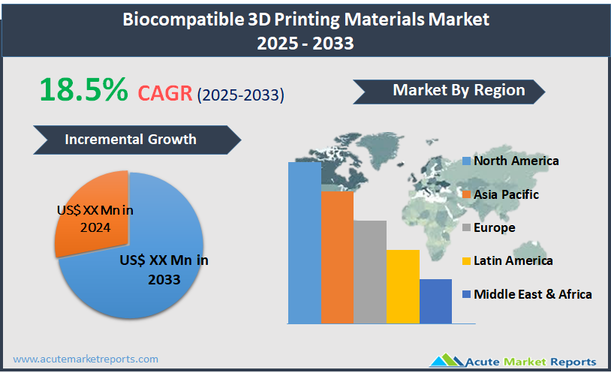

The biocompatible 3D printing materials market encompasses materials that are suitable for medical use and can be used to create structures, devices, and implants through 3D printing technology. These materials are specifically engineered to be compatible with human tissue and body fluids without causing any adverse reactions. Biocompatible 3D printing materials include polymers, metals, ceramics, and composites that meet strict regulatory standards for biocompatibility. This market is vital in fields such as dentistry, orthopedics, and reconstructive surgery, where customized medical devices and implants are increasingly demanded for patient-specific treatments. The biocompatible 3D printing materials market is projected to experience robust growth, with a compound annual growth rate (CAGR) of 18.5% from 2025 to 2033. This rapid growth is primarily driven by advancements in 3D printing technologies and the increasing adoption of 3D printing in the healthcare sector. As 3D printing techniques become more refined, the applications for biocompatible materials are expanding, enabling the production of more complex and precise medical devices and implants. The demand for customized healthcare solutions that offer improved patient outcomes is significantly contributing to the growth of this market.

Advancements in 3D Printing Technology

The surge in the biocompatible 3D printing materials market is largely driven by significant advancements in 3D printing technology. As these technologies have evolved, they've enabled the production of highly complex medical devices and implants with precision that was previously unattainable. The ability to customize products for individual patients, such as tailor-made prosthetics, dental restorations, and bone scaffolding, enhances patient outcomes by ensuring a better fit and potentially reducing recovery times. Hospitals and medical facilities are increasingly adopting these advanced 3D printing solutions because they allow for on-site manufacturing of medical devices, which can significantly cut costs and wait times associated with traditional manufacturing processes. This driver is evidenced by the increasing number of FDA approvals for 3D printed medical devices and implants, reflecting a growing trust and recognition of the efficacy and safety of these products within the medical community.

Expansion into Emerging Markets

There is a significant opportunity for the expansion of the biocompatible 3D printing materials market into emerging markets, where healthcare sectors are rapidly growing and modernizing. Countries like China, India, and Brazil are investing heavily in healthcare infrastructure and new medical technologies, including 3D printing. These markets are relatively untapped with vast patient populations that could benefit from personalized medical treatments enabled by 3D printing. Moreover, the rising economic growth in these countries increases their healthcare spending capabilities, which is conducive to the adoption of advanced medical technologies. This expansion is facilitated by the global nature of the healthcare industry and the ease with which digital manufacturing designs can be transferred and localized.

High Cost of 3D Printing Technologies

A major restraint in the biocompatible 3D printing materials market is the high cost associated with 3D printing technologies. While the benefits of 3D printing in medicine are clear, the initial investment in 3D printing equipment and the ongoing costs of materials and operation can be prohibitive, particularly for smaller healthcare providers or those in developing regions. These high costs can slow the adoption of 3D printing technologies, as healthcare facilities must balance the cutting-edge benefits with the practicalities of their budgets. This economic barrier is compounded by the need for specialized training and maintenance of these advanced machines, adding further to the overall expenses.

