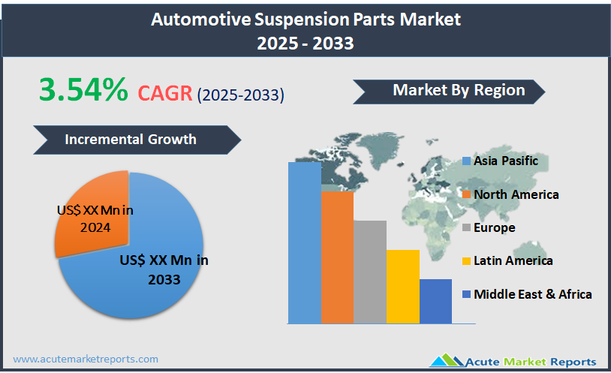

Automotive suspension parts are crucial components of a vehicle's suspension system, designed to absorb and dampen shock while providing support and overall vehicle stability. These parts include shocks, struts, coil springs, leaf springs, linkages, bushings, and ball joints, among others. The primary function of these components is to enhance ride quality by minimizing road irregularities and ensuring that the tires remain in contact with the road surface for traction, control, and comfort. The automotive suspension parts market is experiencing steady growth, projected at a CAGR of 3.54%. This growth is driven by the expanding global automobile industry, increasing consumer demand for vehicles with advanced ride quality, and the ongoing shift towards lightweight materials in suspension manufacturing. As vehicles evolve with more sophisticated technology integrations, the demand for high-performance suspension parts that offer superior handling and durability also increases. Furthermore, the rising popularity of electric vehicles (EVs) and the specific suspension requirements they entail contribute significantly to market expansion. Manufacturers are focusing on innovation in suspension technology, such as electronically controlled systems and air suspension systems, to cater to the premium and luxury segments. The need for regular maintenance and replacement of suspension parts in aging vehicles also supports market growth, underpinning ongoing demand in the aftermarket sector.

Increased Demand for Advanced Suspension Systems

The growth of the automotive suspension parts market is significantly driven by the increasing consumer demand for vehicles that offer superior ride quality and comfort. Advances in automotive technology have led to the development of sophisticated suspension systems that enhance vehicle handling, stability, and safety, contributing to an overall better driving experience. Evidence of this driver can be seen in the rising popularity of luxury and sports vehicles that feature advanced suspension technologies like adaptive and active systems. These systems automatically adjust the suspension settings based on road conditions and driving dynamics, thereby improving ride comfort and performance. The demand is further bolstered by consumer testimonials and growing preferences for vehicles equipped with these advanced systems, particularly in emerging markets where road conditions vary widely and the luxury vehicle segment is expanding rapidly.

Expansion into Electric and Autonomous Vehicle Markets

An emerging opportunity in the automotive suspension parts market lies in the growing electric and autonomous vehicle sectors. These new vehicle types require specialized suspension systems to handle increased weights due to battery packs and to maintain stability and comfort despite the absence of traditional driving controls. The transition towards electric and autonomous vehicles is supported by global environmental policies and technological advancements, positioning suspension manufacturers who innovate for these new applications at a competitive advantage. Developing suspension systems that can accommodate the unique requirements of electric and autonomous vehicles opens up significant new avenues for growth, particularly as governments and consumers push for cleaner and more technologically advanced transportation solutions.

Regulatory Compliance and Environmental Concerns

The expansion of the automotive suspension parts market is restrained by stringent regulatory standards and increasing environmental concerns. Regulations regarding vehicle emissions and safety standards directly influence the design and materials used in suspension systems. For instance, the shift towards lighter materials intended to reduce vehicle weight and enhance fuel efficiency requires manufacturers to invest in new materials and technologies, which can be cost-prohibitive. Moreover, environmental regulations compel manufacturers to consider the recyclability and environmental impact of their products, adding another layer of complexity to the manufacturing process. These factors combine to restrict the rapid development and deployment of new suspension technologies, as compliance with these evolving standards requires significant time and financial investment.

Supply Chain and Raw Material Price Volatility

A major challenge faced by the automotive suspension parts market is the volatility of supply chains and the fluctuating prices of raw materials. The suspension parts industry relies heavily on steel, aluminum, and rubber, the prices of which are highly susceptible to global economic conditions, trade policies, and geopolitical tensions. For instance, tariffs on steel can dramatically increase production costs, while disruptions in rubber supply due to climate or political issues can lead to shortages and delay production schedules. Managing these risks requires robust supply chain strategies and contingency planning, but even well-prepared companies can face difficulties ensuring stable production and keeping costs under control in an unpredictable global market environment.

