"Implant biomaterials market to exhibit lucrative growth during the forecast period"

The global implant biomaterials market is growing steadily, valued at US$ 42.10 Bn in 2021 and expected to attain US$ 77.44 Bn by 2030. Worldwide growing adoption of orthopedic implants, dental and cardiovascular procedures, usage of advanced biomaterials along with preference for minimally invasive surgeries drive the growth of the market. Furthermore, the rising medical tourism in developing nations, growing healthcare expenditure, swift approval of new advanced biomaterials, and growing demand for customized implants in the dental segment are also fuelling the overall implant biomaterials market. New technological development in CAD/CAM systems, rapid product commercialization and encouraging public and government initiatives in the prosthetics industry across various countries in the Asia pacific and Europe will further assist in the overall market growth.

Other developments influencing the overall growth include, innovation in computer-assisted implant dentistry (cloud), usage of polymeric biomaterials, novel formulations in polycarbonate urethanes and silicon. Increasing research and development on nanostructure, biomaterial surface & coating, improvement in the standardization of the properties of biomaterials, and enhancement in bio-functionalization for future infection prevention are gaining traction in the global market. However, product recalls (medical implants), future risk of foreign body-related infections (FBRIs), implant failures, and post-surgery infections are factors restraining the overall market growth during the forecast period.

"Composite material type segment is expected to register higher growth by the end of 2030"

The global sales of implant biomaterials for medical devices will experience a progressive impact from increasing technological interventions in the orthopedic and dental industry. Availability of wide range of products in the global market incorporating bioresorbable polymer technology in stents, natural/synthetic polymers, metal or metal alloys such as titanium, zirconia, and bioactive ceramics show significant growth during the forecast period. Additionally, the widespread use of bone graft biomaterials, and current progresses in synthetic graft biomaterials have discovered further expansion of ceramic materials, bioactive glass, and porous titanium particles. The increasing demand for customized implants globally in the orthopedic and dental segment is further going to spur revenue growth during the forecast period. Increased applications in advanced biomaterials for joint replacements, modular tumor implants and spine implants in the orthopedic segment is also generating a significant revenue share in the market.

"Increasing applications for orthopedic and dental biomaterials will gain maximum share during the forecast period"

Increasing implant procedures in cardiovascular, dental and orthopedic segment along with high precision digital mapping technologies is creating traction in the global market. Utilization of 3D printing technology, consistent new product launches, and usage of implant biomaterials in ophthalmology and drug delivery in developed nations is further going to spur revenue growth during the forecast period. In the dental segment, advancement in new biomaterials such as such as roxolid, zirconia, surface modified titanium implants is also showing a significant market growth.

Additionally, increased applications in cardiovascular (homograft valves, porcine & bovine valves) implant dentistry, reconstructive surgeries and bone tissue engineering is also generating a significant revenue share in the market. Overall enhancement in medical device components, regenerative medicine, tissue engineering, and collagen & tissue biomaterials applications is assisting the overall growth of the market.

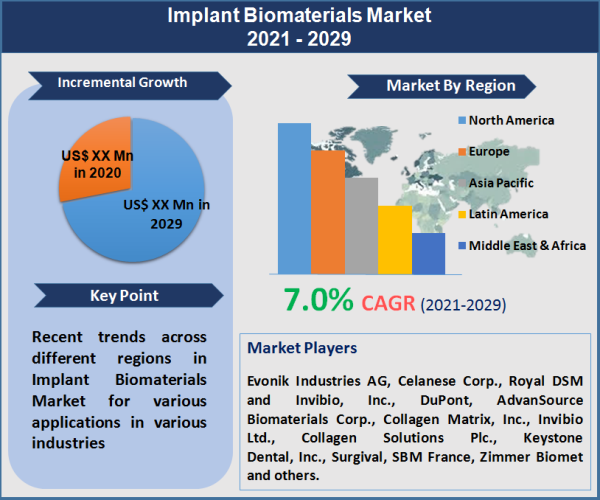

"Greater prevalence of dental and bone infections and the presence of established players holds North America in dominant position"

North America contributes maximum revenue share in the overall implant biomaterials market, and is attributed to increasing orthopedic implant procedures along with the aging population, and higher adoption of branded biomaterials. According to a study by the American Dental Association, overall national dental expenditures in the U.S rose from US$ 114 Bn in 2014 and reached around US$ 117 Bn in 2019. Dynamics enhancing the overall industry growth include, the high prevalence of oral and dental infection, improved care along with growing expenditure on oral care, new technology assessment in the biomaterials, and increasing awareness and demand for aesthetic restorations in the cosmetic dentistry in North America. Increasing demand for biomaterials for oral surgery along with bone graft and membrane materials (bovine/allogenic/synthetic bone-graft materials) in developing nations is generating maximum revenue share in the dental industry. However, in lower economic nations of Africa, Asia, and Latin America, availability of cardiovascular, orthopedic and dental treatment is inadequate. Lack of specialized healthcare professionals, less or no expansion of branded products, less awareness and the high cost of advanced biomaterials along with no reimbursement are few factors restraining the overall growth of the market.

"Dominance of multinational manufacturers with strong product portfolio in the developed regions"

Major players in the implant biomaterials market are Evonik Industries AG, Celanese Corp., Royal DSM and Invibio, Inc., DuPont, AdvanSource Biomaterials Corp., Collagen Matrix, Inc., Invibio Ltd., Collagen Solutions Plc., Keystone Dental, Inc., Surgival, SBM France, Zimmer Biomet and others. Topmost manufacturers are executing growth strategies with technology assessment in advanced biomaterials, partnerships with dental hospitals & medical technology companies and launching new implants with top quality materials, especially in the orthopedic and dental segment. For instance, in Sep 2022, Henry Schein, Inc. declared three investments that will enhance the growth of the company. Henry Schein acquired Intra-Lock (provider of dental restoration solutions, including proprietary surface, connection, and biomaterial and small diameter implant technologies) and Medentis Medical (dental implant manufacturer) to further strengthen its position in Europe. In June 2022, Keystone Dental, Inc. signed a definitive agreement to be acquired by Accelmed (U.S. and Israel-based investment firm majorly dedicated on value creation for medical device companies and technologies).

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Implant Biomaterials market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Material

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report