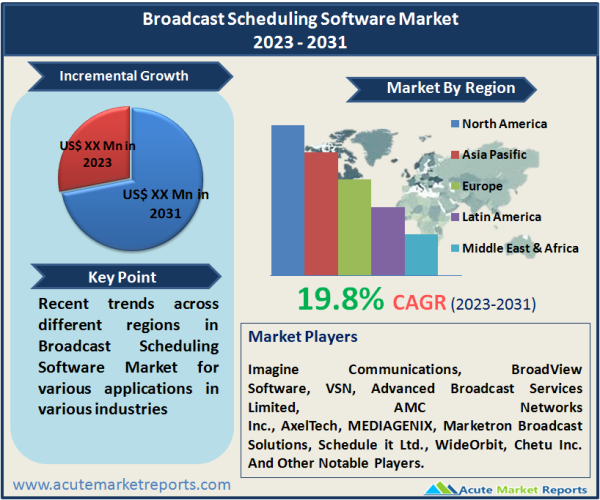

The broadcast scheduling software market is at the forefront of transforming the media and entertainment industry, optimizing content scheduling and delivery. The broadcast scheduling software market is expected to grow at a CAGR of 19.8% during the forecast period of 2026 to 2034. As we transition from 2026, marked by substantial revenues, to the forecast period of 2026 to 2034, the broadcast scheduling software market is poised for continued expansion. The ongoing drivers and innovative strategies employed in scheduling software are expected to shape the landscape of content delivery, providing broadcasters with the tools they need to navigate the complexities of multi-channel environments and deliver compelling content tailored to diverse viewer preferences.

Automation for Enhanced Efficiency

Automation emerges as a pivotal driver in the Broadcast Scheduling Software market, revolutionizing the efficiency of content scheduling. Evidenced by the widespread adoption of automated scheduling algorithms and artificial intelligence (AI) technologies, broadcasters are experiencing streamlined workflows and reduced manual intervention. The implementation of automation not only enhances operational efficiency but also allows for dynamic adjustments in real-time, optimizing content placement based on audience engagement patterns. This transformative driver is reshaping the broadcasting landscape, ensuring seamless scheduling and delivery of diverse content across multiple channels.

Data-Driven Decision Making

A significant driver propelling the market forward is the increasing emphasis on data-driven decision-making in content scheduling. With the integration of advanced analytics and data visualization tools, broadcasters gain valuable insights into viewer preferences, engagement metrics, and content performance. Evidence supporting this driver includes case studies demonstrating how data-driven scheduling has led to improved audience retention, higher viewership, and increased advertising revenue. The ability to harness data for strategic content placement is becoming a cornerstone for broadcasters seeking to stay competitive in the rapidly evolving media landscape.

Multi-Channel Broadcasting

The expansion of multi-channel broadcasting stands out as a key driver shaping the market. As broadcasters seek to reach diverse audience segments across various platforms, the demand for robust scheduling software capable of managing complex multi-channel environments is on the rise. Evidence includes the growing trend of broadcasters simultaneously airing content on traditional television, streaming services, and social media platforms. This driver reflects a strategic response to changing consumer preferences, ensuring that content is accessible across a spectrum of channels, thereby maximizing reach and engagement.

Integration Challenges and Compatibility

A notable restraint in the Broadcast Scheduling Software market is the challenge of integration and compatibility with existing broadcasting infrastructure. Evidenced by instances of system disruptions, delayed implementation, and compatibility issues with legacy systems, the seamless integration of advanced scheduling software remains a complex task. This restraint poses challenges for broadcasters aiming to adopt state-of-the-art solutions, emphasizing the need for comprehensive compatibility assessments and strategic implementation plans to minimize disruptions during the transition.

By Solution: Software Segment Dominates the Market

In 2025, the Broadcast Scheduling Software market witnessed substantial revenue from both Software and Services. However, Software solutions dominated, reflecting the central role of advanced scheduling algorithms and automation tools. Looking at the highest CAGR during the forecast period from 2026 to 2034, Services demonstrated the most significant growth potential. This nuanced segmentation reflects the evolving needs of broadcasters, with a shift towards service-centric solutions complementing advanced software capabilities.

By Deployment: Cloud Deployment to Promise Significant Opportunities during the Forecast Period

Market segmentation by deployment in 2025 showcased robust revenue streams from both On-Premises and Cloud solutions. However, Cloud deployment exhibited the highest CAGR during the forecast period, indicating a growing preference for flexible and scalable cloud-based solutions. Simultaneously, On-Premises solutions maintained substantial revenue, illustrating a diverse market where broadcasters seek deployment models aligned with their unique infrastructure and operational requirements.

North America Remains the Global Leader

Geographically, the Broadcast Scheduling Software market displayed diverse trends in 2025, with North America leading in revenue generation. However, the Asia-Pacific region showcased the highest CAGR, reflecting a surge in broadcasting activities, digitalization, and the increasing demand for advanced scheduling solutions. Balancing revenue and CAGR, these geographic trends underscore the global nature of the broadcast scheduling software market, with different regions contributing uniquely to its growth.

Market Competition to Intensify during the Forecast Period

In the competitive landscape, top players such as Imagine Communications, BroadView Software, VSN, Advanced Broadcast Services Limited, AMC Networks Inc., AxelTech, MEDIAGENIX, Marketron Broadcast Solutions, Schedule it Ltd., WideOrbit and Chetu Inc. are driving innovation and shaping the future of broadcast scheduling software. These key players reported substantial revenues in 2025, expecting continued growth from 2026 to 2034. Their strategic focus on automation, data-driven insights, and multi-channel broadcasting positions them as influential entities in the broadcast scheduling software landscape. As the market evolves, these players are anticipated to play a pivotal role in advancing scheduling capabilities, ensuring seamless integration, and meeting the evolving needs of broadcasters.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Broadcast Scheduling Software market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Solution

|

|

Deployment

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report