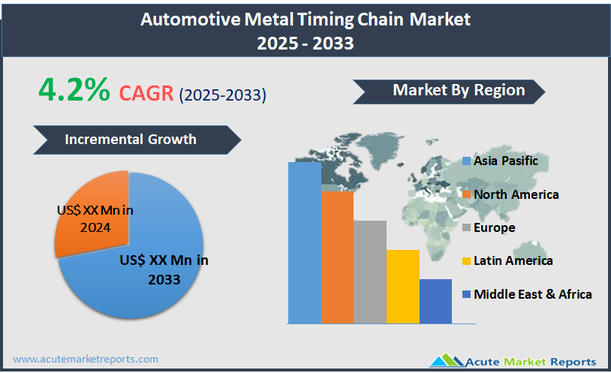

The automotive metal timing chain market encompasses the production and distribution of metal timing chains used in the internal combustion engines of vehicles. A timing chain is a critical component that synchronizes the rotation of the crankshaft and camshaft to ensure the engine's valves open and close at the proper times during each cylinder's intake and exhaust strokes. Metal timing chains are favored over belts due to their durability and longevity, making them a preferred choice for manufacturers focusing on building reliable and long-lasting engines. Projected to grow at a compound annual growth rate (CAGR) of 4.2%, the automotive metal timing chain market's expansion is supported by the ongoing demand for vehicle reliability and engine efficiency. While the automotive industry experiences gradual shifts towards alternative propulsion systems like electric drivetrains, the substantial existing base of internal combustion engines and the continued production in emerging markets ensure sustained demand for metal timing chains. Furthermore, advancements in material science that enhance the durability and performance of metal timing chains contribute to the market's growth, aligning with manufacturers' objectives to extend vehicle lifespans and reduce maintenance frequency.

Increased Demand for Durable and Low-Maintenance Components

The primary driver fueling the growth of the automotive metal timing chain market is the increased demand for durable and low-maintenance engine components. As vehicle owners and manufacturers increasingly prioritize longevity and reliability in automotive engines, the preference for metal timing chains over timing belts strengthens. Metal timing chains offer superior durability and typically require less frequent replacement compared to belts, which are prone to wear and need regular checks and changes. This shift is particularly evident in regions with harsh driving conditions where the robustness of engine components is crucial. The trend towards extending vehicle ownership periods and reducing the lifecycle costs associated with vehicle maintenance also significantly contributes to the demand for metal timing chains.

Expansion into Hybrid Vehicle Markets

A major opportunity for the automotive metal timing chain market lies in its expansion into the hybrid vehicle sector. As the automotive industry moves towards electrification, hybrid vehicles serve as a critical transition technology. These vehicles, which combine traditional internal combustion engines with electric motors, still require timing chains for their petrol-powered components. The growth in hybrid vehicle production globally presents a significant opportunity for the increased use of metal timing chains. Capitalizing on this trend involves manufacturers adapting their offerings to meet the specific requirements of hybrid engines, which often operate under different conditions than standard combustion engines, such as frequent start-stop cycles.

Stringent Environmental Regulations

One major restraint impacting the automotive metal timing chain market is the stringent environmental regulations that are prompting a shift towards cleaner and more sustainable transportation options. These regulations are driving the development and adoption of electric vehicles (EVs), which do not require timing chains. As more regions commit to reducing emissions and phasing out fossil-fuel-powered vehicles, the demand for traditional engine components like metal timing chains could see a significant decline. This shift poses a substantial challenge to manufacturers who are heavily invested in the production capabilities for traditional engine components, as they must pivot to new technologies and product lines to stay relevant.

Adapting to Technological Innovations

A key challenge facing the automotive metal timing chain market is the need to continually adapt to technological innovations in engine design and manufacturing. As engines become more compact and efficient, the design and material requirements for timing chains also evolve. Manufacturers must invest in research and development to keep up with these changes, ensuring that their products can meet the increasingly stringent performance standards while maintaining cost-effectiveness. Additionally, the rise of advanced manufacturing techniques like 3D printing offers both an opportunity and a while these methods can reduce production costs and increase customization, they also require substantial upfront investment in new technologies and training.

