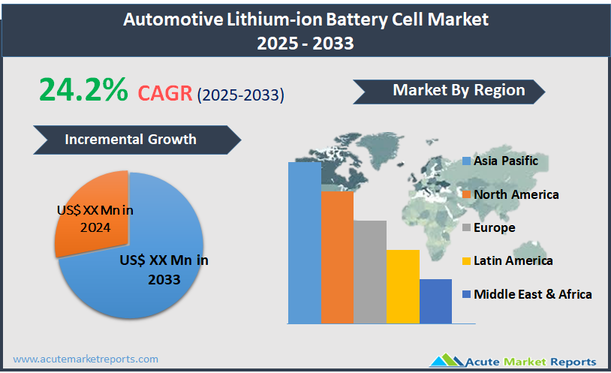

The automotive lithium-ion battery cell market refers to the segment focused on the production and supply of rechargeable battery cells used in electric vehicles (EVs), hybrid electric vehicles (HEVs), and plug-in hybrid electric vehicles (PHEVs). These battery cells serve as the primary energy storage components, delivering power for vehicle propulsion, onboard electronics, and auxiliary systems. Lithium-ion battery cells are preferred in automotive applications due to their high energy density, lightweight characteristics, fast charging capability, long cycle life, and relatively lower self-discharge rates compared to traditional battery chemistries such as nickel-metal hydride (NiMH) and lead-acid. The market includes various lithium-ion chemistries, including lithium iron phosphate (LFP), lithium nickel manganese cobalt oxide (NMC), lithium nickel cobalt aluminum oxide (NCA), and others, tailored for different vehicle performance, safety, and cost requirements. From 2025 to 2033, the automotive lithium-ion battery cell market is expected to grow at a robust compound annual growth rate (CAGR) of 24.26%, driven by expanding EV model offerings, the scaling up of battery recycling initiatives, the transition toward solid-state battery technologies, and increasing investments in domestic battery supply chains across North America and Europe to reduce dependency on Asian manufacturers.

Rising Electric Vehicle (EV) Adoption Globally

The rapid increase in electric vehicle adoption across global markets is a primary driver for the automotive lithium-ion battery cell market. Government policies aimed at reducing greenhouse gas emissions, lowering urban pollution, and decreasing oil dependency have led to the introduction of incentives such as tax credits, subsidies, and stricter emission regulations, which significantly boost EV sales. Leading economies such as China, the United States, Germany, and the United Kingdom have announced plans to phase out internal combustion engine (ICE) vehicles within the next two decades, with electric vehicles positioned as the centerpiece of future mobility. Automotive manufacturers are responding with aggressive electrification strategies, launching an expanding portfolio of battery electric vehicles (BEVs) and plug-in hybrid models, thus increasing the demand for lithium-ion battery cells. For example, leading automakers have announced multi-billion-dollar investments to develop new EV models and to secure long-term supply agreements for battery cells, emphasizing the criticality of stable, high-quality cell supply. Evidence from registration data indicates that EVs achieved record market penetration levels in 2024 across Europe and China, supported by improved charging infrastructure and increasing consumer confidence. Furthermore, fleet operators and logistics companies are transitioning toward electric fleets to meet sustainability targets, creating additional demand. As EV sales are projected to continue their exponential growth trajectory, the requirement for automotive-grade lithium-ion battery cells is expected to expand proportionally, establishing a strong, sustained driver for market growth over the forecast period.

Emergence of Solid-State Battery Technology

The emergence of solid-state battery technology represents a significant opportunity for the automotive lithium-ion battery cell market. Solid-state batteries promise to overcome key limitations associated with conventional liquid electrolyte lithium-ion batteries, such as flammability, limited energy density, and restricted temperature performance. Solid-state cells replace the liquid electrolyte with a solid electrolyte, resulting in higher safety, longer lifespan, faster charging, and potentially lower costs at scale. Several leading automakers and battery manufacturers have announced targeted timelines to commercialize solid-state EV batteries by the late 2020s, creating a massive innovation opportunity. Pilot production lines have already demonstrated early successes in achieving improved energy densities of over 400 Wh/kg, which would enable EVs to deliver longer ranges while using smaller, lighter battery packs. Additionally, the enhanced thermal stability of solid-state batteries could reduce the need for elaborate cooling systems, simplifying battery pack design and further lowering vehicle weight and cost. Evidence from automotive R&D showcases partnerships between automakers and battery specialists focused on fast-tracking solid-state breakthroughs, with prototype vehicles equipped with solid-state cells expected to enter road testing phases soon. Furthermore, governments are funding research programs aimed at accelerating commercialization efforts, recognizing the strategic importance of next-generation battery technologies. As solid-state battery technology matures and becomes commercially viable, it is expected to transform the automotive lithium-ion battery cell landscape, creating substantial growth opportunities for manufacturers that successfully adapt their production processes to support this technological shift.

