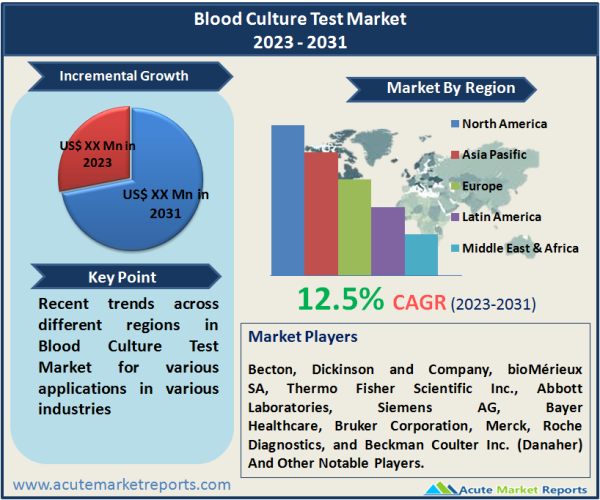

The blood culture test market is a critical component of the medical diagnostics industry, playing a pivotal role in diagnosing various infections. The blood culture test market is expected to grow at a CAGR of 12.5% during the forecast period of 2026 to 2034, driven by the increasing prevalence of bacterial infections, advancements in diagnostic technologies, and the rising incidence of healthcare-associated infections. The time-consuming nature of traditional blood culture methods remains a notable restraint, highlighting the need for faster and more efficient diagnostic solutions. Market segmentation by consumables and applications provides insights into specific areas of growth within the market, and geographic trends reflect the importance of regional variations in demand. Competitive players are expected to maintain their focus on innovation and expansion to cater to the increasing demand for accurate and rapid blood culture tests.

Increasing Prevalence of Bacterial Infections

One of the primary drivers for the Blood Culture Test market is the increasing prevalence of bacterial infections. Bacterial infections can range from common ailments to life-threatening conditions, and timely and accurate diagnosis is crucial for effective treatment. Blood culture tests are a fundamental tool in identifying the causative agents of these infections, guiding physicians in choosing the appropriate antibiotics and therapies. The rise in bacterial infections, including hospital-acquired infections and antimicrobial resistance, has amplified the demand for blood culture tests.

Advancements in Diagnostic Technologies

Advancements in diagnostic technologies have significantly driven the Blood Culture Test market. The evolution of blood culture test methods, such as the development of automated blood culture systems, has improved the accuracy, speed, and efficiency of bacterial and fungal infection detection. These innovations reduce the time needed for culture and result reporting, enabling healthcare providers to initiate targeted treatment sooner. Additionally, molecular diagnostic techniques, including PCR-based tests, have further enhanced the sensitivity and specificity of blood culture tests, allowing for the detection of a broader spectrum of pathogens.

Increasing Incidence of Healthcare-Associated Infections

The increasing incidence of healthcare-associated infections (HAIs) is another vital driver for the Blood Culture Test market. HAIs are infections acquired during the course of healthcare delivery, and they pose a significant risk to patients in hospitals and healthcare facilities. Blood culture tests are instrumental in identifying the pathogens responsible for HAIs, aiding in prompt intervention and infection control measures. With the growing recognition of HAIs as a critical healthcare issue, the demand for blood culture tests as a diagnostic tool has surged.

Restraint for the Blood Culture Test Market

A significant restraint for the Blood Culture Test market is the time-consuming nature of traditional blood culture methods. Conventional blood culture techniques involve incubating blood samples in culture media for a specific period to allow the growth of microorganisms. This process can take several days, delaying the diagnosis and initiation of appropriate treatment. In an era where rapid diagnostics are increasingly important for patient outcomes, the protracted duration of conventional blood culture tests remains a critical limitation. Comparative studies and clinical trials often reveal the extended turnaround time associated with traditional blood culture methods, highlighting the need for faster diagnostic solutions.

Market Segmentation by Consumables (By Type, By Component): Blood Culture Bottles Dominates the Market

The Blood Culture Test market can be segmented by consumables into two categories: by type and by component. In 2025, the "blood culture bottles" segment generated the highest revenue, reflecting their essential role in sample collection and pathogen growth. For the period from 2026 to 2034, the "blood culture media" segment is expected to exhibit the highest compound annual growth rate (CAGR). Innovative culture media formulations that support faster and more efficient pathogen growth and detection are anticipated to drive the demand for these consumables.

Market Segmentation by Application (Bacterial Infections, Fungal Infections, Mycobacterial Infections): Bacterial Infections Dominate the Market

The Blood Culture Test market can be segmented by application into three categories: bacterial infections, fungal infections, and mycobacterial infections. In 2025, the "bacterial infections" segment witnessed the highest revenue, reflecting the predominant use of blood culture tests in diagnosing bacterial infections. For the period from 2026 to 2034, the "mycobacterial infections" segment is expected to experience the highest CAGR. Mycobacterial infections, including tuberculosis, present a growing global health concern, and blood culture tests play a crucial role in their diagnosis.

North America Remains as the Global Leader

The Blood Culture Test market exhibits geographic variations in demand and growth. Geographic trends indicate that regions with high population density, healthcare infrastructure, and a high burden of infectious diseases tend to lead in the adoption of blood culture tests. North America, with its advanced healthcare systems and focus on patient safety, has been a prominent market for blood culture tests. When considering the region with the highest CAGR during the forecast period from 2026 to 2034, the Asia-Pacific region is expected to exhibit substantial growth. The region's rapidly developing healthcare infrastructure, increasing healthcare spending, and rising awareness of infectious diseases are driving the demand for blood culture tests. In terms of revenue percentage, North America is expected to maintain its position as the region with the highest revenue percentage throughout the forecast period. The region's well-established healthcare practices and the implementation of rigorous infection control measures contribute to its prominence in the Blood Culture Test market.

Market Competition to Intensify during the Forecast Period

The Blood Culture Test market features several key players, including Becton, Dickinson and Company, bioMerieux SA, Thermo Fisher Scientific Inc., Abbott Laboratories, Siemens AG, Bayer Healthcare, Bruker Corporation, Merck, Roche Diagnostics, and Beckman Coulter Inc. (Danaher) These companies employ specific strategies to maintain and expand their market presence. In 2025, Becton, Dickinson, and Company (BD) held a significant market share, offering a range of blood culture testing solutions, including both culture bottles and automated systems. The company's strategy focused on continuous innovation, emphasizing the development of blood culture systems that provide faster and more accurate results. bioMérieux SA, known for its diagnostic solutions, excelled in providing blood culture media and systems. Their strategy emphasized global expansion and collaborations with healthcare institutions to enhance the accessibility of blood culture tests. Thermo Fisher Scientific Inc., a prominent player in the life sciences and diagnostics sector, positioned itself as a key player in the market. Their strategy centered on providing comprehensive diagnostic solutions, encompassing blood culture tests, molecular diagnostics, and other laboratory services. For the forecast period from 2026 to 2034, these companies are expected to continue their strategies, focusing on innovation, global expansion, and partnerships with healthcare providers. They will explore new technologies and products to maintain their competitive edge in the evolving Blood Culture Test market.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Blood Culture Test market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Technique

|

|

Technology

|

|

Application

|

|

End-Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report