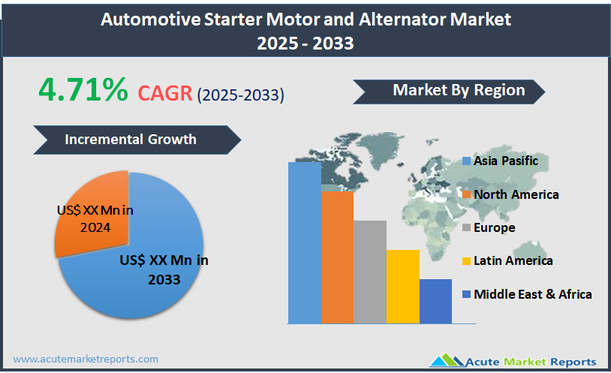

The automotive starter motor and alternator market encompasses the manufacturing and distribution of essential components used in the automotive industry for vehicle operation. Starter motors are electric motors that initiate the engine's operation by cranking the internal combustion engine to start, while alternators are devices that convert mechanical energy from the engine into electrical energy to power the electrical systems and recharge the vehicle's battery. This market is crucial due to the pivotal role these components play in vehicle functionality. As of recent estimations, the automotive starter motor and alternator market is projected to grow at a compound annual growth rate (CAGR) of 4.71%. This growth is driven by the increasing demand for vehicles, advancements in automotive technologies, and the rising adoption of fuel-efficient vehicles that require highly efficient and durable starter motors and alternators.

Increasing Vehicle Electrification

The escalating trend towards vehicle electrification acts as a primary driver for the automotive starter motor and alternator market. As governments worldwide implement stricter emissions regulations, automotive manufacturers are compelled to increase the production of electric and hybrid vehicles. This shift necessitates the development of advanced starter motors and alternators that are compatible with electrically powered engines. For instance, the introduction of mild hybrid vehicles, which utilize a combination of traditional combustion engines and electric power, has spurred the need for enhanced starters and alternators that can handle frequent start-stop operations and provide greater energy efficiency.

Expansion into Emerging Markets

A significant opportunity in the automotive starter motor and alternator market is the expansion into emerging markets, where the automotive industry is experiencing rapid growth due to rising economic prosperity and increasing consumer purchasing power. Countries like India and China are witnessing a surge in vehicle sales, which in turn boosts the demand for automotive components, including starters and alternators. The automotive sector in these regions benefits from favorable government policies aimed at promoting automotive manufacturing, which further facilitates market expansion and offers lucrative opportunities for component manufacturers to establish and expand their operational bases.

High Cost of Advanced Technologies

One of the main restraints in the automotive starter motor and alternator market is the high cost associated with advanced technologies. The development and integration of new technologies to improve the efficiency and functionality of starter motors and alternators involve significant R&D expenditures, which can increase the overall cost of the automotive components. This cost increment can be a barrier, particularly in cost-sensitive markets, limiting the widespread adoption of new technologies. The challenge for manufacturers is to balance innovation with cost-efficiency to remain competitive and attractive to automotive manufacturers.

Supply Chain Disruptions

A critical challenge facing the automotive starter motor and alternator market is supply chain disruptions. The automotive industry relies heavily on a global network of suppliers for parts and raw materials. Events such as the COVID-19 pandemic have highlighted the vulnerabilities in the automotive supply chain, causing delays and shortages that affect the production of starter motors and alternators. These disruptions can lead to production halts, increased costs, and delayed deliveries, affecting the overall market growth. The challenge for component manufacturers is to develop more resilient supply chain strategies that can mitigate the impact of such disruptions and ensure steady supply chain flow.

Market Segmentation by Types of Starter Motor

The automotive starter motor market is segmented into electric, pneumatic, and hydraulic types, each catering to different mechanical and operational demands of vehicles. Electric starter motors dominate the market in terms of both revenue and CAGR, primarily due to their widespread adoption in passenger vehicles and light commercial vehicles. These starters are favored for their reliability, cost-effectiveness, and efficiency in starting traditional combustion engines. The shift towards vehicle electrification and the increasing integration of stop-start systems in modern vehicles further boost the demand for electric starters, as they are more compatible with these technologies compared to their pneumatic and hydraulic counterparts. On the other hand, pneumatic and hydraulic starters, often used in heavy commercial and industrial vehicles due to their robustness and effectiveness in harsh environments, show slower growth. These types are essential in applications requiring reliable performance under extreme conditions, but their growth is limited by the overall slower expansion rate of the industrial vehicle sector compared to the passenger vehicle segment.

Market Segmentation by Alternator Type

In the alternator market, the segmentation includes claw pole alternators and cylindrical alternators. Claw pole alternators lead the market in terms of revenue generation and are projected to witness the highest CAGR. This type of alternator is extensively used across a wide range of vehicles due to its ability to deliver high output at low engine speeds, making it particularly suitable for passenger cars where low-speed driving is common. The design of claw pole alternators, which typically features a compact and robust structure, enhances their suitability for modern vehicles that require efficient and space-saving components. The increasing demand for vehicles equipped with advanced electronics and convenience features drives the need for more powerful and reliable alternators, thereby bolstering the growth of the claw pole alternator segment. Cylindrical alternators, although used in specific applications requiring high durability and longer service life, such as in commercial vehicles and off-road equipment, lag behind in growth due to their niche application area and higher costs compared to claw pole alternators.

Geographic Segment

The automotive starter motor and alternator market demonstrates diverse geographic trends, with Asia Pacific leading in terms of both the highest revenue generation and the highest CAGR. In 2025, this region dominated the market revenue share, driven by significant vehicle production volumes, especially in China and India, coupled with increasing investments in automotive technologies. The demand in Asia Pacific is further fueled by the expanding middle class and their rising vehicle ownership, as well as the robust presence of automotive OEMs and component manufacturers. North America and Europe also show substantial market activity, with North America particularly benefiting from advanced technological integration in automotive manufacturing and a high preference for vehicles equipped with start-stop systems. However, it is Asia Pacific that is expected to maintain its lead in growth rate through the forecast period of 2026 to 2034, primarily due to ongoing industrialization, urbanization, and the increasing adoption of electric vehicles in these regions.

Competitive Trends

The competitive landscape in the automotive starter motor and alternator market features prominent players such as ASIMCO Technologies Ltd., BBB Industries LLC, Controlled Power Technologies Ltd., Cummins, Inc., Denso Corporation, Hitachi Automotive Systems, Ltd., Hella KGAA Hueck & Co., Lucas Electrical Ltd., Mitsubishi Electric Corporation, Mitsuba Corporation, Ningbo Zhongwang Auto Fittings Co., LTD., Robert Bosch GmbH, Remy International, Inc., RFL Alternators, Unipoint Electric MFG Co., Ltd., and Valeo SA. In 2025, these companies were instrumental in driving market innovation and expansion, leveraging strategies such as mergers and acquisitions, geographic and product line expansions, and increased investments in research and development to enhance product efficiency and integration with advanced vehicle technologies. For instance, Robert Bosch GmbH and Denso Corporation, noted for their significant market shares, emphasized advancements in lightweight and high-efficiency products. Moving forward from 2026 to 2034, these top players are expected to focus on aligning with emission standards, enhancing electric vehicle compatibility, and tapping into emerging markets to capitalize on new revenue streams. The focus on sustainability and efficiency in component manufacturing is expected to be particularly crucial in retaining competitive edges in the evolving automotive landscape.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Starter Motor and Alternator market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Types of Starter Motor

|

|

Alternator Type

|

|

Technology

|

|

Vehicle Type

|

|

Sales Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report