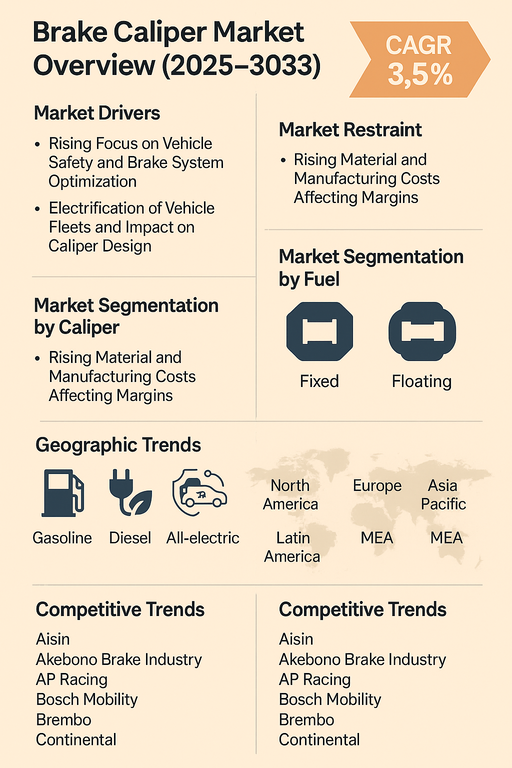

The global brake caliper market is projected to grow at a CAGR of 3.5% between 2025 and 2033, driven by steady vehicle production volumes, increasing focus on safety regulations, and a gradual but consistent rise in electric and hybrid vehicle adoption. Brake calipers are integral to disc braking systems, converting hydraulic pressure into mechanical force to stop or slow vehicles by pressing brake pads against the rotor. With technological advancements in braking systems, particularly electronic braking and regenerative braking in EVs, caliper designs are evolving to offer improved durability, thermal performance, and lighter materials. The market outlook remains positive, supported by OEM upgrades, aftermarket replacements, and stricter government mandates regarding automotive safety and emissions.

Market Drivers

Rising Focus on Vehicle Safety and Brake System Optimization

Global automotive safety standards are becoming increasingly stringent, compelling OEMs to adopt advanced braking technologies to meet regulatory requirements. Brake calipers play a critical role in ensuring effective stopping power, especially in high-speed vehicles and commercial fleets. New-generation vehicles are being equipped with electronically controlled braking systems that require high-performance calipers compatible with anti-lock braking systems (ABS) and electronic stability control (ESC). Additionally, the adoption of larger disc diameters in performance cars and commercial vehicles is reinforcing demand for efficient calipers with higher clamping force and heat dissipation capacity. This trend is further accelerated by consumer demand for improved road safety and driver-assist features.

Electrification of Vehicle Fleets and Impact on Caliper Design

As the global auto industry shifts toward electric vehicles (EVs), brake system requirements are also evolving. While regenerative braking in EVs reduces dependency on mechanical brakes for energy efficiency, disc brakes and calipers remain essential for emergency braking and high-load scenarios. Brake calipers for EVs are being designed to be lightweight, low-drag, and compatible with electronic brake boosters to optimize range and thermal management. Moreover, growing production of plug-in hybrids (PHEVs), battery electric vehicles (BEVs), and fuel cell vehicles (FCEVs) is creating new specifications and opportunities for caliper manufacturers focused on innovation and integration with electric drivetrains.

Market Restraint

Rising Material and Manufacturing Costs Affecting Margins

One of the key restraints impacting the brake caliper market is the rising cost of raw materials such as aluminum, cast iron, and stainless steel used in caliper production. Additionally, precision machining, corrosion resistance coatings, and compliance with OEM specifications increase overall manufacturing complexity and cost. Suppliers operating under price-sensitive OEM contracts are under pressure to maintain cost efficiency while delivering quality and performance. These factors can limit profit margins and reduce competitiveness, especially for smaller or regional manufacturers that lack scale. Furthermore, the transition to lightweight and electronic-integrated calipers requires significant R&D investment, posing challenges for legacy manufacturers in the absence of high-volume demand.

Market Segmentation by Caliper Type

The brake caliper market is segmented into Fixed and Floating (Sliding) calipers. Fixed calipers, which have pistons on both sides of the rotor, are typically used in high-performance and premium vehicles due to their superior braking force and heat dissipation. While they offer better balance and responsiveness, fixed calipers are more complex and expensive to produce. In contrast, floating calipers—using a single piston that moves the caliper itself—are widely used in mid-range and economy vehicles for their cost-effectiveness, compactness, and easier maintenance. In 2024, floating calipers accounted for the majority market share, but fixed calipers are expected to grow at a moderate pace in line with the increasing demand for luxury and sports vehicles globally.

Market Segmentation by Fuel Type

Based on the propulsion system, the market is segmented into Gasoline, Diesel, All-electric, Hybrid, and Fuel Cell Electric Vehicles (FCEVs). In 2024, gasoline-powered vehicles held the dominant share of the brake caliper market, followed by diesel vehicles, particularly in commercial and off-highway applications. However, from 2025 to 2033, the all-electric and hybrid segments are projected to witness faster growth due to increasing electrification efforts across key markets such as Europe, China, and the U.S. Brake caliper designs in EVs are increasingly focused on weight reduction and drag mitigation, while hybrids require calipers that can accommodate both regenerative and friction-based braking. FCEVs, though currently niche, are expected to expand their share gradually, requiring highly efficient caliper systems suited for longer-range electric mobility.

Geographic Trends

Asia Pacific led the global brake caliper market in 2024 and is expected to maintain its dominance through 2033, with China, Japan, South Korea, and India serving as key manufacturing and consumer hubs. The region benefits from a strong base of automotive OEMs, rising domestic demand, and government incentives for EV adoption. North America followed, led by the U.S., where high per capita vehicle ownership and aftermarket demand support consistent caliper sales. Europe remains a highly regulated and innovation-driven market, particularly for advanced braking technologies in premium and EV segments. Latin America and the Middle East & Africa are gradually expanding markets, with growing demand for commercial vehicles and localized assembly plants in Brazil, Mexico, and South Africa driving adoption.

Competitive Trends

In 2024, the global brake caliper market was led by a mix of global OEM suppliers and high-performance brake manufacturers. Bosch Mobility, Continental, and ZF Friedrichshafen were dominant players offering OEM-grade calipers integrated into ABS and ESC systems. Brembo and AP Racing remained leaders in high-performance and motorsport applications, supplying advanced aluminum and carbon-ceramic calipers to luxury, racing, and performance car manufacturers. Akebono Brake Industry and Aisin held strong positions in the Asia Pacific market, particularly among Japanese OEMs. Mando provided robust braking components for Hyundai, Kia, and global customers in the mid-range segment. Knorr-Bremse led the commercial vehicle segment, particularly for truck and trailer brake systems across Europe and North America. Wilwood Engineering specialized in performance aftermarket and racing-grade calipers, while companies such as TEI Racing and others from emerging markets increasingly entered the fray with cost-competitive offerings. The competitive landscape is evolving with growing investments in electric-compatible caliper systems, low-noise friction materials, and smart calipers integrated with brake-by-wire and autonomous vehicle systems.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Brake Caliper market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Caliper

| |

Vehicle

| |

Sales Channel

| |

Fuel

| |

Material

| |

Manufacturing Process

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report