Supply Chain Constraints for Raw Materials

Supply chain constraints for critical raw materials such as lithium, cobalt, and nickel represent a major restraint for the automotive lithium-ion battery cell market. The surge in battery demand for EVs has placed immense pressure on mining, refining, and processing industries, leading to concerns over material shortages, price volatility, and geopolitical risks. Lithium production, heavily concentrated in countries like Australia, Chile, and Argentina, has struggled to scale rapidly enough to meet skyrocketing global demand, leading to substantial price spikes observed throughout 2024. Similarly, cobalt supplies, primarily sourced from the Democratic Republic of Congo, face ethical sourcing challenges, with increasing scrutiny over child labor and environmental impacts. Nickel production, vital for high-energy-density battery chemistries like NMC and NCA, has also faced disruptions due to environmental regulations and production bottlenecks in major mining regions. Evidence from commodity markets shows that raw material costs represent a significant portion of battery cell manufacturing expenses, and sustained price increases could erode EV cost competitiveness, delaying mass-market adoption. Furthermore, the complex and globalized nature of battery material supply chains makes them vulnerable to trade restrictions, political instability, and logistical disruptions, as highlighted during the pandemic and recent geopolitical conflicts. Unless significant investments are made in diversifying supply sources, enhancing recycling programs, and developing alternative chemistries less reliant on scarce materials, raw material supply constraints could severely impact production scalability and profitability in the automotive lithium-ion battery cell market.

Achieving Cost Reduction While Maintaining Performance Standards

One of the critical challenges for the automotive lithium-ion battery cell market is achieving substantial cost reductions while maintaining or improving performance standards required by modern EVs. Although battery costs have fallen significantly over the past decade, reaching an average of around $100-130 per kWh by 2024 for large-scale buyers, further reductions are essential to achieve EV price parity with internal combustion engine vehicles without relying on government subsidies. However, reaching lower cost thresholds is increasingly difficult because new generation battery chemistries, advanced manufacturing processes, and tighter safety and durability standards add complexity and cost pressures. Manufacturers must balance the pursuit of low-cost materials and simplified cell designs with the industry’s expectations for higher energy density, faster charging, longer cycle life, and improved safety. Evidence from recent battery projects indicates that scaling up new production methods such as dry electrode coating or cobalt-free cathodes, while promising cost savings, require significant capital investments and extensive retooling of existing facilities. Moreover, competition among automakers for cutting-edge battery performance specifications forces battery cell manufacturers to invest heavily in research and development, adding to operational costs. Achieving large-scale, sustainable cost reductions without compromising product quality, reliability, and performance consistency remains a formidable challenge, and how effectively industry players address this balancing act will significantly influence the pace and profitability of market expansion through the next decade.

Market Segmentation by Cell Type

Based on cell type, the automotive lithium-ion battery cell market is segmented into Cylindrical, Prismatic, and Pouch Cells. In 2024, the Prismatic cell segment accounted for the highest revenue share due to its widespread adoption by leading automotive OEMs seeking space-efficient designs and enhanced structural integrity for electric vehicles. Prismatic cells, with their rectangular shape, offer better packing efficiency and higher energy densities within battery packs, making them particularly suitable for passenger EVs and commercial vehicles where space optimization is critical. Major EV models launched in 2024 utilized prismatic cell architectures to meet consumer expectations for longer range and reliability, contributing to the segment's revenue dominance. Meanwhile, from 2025 to 2033, the Pouch Cells segment is expected to witness the highest CAGR, driven by their superior flexibility, lightweight nature, and higher specific energy compared to cylindrical and prismatic formats. Pouch cells allow for customizable designs and modular configurations, which are increasingly in demand as EV manufacturers seek to differentiate models with varying range and performance requirements. Evidence from recent EV platform announcements highlights that next-generation electric vehicles are expected to favor pouch cells for performance-focused and lightweight applications, including premium electric sedans and sport utility vehicles. The Cylindrical cell segment, known for its robust thermal stability, lower production cost, and mature manufacturing processes, is projected to maintain steady demand, especially for two-wheelers, low-cost EVs, and commercial fleets. However, ongoing advancements such as the larger 4680 cylindrical format are likely to renew interest in cylindrical cells among major OEMs seeking to balance cost, performance, and manufacturability in mass-market electric vehicles.

