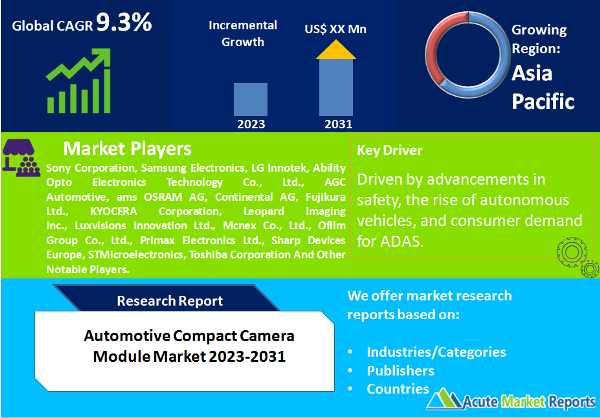

Automotive compact camera module market is expected to grow at a CAGR of 9.3% during the forecast period of 2026 to 2034. The automotive compact camera module market plays a pivotal role in enhancing vehicle safety, offering a wide array of camera modules catering to diverse functionalities. The automotive compact camera module market is on an upward trajectory, driven by advancements in safety, the rise of autonomous vehicles, and consumer demand for ADAS. While cost pressures pose a challenge, market segmentation by type and component, along with regional growth trends, indicates a promising future for this dynamic market. In the period from 2026 to 2034, the industry will witness continued innovation and technological evolution, ensuring that camera modules remain pivotal in shaping the future of automotive safety and autonomy.

Advancements in Vehicle Safety

The pursuit of enhanced vehicle safety, driven by regulatory mandates and consumer demand, is a primary driver of the automotive compact camera module market. Manufacturers are integrating advanced camera modules for features like Forward Collision Warning (FCW) and Lane Departure Warning (LDW) systems. In recent years, global safety standards such as Euro NCAP and NHTSA have become more stringent, encouraging automakers to equip their vehicles with advanced safety features. As a result, the adoption of camera modules for applications like Automatic Emergency Braking (AEB) and Blind Spot Detection (BSD) has surged.

Rise in Autonomous Vehicles

The growing development and testing of autonomous vehicles represent a significant driver for the automotive compact camera module market. These vehicles heavily rely on camera modules for perception and decision-making, bolstering the demand for high-performance camera solutions. From 2026 to 2034, the automotive industry is expected to witness an increasing number of autonomous vehicle trials and deployments. Camera modules are integral to these vehicles, enabling functions such as object detection, pedestrian recognition, and traffic sign recognition.

Consumer Demand for Advanced Driver Assistance Systems

Increasing consumer awareness and demand for Advanced Driver Assistance Systems (ADAS) are propelling the automotive compact camera module market. Consumers seek vehicles equipped with features like adaptive cruise control, lane-keeping assist, and traffic sign recognition, which rely on camera modules. Market surveys and consumer preferences indicate a rising inclination towards vehicles equipped with ADAS features. As ADAS technologies become standard offerings, camera modules are expected to witness greater integration into passenger vehicles.

Cost Pressures

Cost pressures are a significant restraint in the automotive compact camera module market. While there is a growing demand for advanced camera solutions, price sensitivity in the automotive industry remains a critical consideration, especially for mass-market vehicles. The period from 2026 to 2034 will see intense competition in the automotive industry, leading to cost constraints. Automakers will face the challenge of incorporating advanced camera modules without significantly increasing vehicle prices.

Market Segmentation by Type: The Driver Monitoring System Camera Module Dominates the Market

The automotive compact camera module market can be segmented by the type of camera modules used in vehicles. In 2025, the Driver Monitoring System Camera Module is anticipated to exhibit the highest revenue and CAGR due to the increasing focus on driver safety and monitoring. The forecast for 2026 to 2034 highlights the escalating demand for Driver Monitoring System Camera Modules. These modules play a crucial role in ensuring driver attentiveness and alertness, aligning with evolving safety regulations.

Market Segmentation by Component: Image Sensors Dominate the Market

The market segmentation by component identifies various elements that constitute camera modules. In 2025, Image Sensors is projected to hold the highest revenue and CAGR, underscoring their significance in capturing high-quality images and videos. Image Sensors will remain a cornerstone component of camera modules in the forecast period from 2026 to 2034. The continuous development of image sensor technologies, including CMOS and CCD sensors, will contribute to their dominance.

APAC Remains as the Global Leader

Geographic trends in the automotive compact camera module market are influenced by regional automotive production, consumer preferences, and regulatory environments. In 2025 and expected from 2026 to 2034, Asia-Pacific is poised to lead in terms of revenue and CAGR, attributed to the robust automotive manufacturing landscape in countries like China and Japan. The Asia-Pacific region will continue to be a manufacturing hub for the automotive industry, fostering the demand for camera modules. Additionally, growing awareness of safety features among consumers in the region will drive the adoption of ADAS-equipped vehicles. The Middle East and Africa (MEA) region is expected to experience the highest Compound Annual Growth Rate (CAGR) during the forecast period from 2026 to 2034. The growth can be attributed to the increasing incorporation of camera modules in commercial vehicles and the expansion of the automotive market in MEA.

Market Competition to Intensify during the Forecast Period

The automotive compact camera module market is fiercely competitive, with key players such as Sony Corporation, Samsung Electronics, LG Innotek, Ability Opto Electronics Technology Co., Ltd., AGC Automotive, ams OSRAM AG, Continental AG, Fujikura Ltd., KYOCERA Corporation, Leopard Imaging Inc., Luxvisions Innovation Ltd., Mcnex Co., Ltd., Ofilm Group Co., Ltd., Primax Electronics Ltd., Sharp Devices Europe, STMicroelectronics and Toshiba Corporation leading the market. In 2025 and as expected from 2026 to 2034, these players are anticipated to maintain their positions by continually innovating camera module technologies, expanding product portfolios, and forming strategic partnerships. Leading camera module manufacturers are poised to invest in research and development, aiming to enhance image sensor capabilities, reduce form factors, and improve overall performance. Collaborations with automakers and Tier-1 suppliers will further bolster their market presence.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Compact Camera Module market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Component

|

|

Lens Type

|

|

Vehicle Type

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report