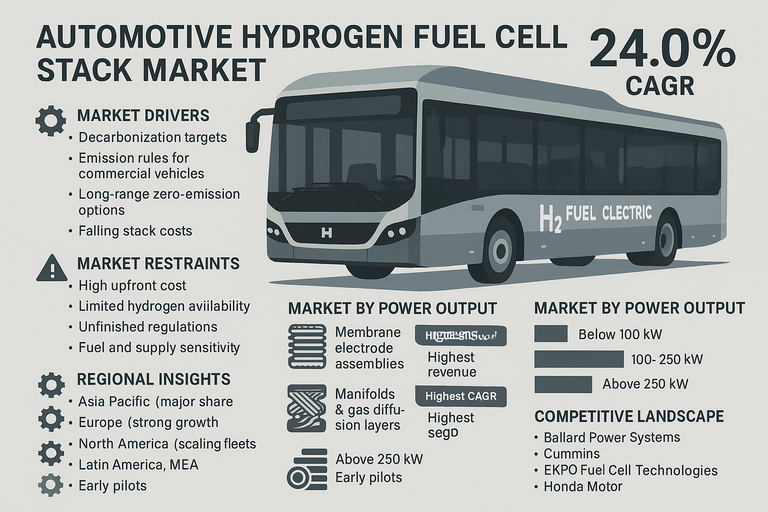

The automotive hydrogen fuel cell stack market is growing at a 24.0% CAGR as OEMs and suppliers scale next-generation stacks to support zero-emission passenger cars, buses, trucks, and emerging applications such as light rail and specialty vehicles. Automakers use stacks as the core “power unit” that converts hydrogen into electricity, often in combination with traction batteries and power electronics. Early volumes are concentrated in buses and trucks in China, Europe, and parts of North America and Asia, while passenger car programs add steady demand in Japan, South Korea, and selected European markets. Within components, membrane electrode assemblies (MEA) account for the highest revenue today because they are the highest value part of the stack, while manifolds and gas diffusion layers are expected to post the highest CAGR as designs move to higher power density and more compact stack layouts. By power output, 100–250 kW stacks generate the highest revenue due to their use in buses, trucks, and higher-power passenger fuel cell electric vehicles, whereas stacks above 250 kW are expected to record the highest CAGR as heavy-duty and fleet platforms scale up.

Market Drivers

Growth is driven by national and regional decarbonization targets for transport, stricter CO₂ and NOx rules for commercial vehicles, and the need for long-range, fast-refueling zero-emission options in duty cycles where batteries alone face range, charging time, or payload limits. Hydrogen fuel cell stacks allow long-distance driving with short refueling stops, which is attractive for buses, heavy trucks, and high-mileage passenger fleets such as taxis and ride-hailing. Falling stack costs through higher production volumes, better material utilization, and automation make fuel cell vehicles more competitive over time. Public funding for hydrogen corridors, refueling stations, and local stack manufacturing plants supports early deployments and reduces investment risk. Improvements in MEA durability, bipolar plate coatings, and cooling designs extend stack life and reduce total cost of ownership for fleets.

Market Restraints

Adoption is limited by high upfront cost of stacks and hydrogen storage, limited availability and price volatility of green hydrogen, and slow roll-out of refueling stations along key corridors. Many regions still lack stable regulations and standards for hydrogen production, transport, and retail, which slows investment decisions. Stack life and performance can be sensitive to fuel quality, duty cycle, and thermal management, increasing engineering effort for OEMs. Supply chains for some key materials and components, such as membranes, catalysts, and coated bipolar plates, are still concentrated in a few suppliers, which can raise cost and supply risk. For some use cases, battery-electric solutions are advancing quickly and compete with fuel cells, especially where daily range and payload needs are moderate.

