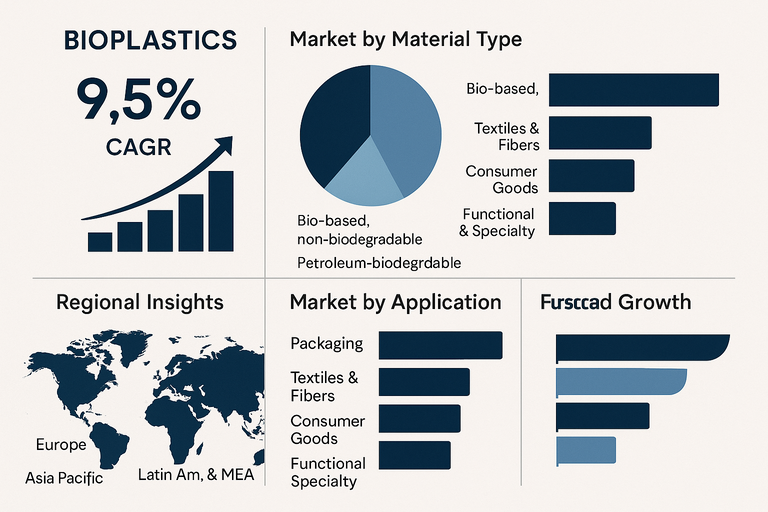

The bioplastics market is growing at a 9.5% CAGR as brand owners, retailers, and regulators move from fossil-based plastics to bio-based alternatives that can reduce carbon footprints and support circular material strategies. Bioplastics are now used in packaging, textiles, consumer goods, automotive, agriculture, electronics, and specialty applications, moving from niche projects to wider commercial use in selected product lines. Within material types, bio-based, non-biodegradable materials such as bio-PE and bio-PET currently generate the highest revenue because they fit existing processing equipment and recycling systems with minimal design changes. Bio-based, biodegradable materials are expected to post the highest CAGR as compostable packaging, bags, and functional items scale in response to stricter rules on single-use plastics. Packaging remains the largest application segment, while functional and specialty applications in electronics, coatings, and performance parts show strong growth potential.

Market Drivers

Market growth is driven by regulations on single-use plastics, extended producer responsibility schemes, and climate targets that push brand owners to cut emissions related to plastic use. Bio-based, non-biodegradable resins allow a drop-in path to lower carbon footprints because they use renewable feedstocks while maintaining similar performance and processing to conventional plastics. At the same time, bio-based, biodegradable materials such as PLA, PHA, and starch blends gain traction in compostable packaging, carry bags, foodservice items, and agricultural films where controlled end-of-life is possible. Corporate sustainability targets for renewable content, carbon reduction, and recyclability, together with retailer scorecards and procurement policies, create stable demand signals. Advancements in fermentation, catalytic conversion, and polymerization improve process efficiency, increase production capacity, and help close the cost gap with fossil-based resins.

Market Restraints

Adoption is constrained by cost premiums over conventional plastics, which remain a key barrier in price-sensitive packaging and consumer goods segments. Many bioplastics rely on agricultural feedstocks such as corn, sugarcane, or vegetable oils, which raises concerns about land use, food-versus-fuel debates, and exposure to agricultural price volatility. Waste management systems are not always ready to handle compostable materials at scale, limiting the practical benefits of biodegradability when separate collection and industrial composting capacity are missing. Confusion around terms such as “bio-based,” “biodegradable,” and “compostable” can lead to mis-sorting, incorrect disposal, and reputational risk for brands. For some technical uses, bioplastics still face performance gaps in heat resistance, barrier properties, or long-term durability, which slows adoption in demanding electronics and automotive applications.

