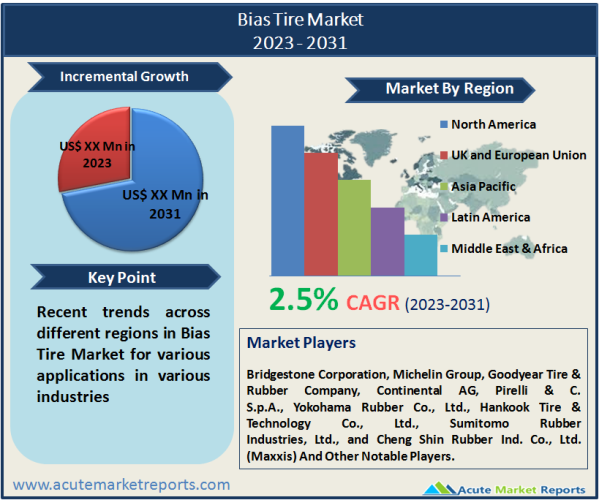

The bias tire market has been experiencing steady growth over the years, driven by various factors such as increasing automotive production, infrastructure development, and expanding transportation networks. The Bias tires market is expected to rise at a CAGR of 2.5% during the forecast period of 2026 to 2034. Bias tires also known as cross-ply tires, are constructed with multiple layers of fabric cords arranged at an angle to the tire's centerline. This design provides strength, durability, and stability, making them suitable for a wide range of applications. One of the key drivers of the bias tire market is the growing automotive industry. With the rising demand for passenger and commercial vehicles, the need for tires has also increased significantly. Bias tires find extensive usage in heavy-duty vehicles such as trucks, buses, and agricultural machinery, due to their ability to withstand heavy loads and rough terrains. Moreover, the robust construction of bias tires ensures better resistance against punctures and damages, making them the preferred choice for off-road applications. Infrastructure development initiatives across the globe are also contributing to the growth of the bias tire market. The construction of roads, highways, bridges, and other transportation infrastructure requires a large fleet of vehicles and machinery, which in turn drives the demand for bias tires. These tires are known for their reliability, longevity, and cost-effectiveness, making them suitable for infrastructure development projects. Factors such as increasing vehicle sales, expanding transportation networks, and technological advancements in tire manufacturing have contributed to this growth. Additionally, the demand for bias tires in emerging economies is expected to further fuel market growth.

Growing Automotive Industry

The bias tire market is being driven by the growing automotive industry worldwide. The demand for passenger and commercial vehicles has been on the rise, leading to increased tire sales. Bias tires, known for their strength and durability, are preferred choices for heavy-duty vehicles such as trucks, buses, and agricultural machinery. These vehicles require tires that can withstand heavy loads and rough terrains, and bias tires fit the bill perfectly. According to the International Organization of Motor Vehicle Manufacturers (OICA), global vehicle production has been steadily increasing over the years. For instance, in 2021, the total number of vehicles produced globally was over 78 million units, showcasing the significant demand for vehicles. This increased production directly translates into higher demand for tires, including bias tires, in the automotive industry.

Infrastructure Development Initiatives

Infrastructure development projects across the globe are major drivers of the bias tire market. The construction of roads, highways, bridges, and other transportation infrastructure requires a large fleet of vehicles and machinery. Bias tires, known for their reliability, longevity, and cost-effectiveness, are the preferred choice for such projects. The robust construction of bias tires ensures better resistance against punctures and damages, making them suitable for rugged terrains encountered during construction activities. Global infrastructure investment has been witnessing substantial growth in recent years. For example, the Belt and Road Initiative (BRI) led by China aims to boost connectivity and economic development across Asia, Europe, and Africa. This initiative involves extensive infrastructure development, including the construction of roads, railways, and ports, which will drive the demand for bias tires.

Cost-Effectiveness and Longevity

The cost-effectiveness and longevity of bias tires make them a preferred choice for many applications. Bias tires are typically less expensive to produce compared to radial tires, making them more affordable for consumers. Additionally, bias tires have a longer tread life, meaning they can be used for a longer duration before replacement, further enhancing their cost-effectiveness. The longevity and cost-effectiveness of bias tires have been proven in various industries. For instance, in the agricultural sector, bias tires are widely used for farming machinery due to their ability to withstand heavy loads and rugged terrains. These tires have shown significant durability, requiring fewer replacements compared to other tire types, thus reducing overall operational costs for farmers.

Increasing Competition from Radial Tires

One of the key restraints in the bias tire market is the increasing competition from radial tires. Radial tires, characterized by their ply cords running at a 90-degree angle to the tire's centerline, have gained popularity due to their superior performance and fuel efficiency compared to bias tires. Radial tires provide better traction, improved handling, and reduced rolling resistance, resulting in enhanced fuel economy for vehicles. As a result, there has been a gradual shift in the automotive industry towards radial tires, particularly in passenger cars and light commercial vehicles. The increasing adoption of radial tires by major automotive manufacturers supports this restraint. Many automakers are equipping their vehicles with radial tires to meet the growing demand for fuel-efficient and high-performance vehicles. This shift is evident in the market share of radial tires, which has been steadily increasing over the years. The demand for radial tires in passenger cars, SUVs, and light trucks has been particularly strong, posing a challenge to the growth of the bias tire market. As a result of this increasing competition from radial tires, the bias tire market may face limitations in terms of market share and growth potential, especially in segments where radial tires offer distinct advantages. However, bias tires still have their own niche applications in heavy-duty vehicles, off-road vehicles, and certain industrial sectors where their durability and load-bearing capabilities outweigh the advantages of radial tires.

