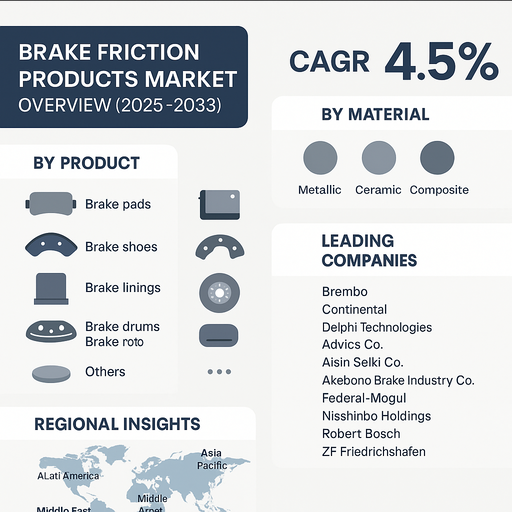

The global brake friction products market is projected to grow at a CAGR of 4.5% from 2025 to 2033, driven by rising automotive production, increasing demand for vehicle safety, and technological advancements in braking systems. Brake friction products, including pads, rotors, shoes, and linings, are critical components of the braking system, ensuring effective deceleration and safety. Growth is supported by regulatory standards mandating advanced braking technologies, the shift toward lightweight and durable materials, and rising replacement demand in both passenger and commercial vehicles.

Rising Safety Regulations and Aftermarket Demand

The adoption of advanced braking systems is strongly driven by stringent government regulations on vehicle safety and emission reduction. Increasing adoption of ABS and electronic stability control systems is boosting demand for high-performance friction products. Additionally, the aftermarket segment plays a crucial role, with replacement of brake pads, linings, and rotors forming a significant revenue share due to wear and tear. Rising urban mobility, expansion of vehicle fleets, and growing awareness of safety maintenance further contribute to market expansion.

Challenges: Price Pressure and Material Constraints

Despite growth, the brake friction products market faces challenges such as raw material price volatility, particularly in steel, copper, and composite materials. Price competition among suppliers limits profitability, especially in the highly fragmented aftermarket. Furthermore, environmental concerns around copper-based brake pads have prompted stricter regulations, leading to increased R&D costs for manufacturers developing eco-friendly alternatives. Electric vehicles (EVs), with their regenerative braking systems, also reduce wear on traditional brake components, moderating long-term demand.

Market Segmentation by Product

By product, the market is segmented into brake pads, brake shoes, brake linings, brake drums, brake rotors/discs, and others. Brake pads hold the largest share, driven by frequent replacement cycles and their universal application across passenger and commercial vehicles. Brake rotors/discs represent the second-largest segment, supported by rising demand for disc braking systems in modern vehicles. Brake shoes and linings remain significant in certain commercial and heavy-duty vehicle applications, while drums and others contribute to niche applications.

Market Segmentation by Material

By material, the market is categorized into metallic, ceramic, composite, and others. Metallic friction products dominate due to durability and cost-effectiveness, especially in heavy-duty vehicles. Ceramic brake pads are the fastest-growing segment, favored for their lightweight, high performance, and lower noise levels, particularly in premium and sports vehicles. Composite materials are gaining traction as eco-friendly alternatives with strong heat resistance, while other materials include niche and specialized formulations.

Regional Insights

In 2024, Asia Pacific led the brake friction products market, with strong automotive production in China, India, and Japan driving demand. Europe followed, supported by advanced vehicle safety regulations, premium car production, and increasing adoption of eco-friendly friction materials. North America remains a significant market, with high replacement demand in the aftermarket and strong adoption of advanced braking systems. Latin America and Middle East & Africa (MEA) are emerging regions, benefiting from rising vehicle ownership and improving safety regulations.

Competitive Landscape

The 2024 market was dominated by global automotive component manufacturers with strong OEM and aftermarket networks. Brembo leads with advanced brake disc and pad technologies, widely adopted in premium vehicles. Continental, Robert Bosch, and ZF Friedrichshafen remain key players with integrated braking solutions and strong OEM collaborations. Akebono Brake Industry and Advics Co. specialize in high-performance friction materials and systems for both passenger and commercial vehicles. Aisin Seiki and Delphi Technologies provide diversified product portfolios across global markets. Federal-Mogul and Nisshinbo Holdings maintain strong aftermarket presence with cost-effective, reliable friction products. Competitive strategies emphasize R&D in eco-friendly materials, partnerships with OEMs, and expanding presence in emerging automotive markets.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Brake Friction Products market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Material

| |

Vehicle

| |

Sales Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report