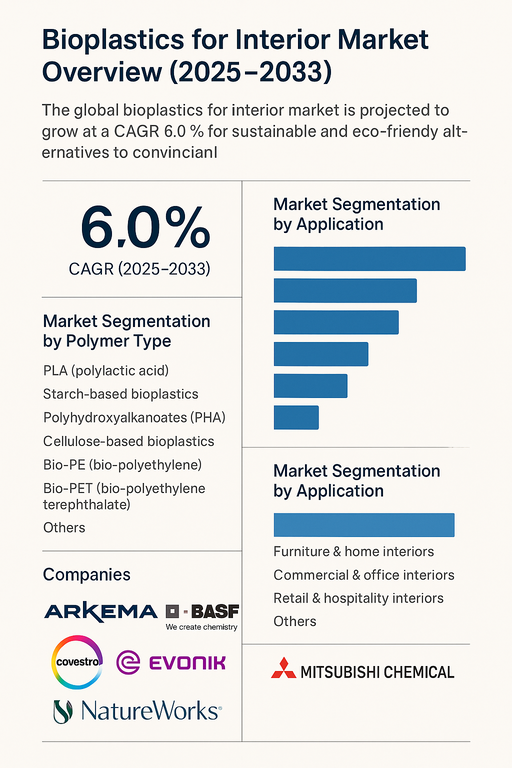

The global bioplastics for interior market is projected to grow at a CAGR of 6.0% between 2025 and 2033, driven by the rising demand for sustainable and eco-friendly alternatives to conventional petroleum-based plastics. Growing environmental awareness, stringent regulatory frameworks targeting single-use plastics, and consumer preference for green interiors across automotive, residential, and commercial sectors are supporting market growth. Bioplastics are increasingly adopted for interior applications owing to their aesthetic appeal, lower carbon footprint, and compatibility with existing manufacturing processes. The trend aligns with broader sustainability goals among manufacturers and end-users, positioning bioplastics as a key material in the future of interior design.

Market Drivers

One of the primary market drivers is the increasing push for sustainable interior materials in automotive and construction industries. Automotive OEMs are under mounting pressure to reduce vehicle weight and environmental impact, leading to the adoption of bioplastic-based components such as dashboards, door panels, and seat backs. Similarly, furniture manufacturers and interior designers are favoring bioplastics to meet green building certification requirements and appeal to environmentally conscious consumers. Advances in polymer chemistry have improved the mechanical strength, thermal resistance, and durability of bioplastics, making them viable for a range of interior applications. Additionally, government policies promoting circular economy principles and banning traditional plastics in several countries are accelerating market penetration.

Market Restraint

High production costs and limited material availability remain key restraints. Compared to traditional plastics, bioplastics often entail higher raw material and processing costs due to reliance on agricultural feedstocks and relatively nascent manufacturing infrastructure. Further, variability in feedstock quality and regional supply chain inefficiencies can disrupt production. Compatibility with existing recycling streams also poses a challenge, especially for bioplastics that mimic conventional polymers like PET and PE. End-user industries may also encounter hurdles in ensuring consistent performance and compliance with safety standards, especially in high-load or heat-sensitive interior environments.

Market Segmentation by Polymer Type

By polymer type, the market is segmented into PLA (polylactic acid), starch-based bioplastics, polyhydroxyalkanoates (PHA), cellulose-based bioplastics, bio-PE, bio-PET, and others. In 2024, PLA and starch-based bioplastics collectively held a major share due to their ease of processing, cost-effectiveness, and suitability for decorative interior components. PLA, derived from corn and sugarcane, is especially popular in furniture and home interiors due to its aesthetic finish and compostable properties. Bio-PE and bio-PET are gaining momentum in automotive and commercial interiors as drop-in solutions that match the properties of conventional PE and PET. From 2025 to 2033, PHA and cellulose-based bioplastics are expected to witness robust growth due to increasing investment in advanced bio-polymer technologies and their superior biodegradability.

Market Segmentation by Application

By application, the market is categorized into automotive interiors, furniture & home interiors, commercial & office interiors, retail & hospitality interiors, and others. Automotive interiors led the market in 2024, with manufacturers integrating bioplastics to enhance vehicle sustainability and comply with emissions and recyclability norms. Furniture and home interiors represent the second-largest segment, driven by green building trends and consumer awareness. The commercial, retail, and hospitality sectors are also adopting bioplastics for fixtures, wall panels, and decorative elements to improve environmental credentials and brand image. From 2025 to 2033, commercial and office interiors are anticipated to register notable growth, supported by increasing green certifications in the corporate real estate sector.

Geographic Trends

Geographically, Europe dominated the bioplastics for interior market in 2024 due to favorable regulatory policies, strong environmental activism, and the presence of biopolymer pioneers such as BASF and Arkema. Countries like Germany, France, and the Netherlands have been early adopters of sustainable interior materials. North America followed closely, with rising adoption in the U.S. driven by eco-design standards, automotive industry innovation, and demand from green-conscious consumers. The Asia Pacific region is expected to exhibit the fastest growth through 2033, particularly in China, India, and Japan, where automotive production, urbanization, and eco-friendly material adoption are accelerating. Latin America and the Middle East & Africa are emerging regions, where government incentives and international investments are supporting the development of bio-based infrastructure.

Competitive Trends

In 2024, the competitive landscape was marked by strategic innovation and partnerships across polymer science, automotive supply chains, and interior design ecosystems. BASF and Arkema led the market with a diverse portfolio of biodegradable and bio-based polymers customized for high-performance interiors. Covestro and Evonik focused on bio-based polyurethanes and specialty chemicals offering thermal resistance and flexibility. NatureWorks, a key PLA manufacturer, expanded its reach by partnering with downstream processors in the interior design and furniture markets. Mitsubishi Chemical invested in research and development of advanced PHA blends targeting commercial and office applications. Competitive strategies include forward integration, collaborative innovation, sustainability branding, and capacity expansion to meet growing demand across sectors.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Bioplastic for Interior market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Polymer Type

| |

Application

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report