Market Segmentation by Vehicle Type

The automotive metal timing chain market is segmented by vehicle type, including two-wheelers, three-wheelers, passenger vehicles, light commercial vehicles, trucks, buses, and coaches. Among these, the passenger vehicle segment is the largest revenue contributor to the market. This segment's dominance is driven by the high volume of passenger vehicles globally, coupled with the frequent integration of durable components like metal timing chains to ensure longevity and reduce maintenance costs. However, the light commercial vehicle (LCV) segment is projected to exhibit the highest compound annual growth rate (CAGR) from 2025 to 2033. The growth in the LCV segment is fueled by the increasing use of these vehicles for transportation and delivery services in urban areas, where operational reliability and cost-effectiveness are critical. As businesses expand and e-commerce thrives, the demand for dependable light commercial vehicles equipped with durable components like metal timing chains is expected to rise significantly.

Market Segmentation by Engine Type

In terms of engine type, the automotive metal timing chain market includes overhead cam (OHC) engines, push rod engines, and others. The overhead cam engine segment holds the largest share in terms of revenue due to its widespread adoption in modern vehicles. OHC engines, which are favored for their efficiency and performance, typically use timing chains to drive their camshafts, making this segment a crucial market for metal timing chains. On the other hand, the push rod engine segment is anticipated to witness the highest CAGR during the forecast period from 2025 to 2033. Despite being an older technology compared to OHC engines, push rod engines are experiencing a resurgence in specific market niches such as performance and utility vehicles due to their simplicity, cost-effectiveness, and ease of maintenance. This resurgence is expected to drive increased demand for metal timing chains in push rod engines, as manufacturers focus on improving these engines' efficiency and reliability without significant redesigns.

Geographic Segment

In the automotive metal timing chain market, geographic segmentation reveals varied growth dynamics across different regions. Historically, Asia-Pacific has been the region with the highest revenue generation due to its massive automotive manufacturing base and high volume of vehicle production, particularly in countries like China, Japan, and India. The demand in this region is primarily driven by the continuous growth of both consumer and commercial automotive sectors. Europe and North America also contribute significantly to market revenues with mature automotive industries and high adoption rates of advanced automotive technologies. However, the highest compound annual growth rate (CAGR) from 2025 to 2033 is expected in the Asia-Pacific region, propelled by increasing automotive production, rising economic prosperity, and growing demand for vehicles equipped with reliable components such as metal timing chains.

Competitive Trends and Top Players

In 2024, the automotive metal timing chain market was characterized by intense competition among key players such as BG Automotive (British Gaskets Group), BorgWarner Inc., Cloys, Continental AG, Dayco IP Holdings, LLC, FAI Automotive plc, Ferdinand Bilstein GmbH + Co. KG, Iwis, MAPCO Autotechnik GmbH, Melling, NTN-SNR, Schaeffler Automotive Aftermarket GmbH & Co. KG, SKF, and Tsubakimoto Europe B.V., with other key players like Renold plc and LG Balakrishnan and Brothers Ltd. also making significant contributions. These companies focused on expanding their global footprints through strategic alliances, mergers, acquisitions, and increasing investments in research and development to innovate and improve the quality and durability of their timing chains. The strategy for most of these players involved enhancing product portfolios to include chains that meet the specific requirements of newer engine designs and emissions regulations. Looking forward from 2025 to 2033, these companies are expected to deepen their market penetration by adopting advanced manufacturing technologies, expanding into emerging markets, and adapting to the latest automotive trends such as the increase in hybrid vehicle production. The overall competitive strategy will likely focus on sustainability and efficiency improvements, aligning with global efforts to reduce environmental impact and meet stringent automotive standards.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Metal Timing Chain market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Vehicle Type

| |

Engine Type

| |

Type

| |

Sales Channel

| |

Propulsion Type

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report