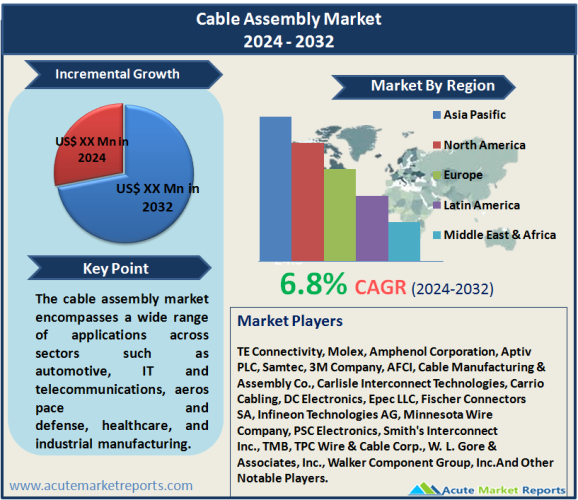

The cable assembly market is expected to grow at a CAGR of 6.8% during the forecast period of 2026 to 2034, driven by advancements in various industries requiring efficient and reliable cable systems. The market encompasses a wide range of applications across sectors such as automotive, IT and telecommunications, aerospace and defense, healthcare, and industrial manufacturing. Key conclusions from the market analysis indicate that technological innovation, increasing demand for high-speed connectivity, and the expansion of industrial automation are primary drivers. However, the market also faces challenges such as high raw material costs and stringent regulatory requirements. The detailed analysis of market segmentation by type reveals that optic cable assemblies generated the highest revenue in 2025, while custom cable assemblies are expected to witness the highest CAGR during the forecast period. In terms of end-use, the IT and Telecommunication segment led the market in 2025, whereas the Healthcare segment is projected to register the highest growth rate from 2026 to 2034. Geographic trends indicate that the Asia-Pacific region generated the highest revenue in 2025, while North America is expected to experience the highest CAGR during the forecast period. The competitive landscape is marked by the presence of key players such as TE Connectivity, Molex, Amphenol Corporation, Aptiv PLC, and Samtec, who are adopting strategic initiatives to strengthen their market positions. Despite the challenges posed by high raw material costs and stringent regulatory requirements, the market offers significant growth opportunities, particularly in emerging economies and sectors with high demand for advanced connectivity solutions. As industries continue to innovate and adopt new technologies, the demand for reliable and efficient cable assemblies is expected to remain strong, driving market growth during the forecast period.

Market Drivers

Technological Innovation and Advancements

Technological innovation in cable assemblies has significantly driven market growth. The continuous development of new materials and manufacturing techniques has resulted in cable assemblies that are more durable, efficient, and capable of supporting higher data transfer rates. For instance, advancements in fiber optic technology have led to the production of optic cable assemblies that offer superior performance in terms of speed and bandwidth compared to traditional copper cables. Companies like Corning Inc. and Prysmian Group are at the forefront of these innovations, providing high-performance cable assemblies that meet the evolving needs of various industries. The introduction of next-generation connectors and shielding materials has also enhanced the reliability and performance of cable assemblies in harsh environments. In the automotive sector, the shift towards electric vehicles (EVs) and autonomous driving technologies has created a demand for advanced cable assemblies capable of handling high power and data transmission requirements. Similarly, in the IT and telecommunications sector, the rollout of 5G networks necessitates the use of high-quality cable assemblies to ensure seamless connectivity and data transfer. The increasing adoption of Internet of Things (IoT) devices across various industries further drives the demand for reliable and efficient cable assemblies. As industries continue to innovate and adopt new technologies, the demand for advanced cable assemblies is expected to grow, driving market expansion.

Increasing Demand for High-Speed Connectivity

The growing need for high-speed connectivity in various applications is a major driver for the cable assembly market. In the IT and telecommunications sector, the rapid expansion of broadband services and the deployment of 5G networks have significantly increased the demand for high-quality cable assemblies. These assemblies are crucial for ensuring fast and reliable data transmission and supporting the seamless operation of high-speed internet services, cloud computing, and data centers. The increasing use of high-definition video streaming, online gaming, and other bandwidth-intensive applications further emphasizes the need for efficient cable assemblies. In the healthcare sector, the adoption of advanced medical devices and telemedicine services relies heavily on high-speed data transfer, necessitating the use of reliable cable assemblies. Additionally, the industrial automation sector, driven by Industry 4.0 initiatives, requires robust cable assemblies to support the integration of smart manufacturing systems, robotics, and automated machinery. The aerospace and defense sector also demands high-speed connectivity for communication systems, navigation, and surveillance applications. The ability of cable assemblies to provide reliable and high-speed data transmission in these critical applications is a key factor driving their demand. As the need for high-speed connectivity continues to grow across various sectors, the cable assembly market is expected to witness significant growth.