Market Segmentation by Suspension Parts Type

The automotive suspension parts market is segmented by different types of components, including shock absorbers, struts, links, and springs. Among these, shock absorbers are currently generating the highest revenue due to their critical role in damping the impact and vibrations caused by road surfaces, thereby enhancing vehicle stability and comfort. The widespread use of shock absorbers across various vehicle types, from passenger cars to heavy-duty vehicles, underpins their dominant market position. However, springs, particularly coil springs and leaf springs, are expected to exhibit the highest CAGR. This growth is driven by innovations in materials and design that improve durability and performance, catering to the increasing demands of modern vehicles. The development of lightweight and high-strength spring materials enhances vehicle handling and fuel efficiency, aligning with global trends towards energy-efficient automobiles.

Market Segmentation by Technology Type

In terms of technology, the automotive suspension parts market is segmented into gas-charged and hydraulic suspension components. Hydraulic suspension components account for the highest revenue share due to their longstanding presence and proven reliability in the market. These systems use fluid to absorb shocks, providing a smooth ride quality that is particularly favored in traditional vehicle setups. On the other hand, gas-charged suspension components are projected to experience the highest CAGR. This growth is driven by the superior performance these components offer, including reduced aeration and foaming compared to purely hydraulic systems. Gas-charged shocks and struts provide better damping consistency and have become increasingly popular in both standard and high-performance vehicles. The trend towards more dynamic and adaptable suspension systems favors the adoption of gas-charged technologies, which are better suited to meet the demands of modern drivers and road conditions.

Geographic Segment: Automotive Suspension Parts Market Trends and Projections

The automotive suspension parts market is characterized by significant regional variances in growth rates and market dynamics. The Asia Pacific region has historically held the highest revenue percentage, driven by the expansive automotive manufacturing sectors in countries such as China, Japan, and India. This region benefits from robust local production capacities, rising vehicle ownership, and the presence of major automobile manufacturers. The demand in Asia Pacific is further supported by increasing urbanization and improvements in road infrastructure, which enhance the need for advanced automotive suspension systems. However, the region with the highest projected CAGR from 2025 to 2033 is expected to be Latin America. This growth will likely be fueled by the recovery of automotive sales post-economic downturns, ongoing industrialization, and increased investments by global automakers in local production facilities to capitalize on emerging market opportunities.

Competitive Trends and Key Strategies: Major Players in the Automotive Suspension Parts Market

In 2024, the automotive suspension parts market was dominated by key players such as Brinn Inc., BWI Group, Continental AG, Datsons Engineering Works Pvt. Ltd., DMA Sales, Inc., Duroshox, Endurance Technologies Limited, FCS Auto, Halla Holdings Corp., Hitachi Automotive Systems, Ltd., Kalyani Forge, Kobe Suspensions, KYB Corporation, LEACREE Company, Magneti Marelli S.p.A., Mubea Suspension Pvt. Ltd., QBAutomotive Inc., Ride Control, LLC, Robert Bosch GmbH, Samavardhana Motherson Group, Tenneco Inc., and ZF Friedrichshafen AG. These companies employed strategies focusing on technological innovation, geographical expansion, and enhancements in material science to improve the performance and durability of suspension components. For instance, developments in lightweight materials were emphasized to meet the industry's demand for fuel-efficient vehicles. Mergers and acquisitions were also prominent, allowing companies to expand their market presence and gain access to emerging markets. From 2025 to 2033, it is expected that these companies will continue to advance their technologies, particularly in electronic and adjustable suspension systems, to cater to the evolving requirements of electric and autonomous vehicles. Global expansion, especially in underpenetrated markets, will likely remain a strategic focus as companies seek to leverage new automotive growth trends and consumer preferences for advanced driving experiences. Additionally, sustainability and adaptation to regulatory changes will drive innovations in product offerings to meet stricter environmental standards and consumer expectations for eco-friendly products.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Suspension Parts market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Suspension Parts Type

| |

Technology Type

| |

Vehicle Type

| |

Sales Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report