Regulatory and Safety Standards

Navigating the complex landscape of regulatory and safety standards poses a significant challenge in the biocompatible 3D printing materials market. Each new material or device intended for medical use must undergo rigorous testing and approval processes to ensure it is safe and effective. These processes can be lengthy and costly, potentially delaying the introduction of innovative products into the market. Additionally, the variability in regulatory requirements from one country to another complicates the global distribution of these products. Manufacturers must stay abreast of evolving standards and ensure that their products consistently meet these stringent requirements across all markets to avoid legal and financial repercussions.

Market Segmentation by Product

In the biocompatible 3D printing materials market, products are segmented into Polymers, Metal, and Others, which includes Ceramics and Composites. Polymers are currently the segment generating the highest revenue due to their versatility, ease of use in 3D printing processes, and wide range of applications in medical devices like implants and prosthetics. Polymers are preferred for their flexibility and ability to be printed under a variety of conditions to meet specific medical requirements. However, Metals are projected to experience the highest CAGR from 2025 to 2033. The growth in the Metals segment is driven by their increasing use in orthopedic implants, dental implants, and surgical instruments, where strength and durability are critical. Metals such as titanium and stainless steel are highly valued for their superior mechanical properties, biocompatibility, and ability to integrate with bone structures, making them increasingly popular in advanced medical applications.

Market Segmentation by Form

The biocompatible 3D printing materials market by form includes Powder, Liquid, and Others. Powder form currently holds the highest revenue share, primarily due to its extensive use in metal and ceramic 3D printing. Powder materials are crucial for techniques like laser sintering and binder jetting, which are commonly used for creating complex and durable medical devices. On the other hand, the Liquid form is expected to register the highest CAGR over the forecast period. This growth can be attributed to the rising popularity of stereolithography (SLA) and digital light processing (DLP) technologies in dental and medical device fabrication. Liquid resins used in these processes offer high precision and detail resolution, which are essential for producing intricate designs and patient-specific products that require exact anatomical fit and functionality.

Geographic Segment

The biocompatible 3D printing materials market showcases strong geographic trends, with North America historically leading in revenue generation in 2024, driven by advanced healthcare infrastructure, substantial investments in R&D, and rapid adoption of innovative medical technologies. The region's dominance is supported by stringent regulatory standards and a robust medical device industry that leverages 3D printing for personalized healthcare solutions. However, the Asia-Pacific region is expected to exhibit the highest CAGR from 2025 to 2033. This surge is anticipated due to increasing healthcare expenditure, growing medical tourism, and expanding manufacturing capabilities in countries such as China, Japan, and South Korea. The region's market growth is further propelled by improving regulatory landscapes and increasing collaborations between global and local companies to develop and market advanced biocompatible 3D printing solutions.

Competitive Trends

In 2024, the competitive landscape of the biocompatible 3D printing materials market was defined by the strategic actions of key players like 3D Systems, Inc., Stratasys Ltd., Evonik Industries AG, Renishaw plc, Formlabs Inc., Envisiontec, Inc., Sandvik AB, Elix Polymers SLU, Concept Laser GmbH, Apium Additive Technologies GmbH, EOS GmbH, Aspect Biosystems Ltd., Cemetrix Solutions, and Bioink Solution, Inc. These companies focused heavily on innovation and strategic partnerships to enhance their product offerings and expand their market footprint. For instance, 3D Systems and Stratasys emphasized developing high-performance polymers and advanced metal printing solutions tailored for medical applications, while Evonik and Elix Polymers concentrated on creating novel biocompatible materials that meet rigorous healthcare standards. From 2025 to 2033, these companies are expected to further their initiatives in emerging markets and continue investing in technological advancements to meet the increasing demands for more sophisticated biocompatible 3D printing solutions. Emphasis will likely be on expanding their capabilities in bio-printing and composite materials to support complex medical applications, such as tissue engineering and regenerative medicine. Additionally, collaborations with healthcare providers and institutions are anticipated to be a key strategy, enabling direct integration of 3D printing technologies into clinical settings, thereby enhancing the development and adoption of personalized medicine practices.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Biocompatible 3D Printing Materials market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Form

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report