Expansion of Industrial Automation

The expansion of industrial automation is another crucial driver for the cable assembly market. The adoption of automation technologies in manufacturing and industrial processes has led to an increased demand for reliable and efficient cable assemblies. Automation systems rely on a network of interconnected devices and sensors that require robust cable assemblies to ensure seamless communication and power transmission. The growing implementation of robotics, automated machinery, and smart manufacturing systems in industries such as automotive, electronics, and food and beverage is driving the demand for cable assemblies that can withstand harsh industrial environments and provide reliable performance. Companies like TE Connectivity and Molex are developing advanced cable assemblies specifically designed for industrial automation applications, offering features such as high durability, flexibility, and resistance to environmental factors. The increasing focus on enhancing operational efficiency, reducing downtime, and improving product quality through automation is further propelling the demand for cable assemblies. Additionally, the integration of IoT and Industrial Internet of Things (IIoT) technologies in manufacturing processes requires reliable data transmission, which is facilitated by high-quality cable assemblies. As industries continue to adopt automation technologies to improve productivity and competitiveness, the demand for cable assemblies is expected to rise significantly, driving market growth.

Detailed Restraint

High Raw Material Costs and Regulatory Requirements

Despite the positive growth outlook, the cable assembly market faces significant challenges, particularly related to high raw material costs and stringent regulatory requirements. The production of cable assemblies involves the use of various raw materials, including copper, aluminum, and specialty plastics, whose prices are subject to fluctuations in the global market. The volatility in raw material prices can significantly impact the manufacturing costs of cable assemblies, posing a challenge for manufacturers in maintaining competitive pricing. For instance, the price of copper, a primary material used in many cable assemblies, has seen substantial fluctuations due to changes in supply and demand dynamics, geopolitical tensions, and economic conditions. Additionally, the cable assembly industry is subject to various regulatory standards and requirements aimed at ensuring the safety, performance, and environmental compliance of products. Regulations such as the Restriction of Hazardous Substances (RoHS) Directive and the Waste Electrical and Electronic Equipment (WEEE) Directive in the European Union impose stringent restrictions on the use of certain hazardous substances and mandate proper disposal and recycling of electronic products. Compliance with these regulations requires manufacturers to invest in advanced testing, certification, and manufacturing processes, adding to production costs. Moreover, different regions have varying regulatory frameworks, making it challenging for manufacturers to ensure compliance across all markets. The need to meet these regulatory requirements while managing raw material costs poses a significant restraint on the cable assembly market. However, manufacturers are focusing on developing innovative solutions and adopting sustainable practices to mitigate these challenges and remain competitive in the market.

Market Segmentation by Type

The cable assembly market is segmented by type into Discrete Wire Assemblies, Optic Cable Assemblies, RF Cable Assemblies, Ribbon Cable Assemblies, Coaxial Cable Assemblies, Custom Cable Assemblies, and Others (including Power Cable Assemblies and custom electro-mechanical assemblies). In 2025, the Optic Cable Assemblies segment generated the highest revenue, driven by the increasing demand for high-speed data transmission in various applications such as telecommunications, data centers, and healthcare. The superior performance of optic cables in terms of speed and bandwidth, coupled with their ability to support long-distance communication, makes them highly sought after in these industries. The rapid deployment of 5G networks and the expansion of fiber optic infrastructure globally have further boosted the demand for optic cable assemblies. The Custom Cable Assemblies segment is expected to witness the highest CAGR during the forecast period of 2026 to 2034. The growing need for customized solutions tailored to specific applications is driving the demand for custom cable assemblies. Industries such as automotive, aerospace, and industrial automation require cable assemblies that meet unique specifications and performance requirements. The ability to provide bespoke solutions that address specific challenges and enhance operational efficiency is a key factor driving the growth of the custom cable assemblies segment. As industries continue to evolve and adopt new technologies, the demand for custom cable assemblies is expected to increase, driving the highest CAGR in this segment during the forecast period.

