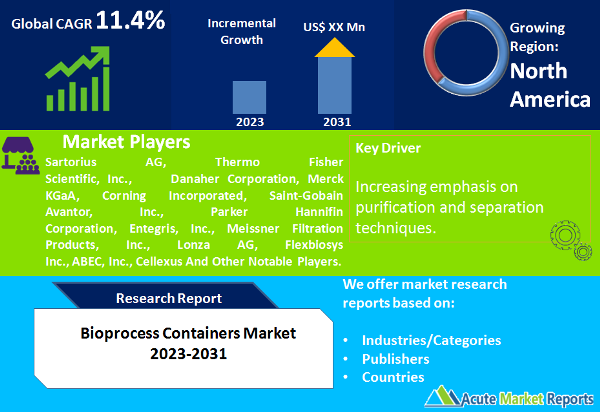

The bioprocess containers market is poised to witness significant expansion, projected to achieve a CAGR of 11.4% during the forecast period of 2026 to 2034. The Bioprocess Containers market, a pivotal segment within the biopharmaceutical industry, has been orchestrating transformative advancements in drug manufacturing processes. As a vital cog in the bioprocessing wheel, these containers have evolved to meet the dynamic demands of the pharmaceutical sector.

Rapid Advancements in Biopharmaceutical R&D

The Bioprocess Containers market's trajectory is closely intertwined with the rapid advancements in biopharmaceutical research and development. The year 2026 witnessed a surge in ground-breaking innovations within the biopharmaceutical sector, where novel therapeutic solutions and treatments were unveiled. This pivotal progression necessitated an evolution in bioprocessing methodologies, and Bioprocess Containers emerged as an indispensable tool. These containers, designed to facilitate the growth of cells and microbes under precisely controlled conditions, played a pivotal role in accommodating the complex and diverse needs of biopharmaceutical research. As we journey from 2026 to 2034, it is anticipated that the relentless pursuit of therapeutic breakthroughs will continue to drive the growth of the Bioprocess Containers market.

Cost-Efficiency and Time Savings

A prominent driving force behind the Bioprocess Containers market's expansion is the quest for cost-efficiency and time savings within the biopharmaceutical industry. The biopharmaceutical landscape is characterized by rigorous research timelines and high costs associated with drug development. In 2025, Bioprocess Containers emerged as a solution to streamline processes, reduce contamination risks, and enhance workflow efficiency. By eliminating the need for complex sterilization procedures and facilitating single-use setups, these containers have enabled significant cost savings and accelerated research timelines. The value proposition of cost-effectiveness and time efficiency is expected to perpetuate the market's growth, as biopharmaceutical companies increasingly recognize the benefits of optimized processes.

Rising Adoption of Single-Use Bioprocessing

The rising tide of single-use bioprocessing has been a pivotal driver shaping the Bioprocess Containers market. In 2025, the shift towards single-use systems gained substantial momentum due to their reduced cross-contamination risks, simplified cleaning procedures, and improved flexibility. Bioprocess Containers, with their innate compatibility with single-use principles, seamlessly fit into this paradigm. These containers have emerged as a cornerstone in facilitating the scalability and adaptability required by modern biopharmaceutical manufacturing. The anticipated continuation of the single-use bioprocessing trend from 2026 to 2034 underscores the market's sustained growth potential.

Environmental Impact and Sustainability Concerns

An intricate restraint that the Bioprocess Containers market grapples with pertains to environmental impact and sustainability concerns. As the adoption of single-use systems and disposable technologies increases, questions surrounding the environmental consequences of disposable products have been raised. The year 2026 witnessed a heightened focus on sustainability across industries, and the biopharmaceutical sector was not exempt. While Bioprocess Containers offer distinct advantages in terms of cost-effectiveness and reduced contamination risks, the issue of disposable waste and its ecological implications warrants careful consideration. The market must address these concerns transparently and innovate in ways that mitigate environmental impact to maintain growth while aligning with responsible practices.

2D Bioprocess Containers Dominates Market by Type

The segmentation of the Bioprocess Containers market based on type encompasses a spectrum including 2D Bioprocess Containers, 3D Bioprocess Containers, and Others. Among these, 3D Bioprocess Containers exhibited the highest Compound Annual Growth Rate (CAGR), owing to their compatibility with advanced cell culture techniques and three-dimensional applications. However, in terms of revenue, 2D Bioprocess Containers dominated the market in 2025, as they are more established and widely adopted. Meanwhile, the segment of "Others" caters to emerging container designs that address specific research needs. As the market advances from 2026 to 2034, the type segmentation is poised to evolve to align with evolving biopharmaceutical methodologies.

Upstream Processes Dominates Market by Application

The segmentation by application encompasses Upstream Processes, Downstream Processes, and Process Development. In 2025, Upstream Processes commanded a significant share of the market's revenue, as biopharmaceutical companies heavily invested in optimizing cell cultivation and growth processes. Simultaneously, Downstream Processes displayed a noteworthy CAGR, driven by the increasing emphasis on purification and separation techniques. Process Development, pivotal for research and scale-up, maintained a balance between revenue and CAGR. As biopharmaceutical research intensifies from 2026 to 2034, these applications are anticipated to continue driving the Bioprocess Containers market.

North America Remains as the Global Leader

Geographically, the Bioprocess Containers market is marked by trends that align with regions at the forefront of biopharmaceutical research and innovation. In 2025, North America led in terms of both revenue and CAGR, owing to its robust biopharmaceutical industry and extensive research initiatives. Europe also demonstrated a significant market presence, driven by its well-established pharmaceutical landscape and investment in bioprocessing technologies. Meanwhile, the Asia-Pacific region showcased a burgeoning interest in biopharmaceutical research, reflected in its substantial CAGR. The forecast period from 2026 to 2034 is expected to witness the emergence of Asia-Pacific as a significant player in the global biopharmaceutical landscape.

Competitive Trends

The Bioprocess Containers market's competitive landscape is marked by a league of dynamic players committed to driving biopharmaceutical progress through innovative solutions. Esteemed companies such as Sartorius AG, Thermo Fisher Scientific, Inc., Danaher Corporation, Merck KGaA, Corning Incorporated, Saint-Gobain Avantor, Inc., Parker Hannifin Corporation, Entegris, Inc., Meissner Filtration Products, Inc., Lonza AG, Flexbiosys Inc., ABEC, Inc., and Cellexus stand at the forefront of this industry. These companies have strategically positioned themselves by investing in research and development, partnering with biopharmaceutical companies, and continuously innovating to address evolving research needs. As of 2026, their revenues reflect their market leadership, and their projected strategies from 2026 to 2034 revolve around adaptive product development and the expansion of global reach to capitalize on emerging research centers.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Bioprocess Containers market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Capacity

|

|

Application

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report