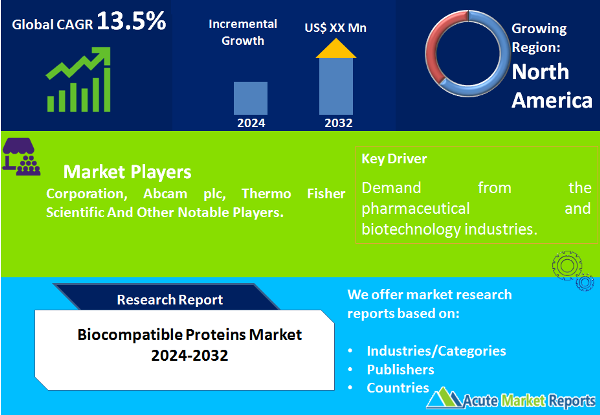

The biocompatible proteins market is expected to grow at a CAGR of 13.5% during the forecast period of 2026 to 2034, driven by technological advancements, expanding applications, and robust demand from the pharmaceutical and biotechnology industries. Despite challenges in regulatory approval processes, the market's outlook remains optimistic. As the forecast period progresses, the biocompatible proteins market is expected to witness transformative developments, reaffirming its significance in various sectors, including healthcare, biotechnology, and research.

Drivers of Biocompatible Proteins Market

Technological Advancements in Protein Engineering

Technological advancements in protein engineering play a pivotal role in driving the biocompatible proteins market. Innovations in the production of synthetic or recombinant proteins have expanded the range of applications in medical devices, drug delivery systems, and tissue engineering. For instance, the development of sophisticated techniques for protein synthesis and modification has led to the production of proteins with enhanced biocompatibility and functionality.

Growing Demand for biocompatible proteins in Pharmaceutical and Biotechnology Industries

The pharmaceutical and biotechnology industries are major consumers of biocompatible proteins, driving the market's growth. Structural proteins, functional proteins, and enzymes find extensive applications in drug development, biopharmaceutical production, and medical research. The increasing focus on personalized medicine and biologics further propels the demand for biocompatible proteins, fostering collaborations between research institutions and industry players.

Rising Adoption in Medical Devices and Tissue Engineering

Biocompatible proteins play a crucial role in the development of medical devices and tissue engineering applications. The use of these proteins in implantable medical devices and regenerative medicine has gained traction due to their compatibility with biological systems. This trend is expected to continue, driven by advancements in biomaterials and an aging population with a growing demand for implantable medical solutions.

Restraint in the biocompatible proteins market

Challenges in Regulatory Approval Processes

While the biocompatible proteins market shows immense promise, challenges in regulatory approval processes act as a significant restraint. The complex nature of protein-based therapies and the need for rigorous safety assessments often lead to prolonged approval timelines. Delays in regulatory approvals hinder market growth and pose obstacles for companies aiming to bring novel biocompatible protein products to market.

Market Segmentation Analysis

Market by Source: Recombinant Proteins Dominate the Market

The biocompatible proteins market is sourced from animal-derived proteins, plant-derived proteins, and synthetic or recombinant proteins. In 2025, synthetic or recombinant proteins emerged as the leading source, boasting not only higher revenue but also the highest Compound Annual Growth Rate (CAGR) among the segments, driven by advancements in genetic engineering technologies.

Market by Application Areas: Drug Delivery Systems Dominate the Market

Biocompatible proteins find applications in medical devices, drug delivery systems, tissue engineering, and other areas. Among these application areas, drug delivery systems took the forefront in 2025, contributing significantly to both revenue and CAGR. The robust growth in drug delivery systems can be linked to the increasing demand for targeted and controlled drug release, highlighting the versatility of biocompatible proteins in this domain.

Market by Type: Structural Proteins Dominate the Market

The market is segmented by type into structural proteins and functional proteins. In 2025, while structural proteins reported higher revenue, it is worth noting that functional proteins exhibited a superior CAGR. The heightened demand for functional proteins, driven by their diverse applications in enzymatic reactions and biological processes, underpins their strong growth trajectory.

Market by End-user Industries: The Pharmaceuticals Industry Dominates the Market

End-user industries include pharmaceuticals, biotechnology companies, medical research institutions, food & beverages, and cosmetics and personal care. In 2025, pharmaceuticals dominated the end-user industries in terms of revenue. However, for CAGR, medical research institutions showed promising growth, reflecting the expanding role of biocompatible proteins in research applications.

Market by Formulation and Delivery Methods: Injectable Proteins Dominate the Market

Market segmentation by formulation and delivery methods comprises powders solubles and injectable proteins. In 2025, injectable proteins exhibited higher revenue, and powders and solubles showed a commendable CAGR, driven by their applications in targeted drug delivery and regenerative medicine. The increased adoption of injectable proteins is attributed to their effectiveness in ensuring the precise delivery of therapeutic agents, aligning with the growing emphasis on personalized medicine.

Market by Grades: Medical Grade Proteins Dominate the Market

Biocompatible proteins are categorized into medical grade, research-grade, and others. In 2025, medical-grade proteins led the market in terms of revenue, and research-grade proteins displayed a commendable CAGR. The prominence of medical-grade proteins underscores the importance of adhering to stringent quality standards, particularly in applications with direct implications for human health.

Market by Classes: Collagen-based Proteins Dominate the Market

The classes segment includes collagen-based proteins, albumin, and enzymes. Collagen-based proteins emerged as the leading class in 2025, contributing significantly to revenue and displaying a commendable CAGR. The enduring popularity of collagen-based proteins can be attributed to their structural importance in various biological tissues, rendering them indispensable in medical and cosmetic applications.

North America Remains the Global Leader

The biocompatible proteins market exhibits dynamic geographic trends. North America led in terms of revenue percentage in 2025, attributed to the region's advanced healthcare infrastructure and significant investments in research and development. Europe, while demonstrating commendable CAGR, slightly lagged in revenue percentage. The Asia-Pacific region, with its burgeoning healthcare markets, showcased the highest CAGR, indicating untapped potential. The Middle East and Africa contributed modestly to the market, influenced by diverse regional dynamics.

Market Competition to Intensify during the Forecast Period

Top players in the biocompatible proteins market employ diverse strategies to maintain their positions. In 2025, key players such as Sigma-Aldrich Corporation, Abcam plc, and Thermo Fisher Scientific reported substantial revenues, with projections for the 2026 to 2034 period indicating further growth. Collaborations with research institutions, expansion of product portfolios, and investments in clinical trials are key strategic initiatives driving these companies forward.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Biocompatible Proteins market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Source

|

|

Application

|

|

Type

|

|

End-User

|

|

Formulation And Delivery Methods

|

|

Biocompatibility Grades

|

|

Specific Proteins Or Classes

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report