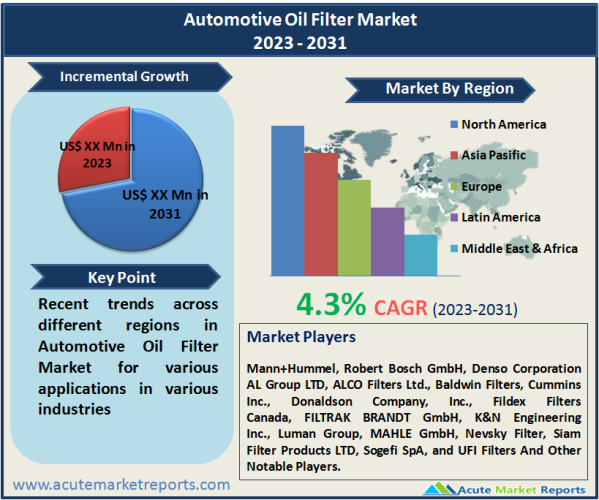

The automotive oil filter market plays a critical role in maintaining engine health and efficiency. The automotive oil filter market is expected to grow at a CAGR of 4.3% during the forecast period of 2026 to 2034, propelled by a convergence of factors ranging from emission regulations and technological innovations to the rise in vehicle ownership. While the industry embraces growth drivers, the threat of counterfeit products serves as a reminder of the need for quality control and consumer education. Segmentation by fuel type and filter type highlights the market's nuanced trends, with diesel and engine oil filters dominating revenue while alternative fuels and hydraulic filters drive growth. Geographically, North America and the Asia-Pacific region emerge as significant revenue generators and growth hotspots, respectively. Finally, the competitive landscape showcases the dominance of key players who drive innovation and define industry trends. As the forecast period unfolds, the automotive oil filter market is poised for transformative growth, setting the stage for a cleaner and more efficient automotive future.

Stringent Emission Regulations Driving Adoption

The automotive industry's increasing focus on environmental sustainability and emissions reduction has catalyzed the demand for efficient oil filters. Stricter emission regulations imposed globally have compelled automakers to enhance engine efficiency and reduce pollutants. This has necessitated the deployment of advanced oil filters that not only protect engines from contaminants but also contribute to cleaner exhaust emissions. Evidence of this trend can be observed in the European Union's stringent Euro emission standards and similar regulations adopted in other regions, which have prompted automakers to integrate high-performance oil filters into their vehicles.

Rising Vehicle Ownership and Usage

The growing global vehicle fleet and increased vehicle utilization are substantial drivers of the automotive oil filter market. As the number of vehicles on the road surges, the demand for regular maintenance, including oil changes and filter replacements, experiences a corresponding rise. Moreover, the expanding middle-class population in emerging economies has led to increased vehicle ownership, further bolstering the aftermarket for oil filters. Statistical data from various automotive industry reports corroborates this trend by highlighting the growth in vehicle sales and its direct impact on the oil filter market.

Advancements in Filter Technology

Continuous innovations in filter technology have amplified the efficiency and longevity of oil filters. Manufacturers are integrating cutting-edge materials, such as synthetic media and advanced filtration layers, to achieve finer particle removal and extended service intervals. The incorporation of features like bypass valves and anti-drain back valves has also enhanced filter performance. These technological advancements have led to oil filters being more effective in capturing contaminants and ensuring optimal oil flow. Evidences from patents, technical journals, and industry conferences validate the industry's focus on technological enhancements.

Threat of Counterfeit Products

The proliferation of counterfeit and substandard automotive oil filters poses a significant challenge to the market's growth. Counterfeit filters often fail to meet industry standards and can result in inadequate filtration, reduced engine performance, and even long-term damage. The presence of counterfeit products erodes consumer trust and can undermine the reputation of legitimate filter manufacturers. Instances of counterfeit filters infiltrating the market have been documented by automotive associations and industry watchdogs, emphasizing the need for stringent quality control measures.

Diesel Engines Segment Dominates the Market by Fuel Type

Among the various segments of the automotive oil filter market, the fuel filter category showcases divergent trends in revenue and growth. As of 2026, the market for fuel filters designed for diesel engines commanded the highest revenue, owing to the prevalent use of diesel-powered vehicles in commercial and heavy-duty applications. The diesel fuel filter market has been supported by its indispensability in ensuring efficient combustion and prolonged engine life in diesel engines. However, during the forecast period from 2026 to 2034, the market for fuel filters tailored for alternative fuels is projected to exhibit the highest Compound Annual Growth Rate (CAGR). This trend can be attributed to increasing environmental consciousness and the gradual adoption of alternative fuels, such as ethanol and compressed natural gas (CNG). As the automotive landscape undergoes a paradigm shift towards sustainability, the demand for filters that cater to alternative fuel systems is anticipated to surge, driving the projected high CAGR.

Engine Oil Filters Dominates the Market by Filter Type

In terms of filter types, the engine oil filter market emerged as the revenue leader in 2025. Engine oil filters play a pivotal role in safeguarding engine components from wear and contaminants, enhancing engine longevity. The reliance on internal combustion engines in a majority of vehicles underscores the consistent demand for effective engine oil filters. However, the market for hydraulic filters is projected to exhibit the highest CAGR from 2026 to 2034. This growth is fueled by the expansion of industries such as construction, agriculture, and manufacturing, where hydraulic systems play a crucial role. As these industries expand and modernize, the demand for hydraulic systems and associated filters is poised to surge, driving the projected high CAGR.

North America Remains as the Global Leader

Geographically, the automotive oil filter market showcases diverse trends that reflect regional dynamics. In terms of revenue generation, North America led the market in 2025, bolstered by a mature automotive sector and a substantial vehicle fleet. The Asia-Pacific region, however, is poised to exhibit the highest CAGR during the forecast period from 2026 to 2034. This growth is driven by the region's burgeoning automotive industry, rising vehicle ownership, and increasing awareness of the importance of regular vehicle maintenance. As economies in the Asia-Pacific region continue to flourish, the demand for automotive oil filters is anticipated to surge, underpinning the projected high CAGR.

Market Competition to Intensify during the Forecast Period

In the competitive landscape, real companies such as Mann+Hummel, Robert Bosch GmbH, Denso Corporation AL Group LTD, ALCO Filters Ltd., Baldwin Filters, Cummins Inc., Donaldson Company, Inc., Fildex Filters Canada, FILTRAK BRANDT GmbH, K&N Engineering Inc., Luman Group, MAHLE GmbH, Nevsky Filter, Siam Filter Products LTD, Sogefi SpA, and UFI Filters held commanding positions in 2025. Their strategic focus on research and development, product innovation, and global expansion enabled them to capitalize on market opportunities. Throughout the forecast period from 2026 to 2034, these industry leaders are expected to maintain their dominance. They will continue to introduce advanced filter technologies, forge strategic collaborations, and expand their geographic footprint to cater to evolving consumer preferences and environmental regulations. As of 2026, these key players stood as stalwarts in shaping the industry, and their sustained efforts are projected to define the market's trajectory in the years ahead.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Oil Filter market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Fuel Filter

|

|

Filter Type

|

|

Filter Media

|

|

Vehicle Type

|

|

Sales Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report