Market Segmentation by Product Type

Based on product type, the automotive lithium-ion battery cell market is segmented into Lithium Iron Phosphate (LFP), Lithium Cobalt Oxide (LCO), Lithium Manganese Oxide (LMO), Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), and Lithium Titanate Oxide (LTO). In 2024, the Lithium Nickel Manganese Cobalt Oxide (NMC) segment recorded the highest revenue share, driven by its optimal balance between energy density, thermal stability, and lifespan, which made it the chemistry of choice for a wide range of passenger EVs across major markets. Automakers preferred NMC cells for achieving extended driving ranges without compromising safety or affordability, and further enhancements such as shifting from NMC 622 to NMC 811 compositions helped improve energy density and reduce cobalt dependency. From 2025 to 2033, the Lithium Iron Phosphate (LFP) segment is expected to register the highest CAGR, supported by its cost advantages, longer cycle life, improved thermal stability, and growing suitability for mass-market EVs. Evidence from 2024 production trends shows that several leading OEMs adopted LFP batteries for entry-level and mid-range EV models to deliver affordable products while addressing concerns over cobalt sourcing and supply chain risks. Lithium Nickel Cobalt Aluminum Oxide (NCA) cells maintained strong demand, particularly in premium long-range EVs due to their high energy density and efficient performance characteristics. Lithium Cobalt Oxide (LCO) and Lithium Manganese Oxide (LMO) cells witnessed limited use in automotive applications compared to other chemistries, primarily serving niche requirements or integrated into hybrid systems. Lithium Titanate Oxide (LTO) cells, known for their ultra-fast charging capabilities and exceptional cycle life, found specialized application in commercial fleets, buses, and vehicles requiring frequent high-power cycling, although their high cost and lower energy density restricted wider passenger EV adoption. Overall, evolving vehicle performance requirements and cost optimization strategies are expected to drive dynamic shifts across different lithium-ion chemistries through the forecast period.

Geographic Segment

Based on geography, the automotive lithium-ion battery cell market is segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. In 2024, Asia Pacific accounted for the highest revenue share, driven by the dominance of China, South Korea, and Japan in global battery manufacturing, strong domestic EV markets, and supportive government policies promoting electric mobility and localized battery production. China alone commanded a significant portion of global EV sales and maintained substantial control over the raw material supply chain, which further reinforced Asia Pacific’s leadership in battery cell production and revenue generation. Europe followed, with rapid expansion in EV adoption across major markets like Germany, the United Kingdom, France, and the Nordic countries, coupled with substantial investments into domestic battery production facilities to reduce dependence on Asian imports. Initiatives such as the European Battery Alliance and the construction of multiple gigafactories across the continent fueled market development. North America, led by the United States and Canada, witnessed strong growth with federal incentives for EV purchases, large-scale battery plant announcements, and rising consumer preference for electrified vehicles, although it lagged behind Asia Pacific and Europe in overall volume in 2024. From 2025 to 2033, North America is expected to register the highest CAGR, driven by aggressive policy support such as the Inflation Reduction Act in the United States, which incentivizes domestic battery production, EV manufacturing, and critical material sourcing. Latin America and Middle East & Africa are projected to experience steady growth, supported by gradual EV adoption, investments in mining and battery raw material processing, and the expansion of charging infrastructure, though challenges such as economic volatility and lower vehicle affordability may moderate the pace compared to mature regions.

Competitive Trends

The automotive lithium-ion battery cell market in 2024 remained highly competitive, with leading players focusing on capacity expansion, technology innovation, and strategic partnerships to strengthen their positions in a rapidly growing market. Duracell Inc. maintained a diversified presence but showed limited exposure to large-scale automotive applications compared to consumer batteries. Energizer Brands, LLC similarly remained active in broader battery markets but made strategic moves to explore automotive opportunities through partnerships with EV component manufacturers. Samsung SDI Co. Ltd. emphasized high-energy-density battery technologies and formed joint ventures with global automakers to build new battery production facilities across Europe and North America. Toshiba Corporation focused on advancing fast-charging battery chemistries and expanding its SCiB (Super Charge ion Battery) platform, targeting commercial vehicle and hybrid applications. Contemporary Amperex Technology Co., Limited (CATL) dominated the market through aggressive capacity expansion, strategic partnerships with global OEMs, and continuous investment in LFP and NMC technologies to cater to various EV segments. Hitachi Chemical Co. Ltd. strengthened its position by investing in next-generation anode and electrolyte materials to improve battery performance and durability. Automotive Energy Supply Corporation, a former joint venture between Nissan and NEC, played a role in early EV battery supply but saw reduced influence following industry restructuring. GS Yuasa International Ltd. continued supplying battery cells for hybrid and electric commercial vehicles, emphasizing long-life and safety features. Johnson Controls Inc., having shifted focus after divesting its automotive battery division, maintained selective involvement in advanced energy storage initiatives. Future Hi-Tech Batteries Limited concentrated on specialized lithium-ion solutions, serving niche EV markets and aftermarket services. Tianjin Lishen Battery Co. Ltd. expanded its manufacturing footprint domestically and explored international collaborations to diversify its customer base. Hunan Shanshan Toda Advanced Materials Co. Ltd. focused on supplying cathode materials, indirectly strengthening its influence within the battery supply chain. Panasonic Corporation remained one of the leading suppliers of cylindrical cells, particularly through its longstanding partnership with Tesla and efforts to commercialize higher-capacity next-generation battery technologies. From 2025 to 2033, these companies are expected to pursue aggressive strategies including vertical integration, investments in solid-state and cobalt-free chemistries, geographic expansion into emerging EV markets, and collaborations with automakers and raw material suppliers to secure competitive advantages in an increasingly crowded and fast-evolving automotive lithium-ion battery cell market.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Lithium-ion Battery Cell market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Cell Type

| |

Product Type

| |

Category

| |

Electric Vehicle Type

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report