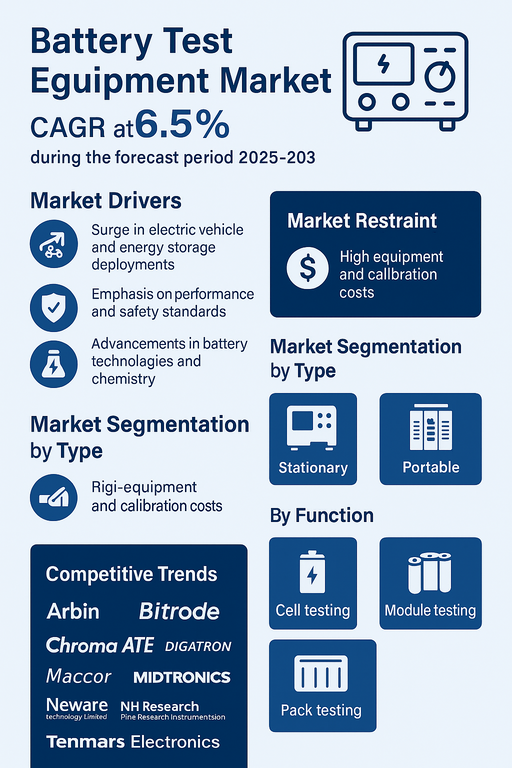

The battery test equipment market is projected to grow at a CAGR of 6.5% during the forecast period 2025 to 2033, driven by increasing demand for accurate, efficient, and reliable testing solutions across automotive, renewable energy, consumer electronics, and industrial sectors. Battery test equipment enables manufacturers and end-users to evaluate the capacity, cycle life, internal resistance, thermal behavior, and safety of individual cells, modules, and packs under real-world operating conditions. The rapid global transition to electric mobility, coupled with significant investments in utility-scale energy storage and electronics miniaturization, has created strong growth potential for the market. Moreover, battery test solutions are evolving to incorporate smart features such as real-time data logging, cloud-based data sharing, predictive maintenance analytics, and automated programming for high-volume production lines. This shift toward digitalization and precision engineering is allowing market players to address stringent standards set by regulatory bodies, optimize production processes, and ensure long-term performance of advanced battery chemistries, all of which is supporting sustained demand growth worldwide.

Market Drivers

Surge in Electric Vehicle and Energy Storage Deployments

The rapid growth of electric vehicles across major global economies is one of the most significant drivers of demand for battery test equipment. Electric powertrains require rigorous and repeated testing to confirm that batteries achieve specified power output, safety margins, and cycle durability under harsh and varying operating conditions. At the same time, the rapid deployment of utility-scale energy storage systems powered by lithium-ion and alternative chemistries is creating new requirements for large-format battery pack testing across broad environmental and load profiles. This drives investments in highly configurable test solutions that can scale up as energy capacity requirements grow. The overall shift toward cleaner and more sustainable power generation and mobility solutions is fostering increased scrutiny on battery safety and long-term performance, further boosting equipment demand.

Emphasis on Performance and Safety Standards

As battery-powered devices become more prevalent in automotive, medical, consumer electronics, and aerospace applications, regulators and industry consortia have introduced stricter performance and safety testing protocols. Standards such as UN 38.3 and IEC 62660 require testing under controlled temperature, pressure, and charge/discharge rates to minimize the risk of thermal runaway, short-circuits, and other hazards. Battery test equipment with accurate thermal management, high-precision sensors, and repeatable cycle tests is therefore in demand. Manufacturers increasingly rely on advanced battery cyclers, simulators, and pack-level test systems to meet these rigorous requirements while also improving quality control and lowering the rate of returns or warranty claims.

Advancement in Battery Technologies and Chemistry

The rapid emergence of new battery technologies such as lithium iron phosphate (LFP), silicon-anode, and all-solid-state batteries is reshaping test requirements. Manufacturers require modular, programmable test stations that can quickly adapt to different chemistries and formats without compromising measurement accuracy. Battery test equipment capable of supporting wide voltage and current ranges, rapid data sampling rates, and built-in safety protocols is increasingly preferred to meet diverse development and validation needs. This shift toward next-generation chemistries will continue to drive R&D investments and, by extension, demand for advanced, scalable test solutions.