Market by Material Type

Bio-based, non-biodegradable materials form the largest share of the bioplastics market today. Grades such as bio-PE and bio-PET can run on standard extrusion, injection molding, and blow-molding lines and are compatible with existing recycling streams, especially in beverage bottles and rigid packaging; within material types this group currently generates the highest revenue. These materials let brand owners meet renewable content and carbon reduction goals without major requalification or process changes. Bio-based, biodegradable materials include PLA, PHA, PBS, and starch-based blends that can be designed for industrial composting or other controlled biodegradation routes. They are used in compostable bags, foodservice items, coated paper, pods, and agricultural films, as well as selected flexible packaging structures. As regulations tighten on specific single-use plastics and more cities roll out organic-waste collection and composting infrastructure, this segment is expected to record the highest CAGR over the forecast period.

Market by Application

Packaging is the leading application for bioplastics, accounting for the largest share of demand across bottles, films, trays, and pouches in food, beverage, personal care, and household products; within applications this segment currently generates the highest revenue. Textiles and fibers use bioplastics for apparel, nonwovens, and technical fabrics, including PLA-based fibers and bio-based polyester blends. Consumer goods such as toys, kitchenware, writing instruments, and lifestyle products adopt bioplastics to improve product sustainability positioning. In automotive and transport, bioplastics are applied in interior trims, seat fabrics, panels, and selected under-the-hood parts, supporting weight reduction and lower life-cycle emissions. Agriculture and horticulture use biodegradable mulching films, plant pots, clips, and twines to reduce plastic residues in soil and simplify field operations. Electronics and electrical applications are emerging, with bioplastics used in housings, small parts, and cable components where flame retardancy and dimensional stability can be achieved. Functional and specialty applications, including coatings, 3D printing filaments, medical packaging, and performance additives, are expected to post the highest CAGR as formulators exploit specific strengths such as controlled degradation, high clarity, or improved stiffness in niche products.

Regional Insights

Europe holds a leading position in the bioplastics market, supported by strong regulation on single-use plastics, high landfill and incineration costs, and mature customer awareness. The region has an active ecosystem of resin producers, converters, retailers, and industry associations working together on standards, labelling, and application development. Asia Pacific is expected to record the highest CAGR, driven by rapid growth in packaged goods, national plastic waste reduction targets, and significant investments in new bio-based resin capacity in countries such as China, Thailand, and India. North America shows solid growth based on brand-owner commitments, state-level bans on certain plastic products, and expansion of compostable packaging in foodservice and retail channels. Latin America benefits from strong agricultural feedstocks, especially sugarcane, which supports bio-based polyethylene production and export-oriented packaging. The Middle East & Africa are at an earlier stage but see increasing interest in bioplastics for premium packaging, agriculture, and imported consumer products where global brand standards apply.

Competitive Landscape

NatureWorks LLC is a leading producer of PLA, supplying resins for packaging, fibers, and consumer goods and supporting customers with application development in compostable and bio-based product lines. Braskem is a major supplier of bio-based polyethylene derived from sugarcane, targeting packaging and consumer goods applications where drop-in, recyclable bio-PE can reduce carbon footprints without changes to production equipment. BASF SE offers a portfolio of bio-based and biodegradable polymers for packaging, agriculture, and specialty uses, combined with additives and technical support. TotalEnergies Corbion focuses on PLA production and compounding, serving packaging, foodservice, and industrial applications through tailored grades. Novamont S.p.A. specializes in starch-based biodegradable materials for bags, agricultural films, and foodservice items, particularly in European markets. Danimer Scientific develops PHA-based materials for compostable packaging and coatings, while Eastman Chemical Company and Arkema S.A. provide bio-based specialty polymers and intermediates for higher-performance segments. Kaneka Corporation and Mitsubishi Chemical Corporation expand bio-based and biodegradable product lines in Asia, addressing packaging, consumer goods, and industrial applications. Avantium N.V. leads the development of next-generation bio-based polymers such as PEF for high-barrier packaging. Companies such as Evonik Industries, KINGFA Science & Technology, Futerro, COFCO, Zhejiang Hisun Biomaterials, Unitika, Shenzhen Ecomann, RWDC Industries, and Newlight Technologies increase global capacity and support local market development.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Bioplastics market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Material Type

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report