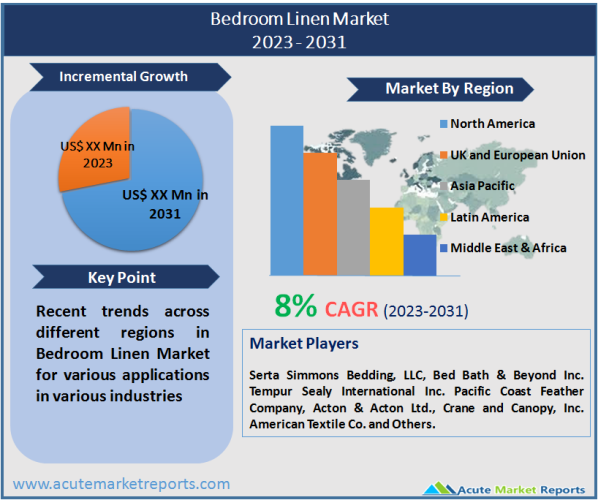

The global bedroom linen market is projected to expand at a CAGR of 8% during the forecast period of 2026 to 2034. The housing and hospitality industries' expansion is a major contributor to the growth of this industry. Moreover, the increasing propensity to spend on home furnishings is also a factor driving the industry's expansion. According to an article by Hotel Tech Report, until October 2022, 665 net hotels and 85,306 rooms had opened in the United States. A high standard of bedroom fabric enhances the quality of hotel rooms, so hotels are always in need of high-quality bedsheets. The continued expansion of the hospitality industry, particularly in developing regions, will continue to drive the bedroom linen market. In the second half of 2022, 454 hotels with 103,832 rooms opened in the Asia-Pacific region, according to an article by Top Hotel. China is the leader in hotel development throughout the Asia-Pacific region, with India and Australia close behind. Therefore, these regions will be the largest bedroom linen consumers. People with a renewed interest in renovating their homes tend to invest in bedroom linen and other home furnishings. During the pandemic, nearly 74 million consumers in the United States completed a home remediation project, according to a Comscore study.

Availability of Sustainable Environment Friendly and Custom Products to Expand Market Growth

Additionally, preferences for bedroom linens vary by region. According to Anki Spets, the owner of the bedding company AREA Home, every person should have at least two sheets, but if they reside in a humid area, this number should be increased. As consumers' purchasing decisions continue to be primarily influenced by sustainability, many brands have begun offering eco-friendly and nontoxic products. These products are made from chemical-free organic cotton, linen, hemp, and tencel. Made Trade's bedding, for example, is made from organic and eco-friendly materials such as bamboo lyocell and tencel eucalyptus.

Personalizing bedroom linen has become popular, particularly among affluent customers. Consumers can choose from a list of fabrics, sizes, colors, and weights to obtain their desired product on a variety of online platforms. For instance, Mosaic Weighted Blankets provides consumers with the option to select and personalize a blanket. In addition, antimicrobial blankets are available for hospitals and similar institutions.

Increasing Bedsheet Usage to Increase Demand

In 2025, the sheet segment held the largest market share. Demand for sheets in the residential and commercial sectors is increasing at a constant rate, in tandem with population growth. The rapid expansion of the global hospitality industry has contributed significantly to the market's expansion. In addition, the growing awareness of the importance of hygiene is one of the primary factors driving product demand. Numerous design options, including floral, geometric, and check patterns, are available in this product segment, making it a vast category. With increased construction in the housing and hospitality industries, the segment will continue to expand. From 2026 to 2034, the blankets/quilts/comforters product segment is anticipated to record the highest CAGR. In this segment, there are numerous options for fabrics and their thickness. This segment's growth will be driven by innovations, such as the use of polyester micro-fiber fabric to protect mattresses from spills and stains.

Additionally, home decoration is anticipated to contribute to the industry's revenue growth, as consumers prefer to maintain their homes' aesthetics. Increasing consumer awareness of the importance of sleep for maintaining a healthy body will increase the demand for sheets made of various materials. Due to the pandemic and heightened consumer awareness of hygiene and safety, however, many service providers are replacing sheets frequently to maintain the hygiene and safety of their customers.