Market Restraint

High Equipment and Calibration Costs

Despite these positive growth trends, the high capital cost of sophisticated battery test equipment can constrain adoption rates among small and medium-sized enterprises and R&D labs operating under budgetary restrictions. The cost of periodic calibration, maintenance, and software updates further adds to total ownership expenses. Additionally, inconsistencies across regional testing standards can create integration and interoperability challenges, especially for companies with geographically diverse operations or who wish to scale production into new international markets. Lack of harmonized standards may discourage investment in versatile, high-end test systems that offer future-proofing but also come with a higher upfront cost.

Market Segmentation by Type

The Type segment comprises Stationary and Portable battery test equipment. In 2024, Stationary battery test equipment dominated global revenues owing to its widespread deployment in centralized test labs, automotive engineering centers, battery production lines, and renewable energy R&D hubs. Stationary test equipment supports continuous and automated testing of high volumes of cells, modules, and packs across long-duration cycling profiles. Their robust measurement accuracy, multi-channel configurations, and scalability make them indispensable in battery qualification and end-of-line testing at OEMs and Tier-1 suppliers. Manufacturers also appreciate their ability to integrate with enterprise software for automated data logging and real-time performance monitoring. Portable test equipment, however, is poised for rapid growth due to its flexibility and ease of deployment. Field technicians, utility operators, and service providers use handheld or benchtop devices for diagnostic checks, rapid fault identification, and maintenance of distributed energy storage units. Portable testers often come equipped with wireless data transfer capabilities and intuitive user interfaces to help technicians in real-world conditions. They enable quick state-of-health assessments without requiring large, fixed installations, making them especially useful for testing batteries in electric vehicle fleets, telecommunications infrastructure, and grid-tied solar-battery systems.

Market Segmentation by Function

The Function segment includes Cell Testing, Module Testing, and Pack Testing. In 2024, Cell testing accounted for the largest market share as cell-level testing forms the foundation of all battery validation processes. Evaluating individual cells enables manufacturers to accurately assess capacity retention, cycle efficiency, energy density, and impedance under varied charge and discharge rates. This data is vital in early-stage R&D and during the production of battery cells to ensure each unit meets strict design criteria. Module testing is projected to register substantial growth between 2025 and 2033 as companies increasingly produce battery modules that integrate multiple cells into scalable units for automotive and renewable energy solutions. Testing at this level allows manufacturers to identify variations between cells and balance these differences to enhance the performance, lifespan, and safety of entire modules. Pack testing is also witnessing significant growth driven by the need for system-level validation under dynamic load and temperature profiles. Battery packs are tested for thermal management efficiency, power delivery, safety under extreme conditions, and long-term degradation. Advanced pack testing solutions often feature automated test scripts and fail-safe monitoring, making them critical in industries where safety and compliance are paramount. Pack testing demand is further boosted by the rapid deployment of electric buses, trucks, and large stationary energy systems across diverse geographies.

Competitive Trends

The battery test equipment market is moderately consolidated, with several leading companies delivering high-precision instruments, tailored automation solutions, and region-specific services. Arbin, Bitrode, and Chroma ATE continue to leverage their global sales networks and advanced engineering teams to offer scalable solutions tailored to automotive OEMs and Tier-1 battery suppliers. DIGATRON and Maccor focus on delivering fully customized test benches and automated cycling systems capable of simulating complex duty cycles for R&D and production lines. Midtronics and Neware Technology Limited have achieved strong traction among mid-scale laboratories and energy system integrators looking for cost-effective, modular solutions that do not compromise on measurement accuracy or cycle testing capabilities. NH Research and Pine Research Instrumentation remain competitive through their focus on precision instruments, especially for electrochemical testing in academic, research, and specialized commercial settings. Tenmars Electronics capitalizes on its expertise in handheld diagnostic tools for rapid battery performance checks in service environments, positioning itself as a value-driven player in repair and maintenance segments. Going forward, companies are investing in automation, intelligent software platforms, and cloud-based data analysis tools to differentiate their offerings. They are also forming strategic alliances with battery OEMs, electric vehicle makers, and testing labs to co-develop application-specific solutions. Furthermore, investments in energy-efficient designs and environmentally friendly test hardware (especially those that reduce energy consumption and recycle heat) will help key players enhance their sustainability profiles and meet evolving buyer preferences. The global competitive landscape will continue to intensify as new entrants and established firms vie for leadership across the diverse and fast-growing battery test equipment ecosystem through 2033.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Battery Test Equipment market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Type

| |

Function

| |

Equipment

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report