The autonomous valet parking system market is growing at a 15.5% CAGR as automakers and parking operators deploy automated parking features that let vehicles drop off passengers and then park themselves in structured facilities. Commercial rollouts are starting with premium models and pilot parking garages where infrastructure and vehicles are jointly validated, before moving into wider mid-segment adoption over the forecast period. Within components, hardware currently generates the highest revenue due to demand for sensors, controllers, and infrastructure equipment, while software is expected to post the highest CAGR as value shifts toward perception, mapping, connectivity, and cloud orchestration. By automation level, SAE Level 2 and Level 3 assisted and conditional parking functions dominate current volumes, whereas SAE Level 4 autonomous valet parking is projected to record the highest CAGR as more parking garages are equipped with smart infrastructure and regulations allow driverless operation.

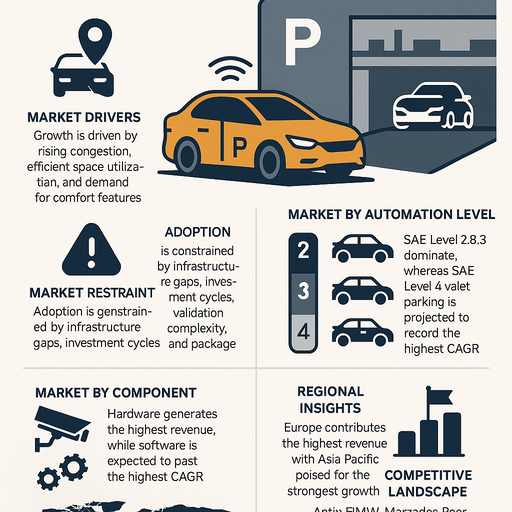

Market Drivers

Growth is driven by rising congestion in urban centers, pressure to use parking space more efficiently, and growing consumer demand for comfort features in mid and high-end vehicles. Automated valet parking helps operators increase parking density, reduce search time for spaces, and lower minor collision claims in tight garages. Advances in low-speed autonomy, sensor fusion, and high-resolution surround-view cameras, radar, and ultrasonic sensors enable reliable maneuvering in complex parking structures. Connectivity between vehicles and parking infrastructure allows remote space allocation, digital reservations, and integration with smart-city platforms, while over-the-air updates improve features after vehicle sale. Regulatory progress in Europe and selected Asian markets around low-speed driverless services inside private facilities provides a path for early SAE Level 4 deployments.

Market Restraints

Adoption is constrained by the need for compatible vehicles and infrastructure, with many garages still lacking the cameras, lidar, communication units, and edge servers needed for Level 4 autonomous valet parking. Investment cycles for parking operators can be long, especially where parking fees are regulated or demand is seasonal. Safety validation, cybersecurity requirements, and liability allocation between OEMs, suppliers, and garage owners add complexity to commercialization. Fragmented standards for vehicle-to-infrastructure communication and parking data formats slow interoperability. For some buyers, the price of advanced parking packages remains high compared with perceived benefits, limiting take-up outside premium segments.

Market by Component

Hardware forms the backbone of autonomous valet parking deployments, including in-vehicle sensor suites, domain controllers, and garage-side cameras, lidar, and connectivity nodes; within components this segment currently generates the highest revenue. Tier 1 suppliers and infrastructure vendors supply scalable sensor and controller platforms that can be configured for different garage layouts and vehicle segments. Software covers perception, localization, trajectory planning, parking-slot allocation, fleet coordination, and connectivity with mobile apps and payment systems. Cloud-based platforms manage maps of parking facilities, update driving policies, and monitor system health; within components the software segment is expected to post the highest CAGR as recurring licenses, feature upgrades, and analytics become central to the business model. Services include design and simulation of parking layouts, installation and commissioning of systems, remote monitoring, maintenance contracts, and software integration with existing parking management systems. Consulting and validation services support regulatory approval and safety case documentation as operators move from pilots to permanent services.

Market by Automation Level

SAE Level 2 assisted parking, including automated steering and guided parking maneuvers with the driver still supervising, is widely available today on passenger cars and provides a volume base for parking automation. SAE Level 3 conditional automated parking extends this with higher autonomy in known environments such as home and office parking, including memory parking features where the vehicle repeats trained paths. SAE Level 4 highly automated valet parking enables driverless parking and retrieval inside defined areas such as multi-storey garages using infrastructure support and strict operating conditions; within automation levels SAE Level 4 is expected to record the highest CAGR as more garages are equipped with smart infrastructure and approvals expand. SAE Level 5 fully automated parking, independent of mapped areas and infrastructure support, remains a longer-term vision under research and pilot testing, with limited near-term revenue but strong strategic importance as part of full-vehicle autonomy roadmaps. Overall, SAE Level 2 and Level 3 drive current revenue, while Level 4 anchors the long-term growth story for autonomous valet parking.

Regional Insights

Europe contributes the highest revenue, supported by a strong premium vehicle mix, early regulatory approvals for automated valet parking in countries such as Germany, and active collaboration between OEMs, Tier 1 suppliers, and parking operators to equip garages with Level 4-capable infrastructure. Asia Pacific records strong growth with deployments in Japan, South Korea, and China where smart-city programs and high-density urban centers favour automated parking, and local OEMs integrate advanced parking functions as part of their ADAS and autonomy packages. North America scales from premium-brand offerings and trials in airports, shopping centers, and office complexes, with focus on integration into wider mobility platforms and EV-charging workflows. Latin America and the Middle East & Africa are at an earlier stage, with interest linked to high-end real estate, mixed-use developments, and smart-city flagships where automated parking is deployed as a value-adding amenity.

Competitive Landscape

Aptiv delivers automated parking solutions as part of its Gen 6 ADAS platform, combining AI-based perception, memory park assist, and scalable software that can run across different hardware platforms and sensor sets. BMW and Mercedes-Benz are early OEM leaders in automated valet parking features, including commercial Level 4 deployments in cooperation with infrastructure partners, and use these systems to differentiate premium models with advanced convenience functions. Bosch and Continental act as key Tier 1 suppliers for infrastructure-based and in-vehicle solutions, providing sensors, cameras, ECUs, and complete automated valet parking platforms that can be integrated into multiple OEM programs and parking garages. Ford Motor and Volkswagen deploy advanced parking features in their ADAS suites and participate in pilots where vehicles communicate with smart garages and charging infrastructure. Magna International and ZF Friedrichshafen supply camera, radar, and ultrasonic systems, central controllers, and software stacks that support park-assist and automated parking functions across several OEMs. Valeo leverages its Park4U family and park assist systems, combining sensors, telematics, and integration with smart parking services to offer automated parking functions to a wide range of vehicle platforms. As the market matures, suppliers with strong partnerships between OEMs and parking operators, validated Level 4 systems, and scalable software platforms are positioned to lead current revenue, while players focusing on cloud-based coordination, EV charging integration, and retrofit solutions for existing garages are set to capture the highest CAGR.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Autonomous Valet Parking System market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Component

|

|

Automation Level

|

|

Vehicle

|

|

End Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report