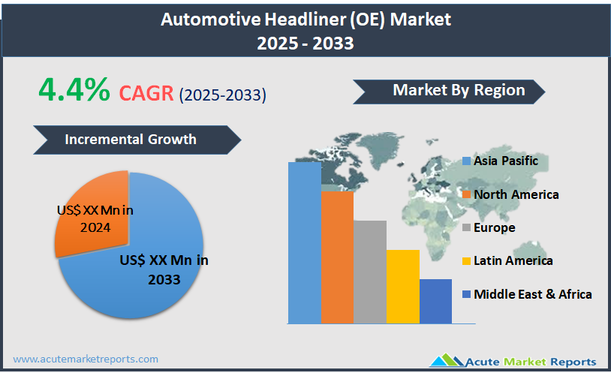

An automotive headliner (OE) refers to the composite material that is fitted inside the cabin of a vehicle, covering the interior of the roof. Typically, these headliners are made from fabric, foam-backed materials, and other composites, and they are designed to offer aesthetic appeal, enhance cabin acoustics, and improve thermal insulation. Original Equipment (OE) headliners are installed during the manufacturing of vehicles and are integral to providing a finished look and feel, as well as functional benefits such as noise reduction and safety in the form of head impact protection. The global automotive headliner (OE) market is experiencing a steady growth trajectory, with a projected Compound Annual Growth Rate (CAGR) of 4.4% through to the upcoming years.

Driver: Increased Demand for Premium Vehicle Interiors

The primary driver of the automotive headliner (OE) market is the increased consumer demand for premium vehicle interiors. As global income levels rise and consumer preferences shift towards more luxurious and comfortable driving experiences, automotive manufacturers are investing in enhancing the interior aesthetics and functionality of their vehicles. High-quality headliners play a crucial role in this regard by improving cabin ambiance and providing superior acoustic insulation. They also contribute to thermal regulation within the vehicle, which is particularly valued in higher-end models. Moreover, as consumers become more aware of the role of interiors in overall vehicle quality, the demand for advanced headliner materials, such as those offering enhanced environmental resistance and lightweight properties, continues to grow. This trend is evident in the expanding luxury car segment where manufacturers emphasize interior comfort and design as key differentiators.

Opportunity: Advancements in Material Technology

A significant opportunity in the automotive headliner market arises from advancements in material technology. Innovative materials that offer better acoustics, lighter weight, and greater environmental sustainability are becoming increasingly popular. The development of eco-friendly headliners made from recycled materials or renewable resources aligns with the automotive industry's broader push towards sustainability. These advancements not only respond to regulatory pressures for more environmentally friendly manufacturing practices but also cater to consumer demands for greener vehicles. As technology progresses, the incorporation of these new materials into headliners is expected to provide manufacturers with competitive advantages in terms of product differentiation and compliance with global sustainability standards.

Restraint: Fluctuations in Raw Material Prices

A major restraint impacting the automotive headliner market is the fluctuation in raw material prices. Headliners are typically made from various fabrics and composites, the costs of which can vary widely due to changes in the global supply chain. Factors such as geopolitical events, trade policies, and economic downturns can affect the availability and price of these materials. This volatility makes it challenging for headliner manufacturers to maintain consistent pricing and profitability. Additionally, the reliance on petroleum-based components for many headliner materials can tie product costs directly to the oil market, further increasing the vulnerability of headliner pricing to external economic influences.

Challenge: Integrating Advanced Technologies

A significant challenge in the automotive headliner market is integrating advanced technologies without compromising the manufacturing process or product performance. As vehicles become more sophisticated, with features such as built-in smart technology and improved safety mechanisms, headliners must also evolve. Incorporating elements such as ambient lighting, sensors, and control modules into headliners requires complex engineering and design adjustments. Additionally, maintaining the structural integrity and aesthetic appeal of the headliner while embedding these technologies presents ongoing difficulties. Manufacturers must balance innovation with functionality to ensure that these new features enhance rather than detract from the overall vehicle design and user experience.

Market Segmentation by Headliner Substrate

In the automotive headliner market, segmentation by substrate includes thermoplastic and thermoset materials. Thermoplastics hold the highest revenue share due to their versatility, ease of processing, and ability to be recycled, which makes them highly appealing in the automotive industry. These materials are favored for their lightweight properties and excellent performance in terms of safety and acoustics, aligning well with industry demands for more fuel-efficient and environmentally friendly vehicles. However, thermoset materials are projected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033. This growth is driven by their superior durability and heat resistance, qualities that are increasingly in demand as vehicles incorporate more integrated electronic systems and require greater thermal management within the cabin space.

Market Segmentation by Material Type

The market for automotive headliners is also segmented by material type, including fabric, foam-backed, suede foam-backed, perforated vinyl, synthetic-backed cloth, and composites. Fabric headliners dominate in terms of revenue generation due to their cost-effectiveness and wide range of aesthetic options, making them a popular choice across both economy and premium vehicle segments. They offer a balance of durability, affordability, and comfort, appealing to a broad consumer base. On the other hand, composites are expected to see the highest CAGR over the forecast period. This anticipated growth is attributed to their advanced properties, such as improved structural strength and lightweight characteristics, which are crucial for enhancing vehicle fuel efficiency and performance. The evolving consumer expectations for luxury and ultra-modern vehicle interiors are pushing manufacturers towards these high-tech materials, which also help in achieving better integration of advanced technologies within the headliner.

Geographic Segment

The automotive headliner market demonstrates significant regional dynamics, with Asia-Pacific commanding the highest revenue share in 2024. This region's dominance is attributed to its robust automotive manufacturing base, particularly in countries like China, Japan, and South Korea, where there is a strong presence of both domestic and international automobile manufacturers. The increasing demand for vehicles in this region, coupled with rising consumer expectations for premium vehicle interiors, drives substantial market growth. Looking ahead, the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033 is expected in the Middle East and Africa (MEA). This anticipated growth is driven by the region's growing automotive sales, economic diversification efforts, and increased investment in automotive manufacturing capabilities, particularly in countries like Saudi Arabia and the United Arab Emirates.

Competitive Trends and Top Players

In 2024, the competitive landscape of the automotive headliner market was shaped by efforts from key players such as Adient plc, Atlas Roofing Corporation, Freudenberg Performance Materials, Grupo Antolin, and Toyota Boshoku Corporation, among others. These companies focused on advancing headliner materials technology and expanding their global footprints through strategic alliances and acquisitions. For instance, Grupo Antolin and IAC Group were particularly active in expanding their market presence in emerging economies to capitalize on growing automotive production rates. Lear Corporation and Motus Integrated Technologies emphasized innovation in sustainable materials to meet increasing regulatory standards and consumer demand for environmentally friendly products.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Headliner (OE) market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Headliner Substrate

| |

Material Type

| |

Technology

| |

Vehicle Type

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report