Bias Belted Tires Market Led the Market by Type

In the bias tire market, two prominent segments are general bias tires and bias-belted tires, each with its own distinct characteristics and market dynamics. General bias tires refer to the traditional cross-ply construction, with multiple layers of fabric cords crisscrossing at various angles to the tire's centerline. These tires are known for their durability, strength, and suitability for heavy-duty applications. General bias tires find extensive usage in off-road vehicles, agricultural machinery, and industrial equipment, where their robust construction allows them to withstand challenging terrains and heavy loads. On the other hand, bias-belted tires are a more advanced variant that combines cross-ply construction with an additional layer of belts made of steel or synthetic materials. This belt layer improves the stability, handling, and overall performance of the tires, making them suitable for passenger cars, SUVs, and light commercial vehicles. In terms of revenue, Bias Belted Tires held a higher market share in 2025 due to their usage in the passenger vehicle segment, which accounts for a significant portion of the overall tire market. However, in terms of the highest CAGR during the forecast period of 2026 to 2034, general bias tires are projected to witness substantial growth. Factors such as infrastructure development, increasing demand for heavy-duty vehicles, and the expansion of agriculture and industrial sectors in emerging economies are driving the demand for General Bias Tires. With their robust construction and ability to handle challenging environments, general bias tires are expected to experience a higher CAGR as compared to bias-belted tires in the coming years.

All-Season Tires Dominates the Market by Product Category

In the bias tire market, the product segment is categorized into all-season tires, summer tires, and winter/snow tires, each catering to specific seasonal requirements and driving conditions. All-Season Tires are designed to provide a balance of performance and traction throughout the year, making them suitable for various weather conditions. These tires offer good grip on dry and wet surfaces, as well as moderate performance in light snow. Summer tires, also known as performance tires, are engineered to deliver excellent grip, handling, and responsiveness on dry and wet roads. They are optimized for high-speed driving and are ideal for warm weather conditions. Winter/snow tires, on the other hand, are specifically designed to provide enhanced traction and control on snow, ice, and cold surfaces. These tires feature special tread patterns and compounds that maintain flexibility in freezing temperatures. In terms of revenue, all-season tires held the highest market share in 2025 due to their versatility and widespread usage across various regions. They are popular choices for passenger cars and light commercial vehicles. However, when considering the CAGR, winter/snow tires are expected to witness the highest growth. The demand for winter/snow tires is primarily driven by regions experiencing severe winter conditions, where these tires are legally mandated or highly recommended for safe driving. Additionally, increasing awareness about the importance of winter safety and the rise in winter tourism contribute to the growing demand for winter/snow tires. With their specialized features and seasonal requirements, winter/snow tires are projected to exhibit the highest CAGR in the bias tire market.

North America and Europe Remain Global Leaders

North America and Europe held a dominant share of revenues for bias tires in 2025, driven by the established automotive industry and the presence of leading tire manufacturers. These regions witness steady demand for bias tires across various applications, including commercial vehicles, agriculture, and industrial equipment. However, in terms of revenue percentage, Asia Pacific holds the largest share due to its vast population, rapid industrialization, and expanding transportation infrastructure. The region's developing economies, such as China and India, have witnessed significant growth in automotive production and infrastructure development, leading to increased demand for bias tires. Moreover, the agricultural sector in countries like India, Indonesia, and Vietnam relies heavily on bias tires for farming machinery. On the other hand, when considering the highest CAGR during the forecast period of 2026 to 2034, the Asia Pacific region is expected to exhibit the fastest growth. The region's rising disposable income, urbanization, and increasing industrial activities are driving the demand for vehicles, leading to a higher demand for bias tires. Additionally, ongoing government initiatives in infrastructure development further contribute to the growth of the bias tire market in the region. Latin America and the Middle East and Africa also show potential for growth, driven by infrastructure projects and the expanding automotive industry.

Market Competition to Intensify during the Forecast Period

The bias tire market is highly competitive, with several key players vying for market share and striving to gain a competitive edge. Some of the top players in the market include Bridgestone Corporation, Michelin Group, Goodyear Tire & Rubber Company, Continental AG, Pirelli & C. S.p.A., Yokohama Rubber Co., Ltd., Hankook Tire & Technology Co., Ltd., Sumitomo Rubber Industries, Ltd., and Cheng Shin Rubber Ind. Co., Ltd. (Maxxis). These companies have established themselves as industry leaders through their extensive product portfolios, global presence, and technological advancements. To maintain their competitive positions, these companies employ various strategies such as product innovation, mergers and acquisitions, collaborations, and geographic expansions. Product innovation is a key focus for market players to meet evolving customer demands and industry requirements. These companies invest heavily in research and development activities to introduce advanced tire technologies, enhance performance, and improve fuel efficiency. For instance, Michelin Group has been at the forefront of tire innovation, introducing new tire compounds, tread patterns, and construction techniques. Mergers and acquisitions are also prominent strategies adopted by key players to strengthen their market presence and expand their product offerings. This enables companies to gain access to new technologies, manufacturing capabilities, and distribution networks. For example, in 2022, Goodyear Tire & Rubber Company completed the acquisition of Cooper Tire & Rubber Company, creating one of the world's largest tire manufacturers with a broader product portfolio and enhanced market reach. With the continuous advancements in tire technology and the growing demand for high-performance and durable tires, the competition among these players is expected to remain intense in the coming years.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Bias Tire market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Product

|

|

Tire Size

|

|

Vehicle Type

|

|

Sales Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report