Market Segmentation by End-Use

By end-use, the cable assembly market is segmented into Automotive, IT and Telecommunication, Aerospace and Defense, Healthcare, Industrial, and Others (including Energy and Power, Consumer Electronics, etc.). In 2025, the IT and Telecommunication segment accounted for the highest revenue, driven by the ongoing expansion of telecommunications infrastructure and the rollout of 5G networks. The increasing demand for high-speed internet services, cloud computing, and data centers has significantly boosted the need for reliable and efficient cable assemblies in this sector. The growing adoption of fiber optic cables and advanced connectivity solutions further supports revenue generation in the IT and telecommunications segment. On the other hand, the Healthcare segment is expected to register the highest CAGR during the forecast period of 2026 to 2034. The increasing adoption of advanced medical devices, telemedicine services, and health monitoring systems is driving the demand for high-quality cable assemblies in the healthcare sector. The need for reliable data transmission and connectivity in critical healthcare applications, such as diagnostic imaging, patient monitoring, and surgical equipment, is a key factor contributing to the growth of this segment. Additionally, the rising investments in healthcare infrastructure and the growing focus on improving healthcare services in emerging economies are expected to further boost the demand for cable assemblies in the healthcare sector, driving the highest CAGR during the forecast period.

Geographic Segment

The geographic trends in the cable assembly market indicate significant variations in revenue and growth rates across different regions. In 2025, the Asia-Pacific region generated the highest revenue in the market. The rapid industrialization, urbanization, and expansion of telecommunications infrastructure in countries like China, India, and Japan are major drivers for the high revenue in this region. The increasing adoption of advanced technologies in various industries, including automotive, IT telecommunications, and healthcare, further supports revenue generation in the Asia-Pacific market. Additionally, the presence of key market players and favorable government initiatives aimed at boosting industrial growth contributes to the high revenue in this region. On the other hand, the North American region is expected to register the highest CAGR during the forecast period of 2026 to 2034. The ongoing advancements in technology, coupled with the increasing adoption of automation and connectivity solutions across various industries, are driving the demand for cable assemblies in North America. The region's strong focus on innovation and research and development, along with the presence of leading technology companies, further supports the market growth. Moreover, the increasing investments in the development of smart cities and the expansion of telecommunications infrastructure are expected to drive the highest CAGR in the North American market during the forecast period.

Competitive Trends

The competitive landscape of the cable assembly market is characterized by the presence of several key players who are continuously adopting strategic initiatives to strengthen their market position. Top players in this market include TE Connectivity, Molex, Amphenol Corporation, Aptiv PLC, Samtec, 3M Company, AFCI, Cable Manufacturing & Assembly Co., Carlisle Interconnect Technologies, Carrio Cabling, DC Electronics, Epec LLC, Fischer Connectors SA, Infineon Technologies AG, Minnesota Wire Company, PSC Electronics, Smith's Interconnect Inc., TMB, TPC Wire & Cable Corp., W. L. Gore & Associates, Inc., and Walker Component Group, Inc. In 2025, these companies led the market due to their extensive product portfolios, strong brand recognition, and widespread distribution networks. TE Connectivity and Molex are two of the dominant players in the market, leveraging their advanced technology and comprehensive service offerings to maintain their leadership. TE Connectivity's focus on integrating smart technologies into their cable assemblies, such as IoT-enabled solutions, has provided them with a competitive edge. This technological innovation not only improves the efficiency and reliability of their products but also reduces maintenance costs for end-users, making TE Connectivity a preferred choice in the industry. Similarly, Molex has emphasized product innovation and expansion to solidify its market position. The company's introduction of high-speed and high-density cable assemblies has resonated well with the increasing demand for efficient connectivity solutions. Molex's robust global service network ensures quick and reliable support, further strengthening its market presence. Amphenol Corporation has also made significant strides in the market by focusing on expanding its product range and enhancing its service capabilities. The company's acquisitions and strategic partnerships have enabled it to enter new markets and expand its customer base. Amphenol's emphasis on providing customized solutions for various applications has contributed to its growth in the cable assembly market. Aptiv PLC and Samtec have maintained their competitive positions through continuous product development and a strong focus on quality. Aptiv's reputation for high-quality and reliable cable assemblies, coupled with its extensive dealer network, has helped it capture a significant market share. Samtec, known for its technologically advanced and durable cable assemblies, continues to invest in research and development to offer innovative connectivity solutions tailored to the needs of various industries. The competitive trends also highlight a growing focus on mergers and acquisitions, strategic partnerships, and collaborations among key players. These strategies are aimed at expanding product portfolios, enhancing technological capabilities, and gaining access to new markets. For instance, partnerships between cable assembly manufacturers and technology companies facilitate the development of customized solutions that address specific operational challenges in various sectors.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Cable Assembly market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

End-Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report