Market by Component

Membrane electrode assemblies (MEA) form the electrochemical core of the fuel cell stack and drive most of the value and performance, including power density, efficiency, and durability; within components this segment currently generates the highest revenue. MEA suppliers focus on reducing platinum loading, improving membranes, and optimizing catalyst layers to reach cost and durability targets set by OEMs and regulators. Bipolar plates manage current collection, gas distribution, and mechanical stability of the stack. They are moving from graphite to coated metal designs to reduce thickness and cost and support high-volume stamping. Gaskets and seals ensure gas tightness and safe operation across a wide temperature and humidity range, which is critical for automotive duty cycles. End plates and current collectors provide clamping force and electrical connection while supporting integration into vehicle platforms. Cooling plates manage heat extraction from the stack and are designed to maintain uniform temperature distribution under dynamic loads. Manifolds and gas diffusion layers distribute hydrogen and air across the MEA, manage water and gas transport, and support higher power density; within components this segment is expected to post the highest CAGR as next-generation stacks rely on more advanced flow field designs and diffusion materials to boost performance.

Market by Power Output

Below 100 kW stacks are used mainly in smaller passenger cars, light commercial vehicles, and range-extender concepts, where packaging constraints and moderate power needs dominate. As these models target early adopters and urban or regional driving, volumes are growing but from a smaller base. The 100–250 kW segment covers most current bus and truck programs as well as mid- to high-power passenger fuel cell electric vehicles; within power output ranges this segment currently generates the highest revenue. These stacks balance power, efficiency, and cost and are often used in modular configurations, combining one or more stack modules per vehicle. Above 250 kW stacks target heavy-duty trucks, high-capacity buses, off-highway equipment, and emerging rail and marine mobility. As fleets and logistics operators look for zero-emission solutions for long-haul and high-payload routes, this segment is expected to record the highest CAGR over the forecast period, supported by multi-stack systems and integrated hydrogen storage packages.

Regional Insights

Asia Pacific contributes a major share of current revenue, led by Japan, South Korea, and China, where automotive hydrogen roadmaps, fuel cell bus and truck programs, and public funding for local stack manufacturing and refueling infrastructure are well advanced. Europe records strong growth as part of its Green Deal, with fuel cell buses, trucks, and pilot rail projects supported by EU and national funding schemes and growing interest in local stack production to support industrial and energy security goals. North America scales fuel cell stacks primarily through bus and truck fleets, port drayage, and regional haul programs, supported by incentive schemes and hydrogen hub initiatives. Latin America and the Middle East & Africa are at an early stage but see pilot deployments in buses, trucks, and special vehicle fleets linked to green hydrogen export projects and large industrial hubs. Regions that align hydrogen strategies, vehicle incentives, and local manufacturing support will see the fastest scale-up of automotive fuel cell stacks.

Competitive Landscape

Ballard Power Systems is a leading specialist in proton exchange membrane fuel cell stacks for buses, trucks, rail, and marine, supplying modules and stacks to OEMs and integrators worldwide and focusing on durability and cost reduction for heavy-duty cycles. Cummins develops fuel cell stacks and systems alongside its hydrogen production and electrolyzer business, targeting integrated powertrain solutions for trucks, buses, and off-highway equipment. EKPO Fuel Cell Technologies, a joint venture backed by automotive suppliers, offers stack platforms for passenger and commercial vehicles with a focus on scalable production and modular designs. Honda Motor and Hyundai Motor integrate in-house fuel cell stacks into their own fuel cell electric vehicles and share technology across passenger and commercial platforms. PowerCell Sweden supplies stacks and systems for mobility and off-road applications, emphasizing high power density and compact design. Robert Bosch invests in high-volume production of fuel cell stacks and components, leveraging its automotive manufacturing base to supply OEMs and Tier 1s. Symbio, backed by automotive and industrial partners, develops stacks and systems for vans, light trucks, and heavy-duty vehicles, with a focus on industrialization in Europe. Toyota Motor is a pioneer in fuel cell passenger cars and buses, with stack technology that is shared across its own vehicles and partner programs. Weichai Power expands fuel cell stack and system production in China for buses, logistics trucks, and construction machinery. Companies that secure long-term fleet contracts, localize stack production near key markets, and integrate tightly with hydrogen storage, power electronics, and control systems are positioned to lead current revenue, while suppliers scaling high-power stacks and heavy-duty platforms will capture the highest CAGR.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Hydrogen Fuel Cell Stack market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Component

|

|

Power output

|

|

Fuel cell technology

|

|

Vehicle

|

|

Sales channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report