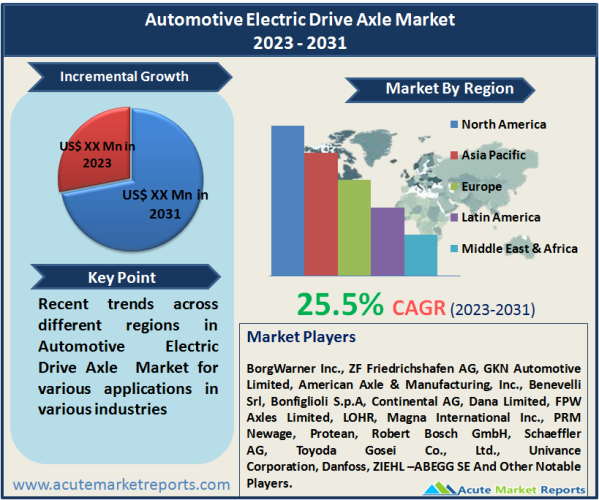

The automotive electric drive axle market is expected to grow at a CAGR of 25.5% during the forecast period of 2026 to 2034, automotive electric drive axle market plays a pivotal role in the evolution of electric and hybrid vehicles, transforming the way power is delivered to wheels. the automotive electric drive axle market is driven by the increasing demand for electric and hybrid vehicles, technological advancements, and government incentives and regulations. While high initial costs remain a restraint, the market remains dynamic and resilient. Market segmentation by type and drive type caters to diverse vehicle requirements, and geographic trends are influenced by government policies and infrastructure development. Competitive players are expected to innovate and collaborate to maintain their market presence in the forecasted period.

Growing Demand for Electric and Hybrid Vehicles

The primary driver of the automotive electric drive axle market is the growing demand for electric and hybrid vehicles worldwide. Consumers and governments are increasingly focused on reducing carbon emissions and transitioning to cleaner, more sustainable transportation options. The global electric vehicle (EV) market witnessed substantial growth in 2025, with numerous automakers introducing new electric models and expanding their EV portfolios. Government incentives, stricter emissions regulations, and rising environmental awareness have fueled the demand for electric and hybrid vehicles, driving the need for advanced electric drive axles.

Technological Advancements in Electric Drive Axles

Technological advancements have played a significant role in driving the automotive electric drive axle market. Innovations in motor design, power electronics, and control systems have led to the development of more efficient and compact electric drive axles. In 2025, automakers and technology companies invested heavily in research and development to improve electric drive axle performance. These innovations resulted in higher power density, regenerative braking capabilities, and improved energy efficiency, enhancing the overall driving experience for electric and hybrid vehicle owners.

Government Incentives and Regulations

Government incentives and regulations have provided a significant boost to the automotive electric drive axle market. Many countries have introduced financial incentives, tax credits, and emissions reduction targets to promote the adoption of electric and hybrid vehicles. In 2025, governments worldwide announced ambitious plans to phase out internal combustion engine vehicles and promote electric mobility. These initiatives included subsidies for electric vehicles, charging infrastructure investments, and stricter emissions standards, creating a favorable environment for electric drive axle manufacturers.

High Initial Costs

A notable restraint affecting the automotive electric drive axle market is the high initial costs associated with electric and hybrid vehicles. While the long-term operational savings are significant, the upfront price of these vehicles can be a deterrent for some consumers. In 2025, electric and hybrid vehicles generally carried a higher price tag compared to their traditional internal combustion engine counterparts. The cost of batteries, electric drive axles, and other advanced components contributed to this price disparity, limiting the adoption of electric vehicles, especially in price-sensitive markets.

Market Segmentation by Type (E-axle, Hybrid Axle): E-axles Dominates the Market

The automotive electric drive axle market can be segmented by type into two categories: E-axle and Hybrid Axle. In 2025, E-axles accounted for the highest revenue, driven by the increasing adoption of fully electric vehicles. E-axles integrate the electric motor, power electronics, and gear into a single unit, simplifying the integration of electric powertrains into vehicles. In 2025, automakers across the globe launched electric models featuring E-axles, contributing to their dominance in the market.

Market Segmentation by Drive Type (Front Wheel Drive, Rear Wheel Drive, Wheel Drive): front-wheel-drive electric vehicles Dominate the Market

The market segmentation by drive type offers customers a choice of drive configurations to suit their vehicle requirements. In 2025, front-wheel-drive electric vehicles generated the highest revenue, particularly in compact and mid-sized EV segments. Front-wheel-drive electric vehicles are known for their efficiency and packaging advantages, making them popular choices among automakers for city and suburban electric vehicles. The demand for rear-wheel-drive and all-wheel-drive configurations also increased in 2025, as automakers diversified their electric vehicle offerings.

North America to Lead the Growth

Geographic trends in the automotive electric drive axle market are influenced by factors such as government policies, infrastructure development, and consumer preferences. In 2025, regions with strong government support for electric mobility and robust charging infrastructure led in terms of both revenue and production. Countries in Europe, such as Norway and the Netherlands, witnessed a significant surge in electric vehicle adoption in 2025 due to generous incentives and extensive charging networks. Additionally, China remained a major hub for electric vehicle production and sales, driven by government mandates and incentives. Looking forward to the period from 2026 to 2034, North America is expected to exhibit the highest CAGR. This projection is supported by increasing investments in electric vehicle manufacturing, charging infrastructure expansion, and consumer willingness to embrace electric and hybrid vehicles.

Market Competition to Intensify During the Forecast Period

The automotive electric drive axle market features intense competition among various manufacturers and suppliers. In 2025, top players such as BorgWarner Inc., ZF Friedrichshafen AG, GKN Automotive Limited, American Axle & Manufacturing, Inc., Benevelli Srl, Bonfiglioli S.p.A, Continental AG, Dana Limited, FPW Axles Limited, LOHR, Magna International Inc., PRM Newage, Protean, Robert Bosch GmbH, Schaeffler AG, Toyoda Gosei Co., Ltd., Univance Corporation, Danfoss and ZIEHL –ABEGG SE were prominent in the market, collectively contributing significantly to industry revenues. These leading companies have adopted various strategies to maintain their competitiveness. They have focused on research and development to innovate and develop advanced electric drive axles with higher efficiency and performance. Additionally, partnerships with automakers and investments in manufacturing capabilities have helped expand their market presence. As expected, these players are anticipated to continue their strategies in the forecast period from 2026 to 2034. The market may also witness the emergence of new entrants offering innovative electric drive axle solutions to meet the evolving demands of the electric and hybrid vehicle market.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Electric Drive Axle market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Drive Type

|

|

Vehicle Type

|

|

Electric Vehicle Type

|

|

Sales Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report