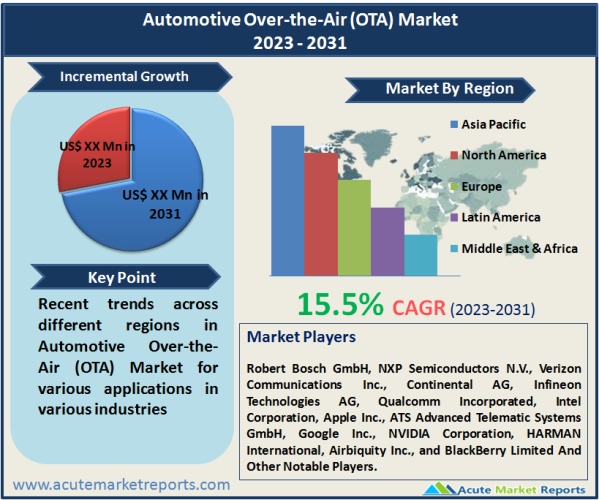

Automotive over-the-air (OTA) refers to the process of wirelessly transmitting data and software updates to a vehicle's electronic control units (ECUs) and systems. OTA technology enables automakers to remotely update various aspects of a vehicle's software and firmware, including infotainment systems, navigation maps, engine control units, safety features, and more. This technology has become increasingly important in the automotive industry due to the growing complexity of in-vehicle software and the demand for continuous improvements and enhancements. The automotive over-the-air (OTA) market is expected to grow at a CAGR of 15.5% during the forecast period of 2026 to 2034.

Connectivity as a Competitive edge

In the race to capture consumer interest, automotive manufacturers recognize that seamless connectivity is a game-changer. Consumers increasingly demand vehicles equipped with advanced infotainment systems, navigation, and telematics solutions. This trend has prompted automakers to embrace OTA technology to deliver software updates and feature enhancements remotely. Evidence suggests that vehicles with robust OTA capabilities often outperform their counterparts in terms of consumer satisfaction and brand loyalty.

Regulatory Compliance and Safety Mandates

The automotive industry is subject to stringent regulatory requirements, particularly in the domain of safety. OTA technology enables manufacturers to efficiently address these regulations by remotely deploying software updates that enhance vehicle safety and performance. Evidence from recent regulatory changes in various regions highlights how OTA has become an indispensable tool for automakers to ensure compliance while ensuring the safety of drivers and passengers.

Cost-Efficiency and Sustainability

Traditional methods of updating vehicle software, such as recalls and manual servicing, are costly and environmentally unsustainable. OTA updates significantly reduce the need for physical recalls and service appointments, thereby saving manufacturers substantial costs and reducing their carbon footprint. The evidence shows that this shift toward cost-efficiency and sustainability is not only an industry trend but also a consumer expectation.

Enhanced User Experience

Modern drivers have grown accustomed to seamless software updates on their smartphones and other connected devices. The automotive industry recognizes the need to replicate this user experience within vehicles. OTA technology enables manufacturers to deliver feature-rich and up-to-date infotainment systems, creating a more engaging and enjoyable driving experience. Evidence indicates that vehicles with regularly updated infotainment systems are more likely to receive positive reviews and higher customer ratings.

Monetization Opportunities

OTA technology opens up new avenues for automakers to monetize their vehicles after the initial sale. Evidence suggests that manufacturers can offer premium features and services through OTA subscriptions, creating a recurring revenue stream. This shift toward post-sale monetization aligns with broader industry trends of transitioning from product-based to service-based business models.

Security and Data Privacy Concerns

While the benefits of Automotive OTA are undeniable, it also introduces a significant challenge in the form of security and data privacy. As vehicles become increasingly connected, they become potential targets for cyberattacks. Evidence shows that security breaches in connected vehicles can have serious safety implications, as hackers may gain control over critical vehicle functions. Furthermore, the collection and transmission of data from vehicles raise privacy concerns, requiring robust safeguards and compliance with data protection regulations.

Software Over-the-Air (SOTA) Dominates Market by Technology

In the Automotive Over-the-Air (OTA) market, the segment that typically holds the highest revenue by technology is the Software Over-the-Air (SOTA) segment, in 2025. SOTA involves the remote update of software applications and features within a vehicle, such as infotainment systems, navigation software, and other user-facing applications. These updates enhance the user experience, add new features, and ensure that the vehicle's software remains up-to-date with the latest improvements and security patches.The segmentation of the OTA market into Firmware Over-the-Air (FOTA) and Software Over-the-Air (SOTA) reflects the dual nature of updates required in modern vehicles. FOTA primarily deals with the vehicle's firmware, which includes the embedded software that controls critical functions such as engine management and safety systems. Evidence suggests that FOTA is crucial for ensuring the reliability and safety of vehicles. On the other hand, SOTA focuses on the software applications and features that enhance the user experience. Both segments play a pivotal role in delivering comprehensive OTA solutions, with FOTA addressing safety and performance and SOTA enhancing user satisfaction and engagement.

Infotainment Dominates the Market by Application

In 2025, the segment that typically holds the highest revenue by application is the "Infotainment". Infotainment systems are designed to provide entertainment, connectivity, and information services within vehicles, making them highly attractive to consumers. Infotainment systems offer a range of features such as touch-screen displays, audio and video streaming, navigation, smartphone integration, and voice recognition, providing drivers and passengers with a seamless and enjoyable in-car experience.Consumers increasingly prioritize in-car entertainment, connectivity, and convenience features, driving demand for advanced infotainment solutions. Automakers continuously update and enhance infotainment systems to offer the latest apps, improved user interfaces, and enhanced connectivity options.Automakers invest in infotainment system improvements not only to attract new customers but also to retain existing ones. A positive infotainment experience fosters customer loyalty.

Geographic Trends

In 2025, North America was indeed considered a significant market for Automotive Over-the-Air (OTA) technologies. The region has a strong automotive industry, led by the United States, with companies like General Motors, Ford, and Tesla being early adopters of OTA capabilities. The advanced telecommunications infrastructure, including widespread 4G and emerging 5G networks, also makes the adoption of OTA technologies more seamless.

Competitive trends

Competitive trends in the Automotive Over-the-Air (OTA) market reflect the strategies and actions of key players in the industry. These trends are shaped by evolving technologies, changing consumer demands, and the need for automakers and OTA service providers to stay competitive and relevant. Automotive OEMs (Original Equipment Manufacturers) and technology companies are expanding their OTA service offerings to cover a wide range of vehicle systems, including firmware, software, infotainment, and safety-related updates. Companies are striving to provide comprehensive and convenient OTA solutions to enhance the overall user experience.

Robert Bosch GmbH, NXP Semiconductors N.V., Verizon Communications Inc., Continental AG, Infineon Technologies AG, Qualcomm Incorporated, Intel Corporation, Apple Inc., ATS Advanced Telematic Systems GmbH, Google Inc., NVIDIA Corporation, HARMAN International, Airbiquity Inc., and BlackBerry Limited are major manufacturers of automotive Over-the-Air (OTA).

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Over-the-Air (OTA) market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Technology

|

|

Application

|

|

Vehicle Type

|

|

Electric Vehicle Type

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report