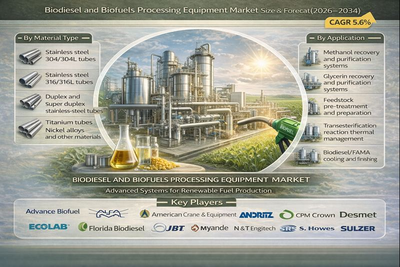

The biodiesel and biofuels processing equipment market is expected to grow at a CAGR of 5.6% during 2026–2034, driven by expanding renewable fuel mandates, rising demand for low-carbon liquid fuels, and capacity additions in biodiesel (FAME) and renewable diesel (HVO/HEFA) production. Processing equipment demand is closely tied to plant debottlenecking, yield improvement, and compliance needs, as producers invest in reliable separation, heat transfer, purification, and high-pressure systems. Growth is also supported by rising use of waste oils and fats as feedstocks, which increases the need for pre-treatment and purification equipment, along with higher focus on energy efficiency and corrosion-resistant materials to reduce downtime and lifecycle cost.

Market Drivers

Market growth is driven by policy support for renewable fuels and decarbonization targets that encourage new plants and expansions, especially for renewable diesel where higher throughput and stricter specifications drive equipment upgrades. Producers are increasing feedstock flexibility to include used cooking oil, animal fats, and other lower-cost inputs, which raises demand for robust feedstock pre-treatment, filtration, and contaminant removal systems. Higher focus on operational efficiency is supporting investment in heat exchangers, thermal management, and energy integration solutions that reduce utility consumption and stabilize reaction conditions. Rising emphasis on coproduct value recovery is expanding demand for methanol recovery and glycerin purification systems that improve product quality and plant economics. In addition, plant reliability needs and stricter safety requirements are pushing adoption of high-performance materials, better instrumentation integration, and skid-based modular equipment that reduces installation and commissioning time.

Market Restraints

The market faces restraints related to project financing risk, feedstock price volatility, and margin sensitivity, which can delay capital spending on new equipment. Long lead times for specialized components, pressure-rated systems, and corrosion-resistant tubing can impact project schedules. Compliance requirements and permitting complexity vary by region and can slow plant approvals and expansions. Equipment selection is also constrained by the need to handle impurities and variable feedstock quality, which increases design complexity and raises capex. In addition, skilled labor shortages for installation and maintenance, and unplanned downtime from corrosion or fouling, can reduce operator willingness to adopt new configurations without proven performance references.

Market Segmentation

By Material Type

By material type, the market is segmented into stainless steel 304/304L tubes, stainless steel 316/316L tubes, duplex and super duplex stainless-steel tubes, titanium tubes, and nickel alloys and other materials. Stainless steel 304/304L holds a major share due to cost efficiency and broad use in non-extreme service conditions across general piping and standard processing sections. Stainless steel 316/316L is widely used where higher corrosion resistance is required, particularly in contact with methanol, fatty acids, salts, and process water, supporting strong demand in purification and recovery trains. Duplex and super duplex stainless-steel tubes are gaining adoption in more aggressive environments where higher strength and superior corrosion resistance reduce failures, supporting longer lifecycle performance in challenging feedstock profiles. Titanium tubes are used selectively where corrosion and chemical compatibility requirements are very high, typically in specialized heat transfer applications, but cost limits broader adoption. Nickel alloys and other materials are critical for severe-duty services, including high temperature, high pressure, or highly corrosive streams, and they are increasingly relevant in renewable diesel (HVO/HEFA) high-pressure systems where reliability and safety are key.

By Application

By application, the market is segmented into methanol recovery and purification systems, glycerin recovery and purification systems, feedstock pre-treatment and preparation, transesterification reaction thermal management, biodiesel/FAME cooling and finishing, and renewable diesel (HVO/HEFA) high-pressure systems. Feedstock pre-treatment and preparation holds a major share due to rising use of waste and low-grade feedstocks that require dewatering, degumming, filtration, and contaminant removal to protect downstream equipment and improve yields. Methanol recovery and purification systems are critical for operating cost control and compliance, supporting steady demand as plants optimize solvent recycling and emissions performance. Glycerin recovery and purification systems remain important as producers target higher coproduct value and improved product quality, especially where refined glycerin routes are viable. Transesterification reaction thermal management is a key investment area because stable temperature control improves conversion, reduces byproduct formation, and increases throughput. Biodiesel/FAME cooling and finishing systems are essential for meeting product specifications, ensuring stability, and improving storage and handling performance. Renewable diesel (HVO/HEFA) high-pressure systems are growing faster as more capacity shifts toward HVO/HEFA routes, driving demand for pressure-rated equipment, advanced materials, and high-reliability heat transfer and separation systems.

Regional Insights

North America represents a major market due to large-scale renewable diesel and biodiesel capacity additions, strong investment in feedstock flexibility, and continued plant debottlenecking activity. Europe shows steady demand supported by long-standing biodiesel production, stricter sustainability requirements, and ongoing optimization of methanol recovery and purification systems. Asia Pacific is growing as new biofuel capacity comes online, especially where government blending programs support expansion, and where equipment demand rises for pre-treatment and purification due to feedstock variability. Latin America is emerging with increased biodiesel blending programs and capacity expansions, supporting demand for standard process equipment and plant upgrades. The Middle East & Africa shows selective growth linked to new biofuel projects and industrial investment, with higher demand potential where export-driven renewable fuels and sustainable aviation fuel supply chains expand over time.

Competitive Landscape

The market is competitive, with equipment suppliers focusing on improving process efficiency, corrosion resistance, and uptime for high-variability feedstocks. Key strategies include offering integrated process packages, modular skid systems, advanced separation and heat transfer designs, and partnerships that combine engineering services with equipment supply. Differentiation is driven by proven performance in handling contaminants, energy efficiency, ease of maintenance, pressure and safety compliance, and ability to support both FAME biodiesel and HVO/HEFA renewable diesel configurations. Vendors are also investing in digital monitoring, predictive maintenance, and retrofit solutions that improve performance without full plant rebuilds, which is important for operators seeking fast payback. Key companies operating in the market include Advance Biofuel, Alfa Laval, American Crane & Equipment, ANDRITZ, CPM Crown, Desmet, Ecolab, Florida Biodiesel, JBT, Myande, N&T Engitech, S. Howes, Springboard Biodiesel, SRS International, and Sulzer.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Biodiesel and Biofuels Processing Equipment market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Equipment Type

|

|

Material Type

|

|

Application

|

|

End Use Scale

|

|

Distribution Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Frequently Asked Questions

What is the growth outlook for the biodiesel and biofuels processing equipment market?

The market is expected to grow at a CAGR of 5.6% during 2026–2034, supported by renewable fuel mandates, capacity expansions, and plant efficiency upgrades.

Which application segment is most important today?

Feedstock pre-treatment and preparation holds a major share due to increasing use of waste oils and fats and the need to protect downstream equipment and improve yields.

Which application segment is growing fastest?

Renewable diesel (HVO/HEFA) high-pressure systems are growing faster as investment shifts toward HVO/HEFA capacity and pressure-rated system needs increase.

Which material type is most widely used?

Stainless steel 304/304L and 316/316L are widely used across many plant sections, with 316/316L preferred where higher corrosion resistance is required.

What are the key challenges in this market?

Feedstock variability, corrosion and fouling risks, capex sensitivity, long lead times for specialized components, and permitting and compliance complexity are major challenges.