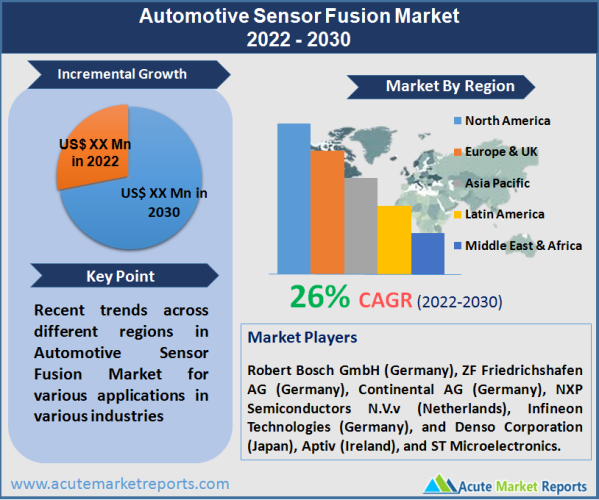

The sensor fusion market for automotive size is anticipated to grow at a CAGR of 26% during the forecast period reaching about $ 22.5 billion by 2034. The demand for the sensor fusion market for automotive is anticipated to be driven by factors such as the implementation of rigorous safety laws, the rising popularity of high-end and luxury automobiles, and the rising popularity of advanced driver assistance systems (ADAS).

COVID-19 epidemic caused disruptions throughout the whole global automotive supply chain during the second and third quarters of 2021, which had an effect on new car sales in FY 2021. The pandemic caused lockdowns and shutdowns of manufacturing facilities in many regions, which presented the automotive sector with an uncertain timescale for recovering from the effects of the pandemic. A limited supply of car parts, decreased sales of new vehicles, the shutdown of production facilities, and a loss in working capital were among the most significant issues that the automotive sector encountered as a result of COVID-19. Due to the fact that the manufacture of automobiles is dependent on the sensor fusion market for automotive, it is anticipated that this industry would be harmed as a result of the epidemic. Nevertheless, a number of specialists in the field predict that the recovery could pick up steam somewhere around the second half of 2022.

Enhanced Technical Capabilities of Sensor Fusion Driving its application

The use of sensor fusion is becoming increasingly common in automobiles, mostly as a result of the many practical advantages that it provides. Sensor fusion is the process of combining the data obtained from several sensors through the utilisation of software algorithms to produce an environmental model that is as exhaustive and accurate. The greater data exchange that occurs as a result of sensor fusion is yet another significant advantage. Because sensors in conventional systems process inputs on their own, it follows that the judgments made by the system can only be as accurate as the information provided by its individual sensors. However, with sensor fusion, the inputs from a number of distinct sensors, such as a camera, LiDAR, and radar, are combined. Therefore, exchanging multiple data sets leads to smarter decisions, which in turn improves the safety of the vehicle.

Sensor Fusion Enables Quick Actions Based on Data However, Development & Maintenance Cost to Hinder Growth

One more advantage is a decrease in latency. The sensor fusion system's domain controller does not need to wait for individual sensors to finish processing data before taking any action based on that data. This helps expedite performance in situations where even fractions of a second count, which ultimately improves the safety of the driver. Lack of standardisation in software design and hardware platform can drive up development and maintenance costs. This is a limitation.

Autonomous Vehicles Promising Opportunities During the Forecast Period

For autonomous vehicles to be able to monitor and assess their surroundings, they need sensors such as cameras, radar, and LiDAR units. They also require computer capacity and artificial intelligence to assess multidimensional impediments, and they frequently require multisource data inputs to present the vehicle with a holistic and unified view of its surroundings in real-time within fractions of a second. In order for autonomous vehicles to fulfil all of these objectives, sensor fusion is an absolute necessity.

Risk of Hacking Poses a Significant Threat

Because they include so many technological parts, vehicles that drive themselves are vulnerable to being hacked. Hackers have the ability to sabotage self-driving cars by pretending to be a person or another vehicle in front of it. Because of this, the software platform is unable to respond appropriately in a timely manner. Because of the vulnerability of numerous apps, such as infotainment systems, adaptive cruise control, and emergency braking systems, hackers are also able to take control of these types of applications. As an illustration, in 2015, Fiat Chrysler recalled over 1.4 million vehicles because of safety concerns. Hackers were able to take control of the infotainment system of the vehicles because it was connected to the mobile data network. The infotainment system of the Jeep Cherokee was connected to the mobile data network, and researchers in the field of information security revealed that it was feasible for hackers to manage the vehicle remotely.

