear, although it is anticipated that the rear-viewing ADAS will achieve the highest market share as a result of its extensive implementation in the majority of the upcoming mid-range and premium passenger vehicles.

Semi-autonomous Vehicles Dominated the Market Due to Increased Demand

Semi-automated vehicles dominated the market in 2022 and as fully autonomous vehicles are yet to be commercial launched at large scale level. A semi-autonomous vehicle can have an autonomous level anywhere from one to three, depending on the specific model. Due to the fact that a greater number of CMOS image sensors have been seen to be implemented in semi-autonomous vehicles, it is anticipated that semi-autonomous would acquire the maximum market share even during the forecast period. These include dynamic driving duties and driverless operation on roads that are completely devoid of traffic.

In-Cabin Applications Largely Used in Premium Passenger Vehicle

The in-cabin sensor is increasingly being installed in luxury passenger vehicles. This not only improves the safety of the vehicle's occupants but also makes it more difficult to steal. The CMOS sensors located inside the vehicle's cabin are able to monitor the driver's eye contact at all times. If the driver nods off or shows signs of being drowsy while behind the wheel, the vehicle will quickly activate an alarm of some kind in order to prevent an accident from occurring. One further feature worthy of attention is the car's built-in face recognition system, which can identify the true owner of the vehicle as well as any drivers who have been pre-registered.

North America Dominating the Automotive CMOS Image Sensors Market

In 2022, the market for automotive CMOS image sensors was led by the North American region's market, which held the largest share. The Asia-Pacific region is expected to experience the CAGRthroughout the forecast period. This is primarily attributable to the region's extensive growth in the automotive industry as well as its extreme penetration towards the commercialization of driverless autonomous cars. The contributions that China, Japan, and India make to this region are among the most important and beneficial.

The market for automobile CMOS image sensors is also considerable in Europe. The most important factor influencing growth in this region is increasing demand for connected vehicles and the rising popularity of ADAS for motor vehicles. Furthermore, the mandatory policies that have been implemented by the European Union (EU) under the General Safety Regulation that have been amended as of 2018 in regard to the installation of certain safety features in vehicles is further contributing to the growing popularity of these sensors in this region. These policies were implemented as part of the General Safety Regulation.

Automotive CMOS Image Sensors Market Remains Moderately Fragmented

The market for CMOS image sensors is very competitive as a result of the large number of players who are currently operating in the market and offering their products to both domestic and international markets. The market looks to have a moderate degree of concentration, with key firms employing strategies such as product innovation, expansions, and alliances in order to remain one step ahead of the competition and broaden their market reach. Key companies dominating the market include Continental AG, DENSO Corp., Gentex Corp., NXP Semiconductors NV, OmniVision Technologies Inc., ON Semiconductor Corp., Samsung Electronics Co. Ltd., Sony Corp., STMicroelectronics NV, Texas Instruments Inc and others.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive CMOS Image Sensor market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Resolution

|

|

Vehicle Type

|

|

Vehicle Autonomy

|

|

Application

|

|

Placement

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report