Linen Cotton Dominates the Material Market

The cotton blended linen segment dominated the bed linen market by material in 2025, accounting for approximately 65% of the total market share. This was due to the rising popularity of cotton in bed linen products. There are numerous advantages to using cotton bed linens, including durability, high air permeability, suitability for sensitive skin, all-season comfort, superior breathability, and appealing aesthetics. Increasing demand for cotton bedsheets in homes and hospitals influences market demand as well.

Offline Distribution Channel Dominates the Market

In 2025, the offline distribution channel segment dominated the industry and accounted for more than 50% of the total revenue. The quality of bedroom linens is a crucial factor in determining their sales. As consumers do not want to take chances with quality, they prefer to purchase these items from stores or brand outlets. Offline channels also feature sales representatives in the field who can assist with any immediate customer inquiries. This expedites the purchasing process, so consumers prefer this market segment. The online distribution channel segment is anticipated to experience the highest CAGR during the forecast period.

With extensive internet penetration and consumers' busy schedules, this channel is a promising factor that will fuel the growth of the industry. After the pandemic, online retailing became more established. According to a Comscore study, one in three consumers purchased an online product on sale that they would not have purchased otherwise, and 75% conducted online research prior to making a major purchase. These trends will boost the growth of the industry during the forecast period.

Commercial Segment Dominates the Application Market

In 2025, the commercial application segment dominated the global market. The segment's high share is largely due to the rapid growth of the hospitality and medical industries. Globally, after the pandemic, a strong desire to travel was observed among populations. According to a report by the World Tourism Organization, approximately 700 million tourists traveled internationally from January to September 2026, a 133% increase over the same period in 2022. As this number increases, hotels' product demand will increase.

The residential segment is anticipated to record the highest growth rate during the forecast period, at 8.00%. As new housing units are constructed, product demand increases. According to the U.S. Census Bureau and the Department of Housing and Urban Development, construction on approximately 1,595,100 housing units began in 2022, a 15.6% increase from 2021. Good bedroom linens provide insulation, warmth, and comfort in addition to influencing the bedroom's aesthetic. Thus, a great deal of consideration goes into the purchase of such products. Increasing global disposable incomes will also stimulate industry expansion.

APAC Remains as the Global Leader

In 2025, the Asia-Pacific region dominated the industry and accounted for more than 45% of global revenue. Throughout the forecast period, the region will maintain its dominant market position while expanding at the highest CAGR. This region's rapidly expanding hospitality and housing industries are the primary driver of market expansion. According to the most recent study by CBRE, hotel investment in Asia-Pacific increased to $10 billion. With confidence in this region's performance and operating profits nearly reaching pre-pandemic levels, this sector will continue to expand, positively impacting the bedroom linen market.

Middle East & Asia is anticipated to grow at a rapid CAGR between 2026 and 2034. This region, including the UAE, Egypt, Oman, Saudi Arabia, and Morocco, attracts throngs of tourists year-round. According to a report by the UAE Ministry of Economy, the number of hotels in the country will reach 1,089 in 2021, with a total capacity of 180,000 rooms. With continued investments in the tourism of such regions as Qatar, Dubai, Abu Dhabi, and Cairo, the hospitality industry is anticipated to expand. Thus, the Middle East and Africa are lucrative markets for bedroom linens.

Market Competition to Intensify During the Forecast Period

The market is significantly fragmented. However, consumer income is the driving force behind demand. Large companies compete by purchasing in bulk, offering a wide variety of products, and effective merchandising and marketing their goods. Small businesses concentrate on a specific market segment and compete through product breadth and superior customer service.

The industry is comprised of a handful of established companies and new entrants. For the purpose of attracting more consumers, a number of major corporations are increasing their emphasis on product innovation. To maintain market share, businesses are diversifying their product offerings. For example:

Key players in this market include Serta Simmons Bedding, LLC, Bed Bath & Beyond Inc. Tempur Sealy International Inc. Pacific Coast Feather Company, Acton & Acton Ltd., Crane and Canopy, Inc. American Textile Co. and others.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Bedroom Linen market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Application

|

|

Distribution Channel

|

|

Material

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report