Middleware Dominates Both in terms of Revenues and Growth

Middleware dominated the market in terms of market revenues for the year 2022. It is also anticipated that this segment will grow at a fastest pace with the highest CAGR during the forecast period of 2026 to 2034. Middleware now makes it possible for many units to communicate with one another. However, as vehicles continue to develop into mobile computing platforms, middleware will make it feasible to customise automobiles and enable the installation and upgrades of vehicle software. This will make it possible for cars to continue their evolution. It is anticipated that during the forecast period, middleware will function with ECU hardware in a vehicle and will make abstraction, virtualization, and distributed computing possible. Automakers are also opting flexible middleware systems as a result of developments in ADAS functionality.

Feature Segment Promising Significant Growth During the Forecast Period

Feature fusion is expected to grow at the fastest pace registering the highest CAGR during the forecast period. The level of fusion known as feature fusion is the one that is utilized the most frequently in autos. The extraction of features from input images from sensors is required in order to perform fusion at the feature level. Pixel intensities, as well as edge and texture features, can also serve as inputs for features. Extraction of features such as edges, areas, shapes, sizes, and lengths, as well as picture segments, are all part of the feature fusion level. In addition to this, it extracts features from the images to be fused that have an intensity level that is comparable to other features. The direction of associated feature values created by several algorithms is the key benefit of feature fusion. This identifies a group of characteristics that can increase the accuracy of the system, which is the fundamental goal of feature fusion. It is anticipated that the market for feature fusion will expand the quickest in Asia Pacific, followed by the market in North America. The primary reason that is driving the market is OEMs' demand for feature fusion, which is also being driven by the technical advantages that it offers. Additionally, as more powerful ADAS features are developed, there is a greater demand for the ability to determine the coordinates of objects and impediments. Feature fusion provides access to the necessary functions for more advanced forms of automated driving functions. As a result, it is anticipated that there will be a growth in the market for feature fusion in the years to come.

L4 Automated Vehicles to Dominate the Future Market Revenues

L4 cars have not yet been launched to the public on a commercial sale due to a variety of complexities including a dearth of supporting infrastructure, stringent government rules, and other similar factors. It is anticipated that these automobiles will be available for purchase by the year 2026 to 2026. Because all L4 cars are equipped with sensor fusion, the launches of these vehicles are anticipated to create considerable opportunities for software development companies working on sensor fusion and associated component makers.

APAC to be the Global Leader

During the forecast period, the Asia-Pacific region is anticipated to represent the largest market for sensor fusion in the automotive sector. It is anticipated that the market in Asia Pacific will expand as a result of the growing usage of advanced ADAS features such as automated emergency braking (AEB), lane departure warning (LDW), adaptive cruise control (ACC), and other similar technologies. The sensor fusion markets in China and Japan are now the largest in the Asia Pacific area. The rising rate of vehicle production in combination with severe safety requirements that require ADAS capabilities to be included in vehicle models is the primary driver that is driving change in these two countries. The market in the region is anticipated to be driven by the increasing demand for premium and luxury automobiles, as well as the improvements in sensor fusion hardware. It is anticipated that countries in the Rest of Asia Pacific will experience significantly slower adoption due to the price-sensitive nature of sensor fusion in these markets as well as the absence of infrastructure necessary for its efficient operation in these countries.

Market Dominated by Few Players, Lucrative for New Market Entrants

The market for automotive sensor fusion is dominated by a few worldwide manufacturers. Robert Bosch GmbH (Germany), ZF Friedrichshafen AG (Germany), Continental AG (Germany), NXP Semiconductors N.V.v (Netherlands), Infineon Technologies (Germany), and Denso Corporation (Japan), Aptiv (Ireland), and ST Microelectronics are some of the key players in the sensor fusion market for automotive. Robert Bosch GmbH is headquartered in Germany (Japan). These businesses provide a comprehensive assortment of goods and benefit from robust distribution networks operating on a worldwide scale. They plan to maintain their market position by implementing methods such as the development of new products, the purchase of other businesses, as well as contracts and collaborations.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Sensor Fusion market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Technology

|

|

Data Fusion Type

|

|

Vehicle Type

|

|

Data Fusion Level

|

|

Software Layer

|

|

Electric Vehicle

|

|

Autonomous Vehicle

|

|

Sensor Type

|

|

Application

|

|

Sensor Fusion Environment

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report