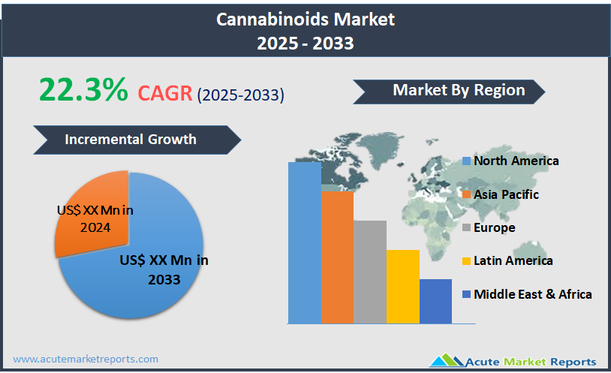

Cannabinoids are a class of chemical compounds that act on cannabinoid receptors in cells, altering neurotransmitter release in the brain. These compounds can be derived from the Cannabis plant (phytocannabinoids), synthesized in a laboratory (synthetic cannabinoids), or produced naturally within the human body (endocannabinoids). In the commercial and therapeutic contexts, cannabinoids from cannabis, such as tetrahydrocannabinol (THC) and cannabidiol (CBD), are the most significant. These compounds are used for a variety of applications including medical treatments, wellness supplements, and recreational use, where legal. The global cannabinoids market is projected to grow at a Compound Annual Growth Rate (CAGR) of 22.3% through the forecast period. This substantial growth is driven by increasing legalization and acceptance of cannabis and its derivatives for both medical and recreational use across the globe. The medical sector accounts for a significant portion of this growth, with cannabinoids being increasingly prescribed for conditions such as chronic pain, anxiety, epilepsy, and multiple sclerosis among others.

Increasing Legalization and Medical Adoption

The primary driver for the cannabinoids market is the increasing legalization of cannabis for both medical and recreational use across various regions globally. As more governments recognize the therapeutic benefits of cannabis, regulatory barriers are being removed, creating a conducive environment for the growth of the cannabinoid industry. The expanding body of scientific research supporting the efficacy of cannabinoids in treating a wide range of medical conditions such as chronic pain, anxiety, epilepsy, and the side effects of chemotherapy has further fueled their acceptance and use in the medical sector. For example, CBD, a non-psychoactive cannabinoid, has gained significant attention for its anti-inflammatory, anti-anxiety, and seizure-suppressant properties, leading to its widespread adoption in a variety of therapeutic formulations. This increasing acceptance has encouraged pharmaceutical companies and healthcare providers to invest in cannabinoid-based research and product development, driving market growth.

Expansion into New Therapeutic Areas and Consumer Products

A significant opportunity within the cannabinoids market lies in its potential expansion into new therapeutic areas and consumer products. The versatility of cannabinoids allows for their incorporation into various health and wellness products, including nutritional supplements, skincare products, and personal care items. As consumer interest in natural and alternative therapies grows, the demand for cannabinoid-infused products is also increasing. Additionally, ongoing clinical trials and research into the effects of cannabinoids on different medical conditions such as Alzheimer’s disease, cardiovascular diseases, and mental health disorders could open new therapeutic avenues for cannabinoids. This expanding application scope presents lucrative opportunities for companies within the pharmaceutical, biotechnology, and consumer goods sectors to innovate and capture new market segments.

Regulatory and Market Access Challenges

A major restraint in the cannabinoids market is the complex regulatory landscape that varies significantly by country and region. Despite the trend toward legalization, cannabis and its derivatives remain heavily regulated in many parts of the world. The inconsistency in laws regarding the production, distribution, and use of cannabis-related products can hinder market access and complicate international trade. For instance, some regions allow medical cannabis but have strict bans on its recreational use, while others have yet to legalize any form of cannabis. These regulatory hurdles not only limit market expansion but also pose challenges for businesses in navigating compliance, marketing, and distribution.

Ensuring Product Quality and Consumer Safety

One of the significant challenges facing the cannabinoids market is ensuring product quality and consumer safety. The cannabinoid industry is relatively young, and the rapid market expansion has sometimes outpaced the establishment of standardized testing and quality control protocols. This has led to variability in product potency and purity, which can compromise consumer safety and erode public trust in cannabinoid products. Additionally, the lack of comprehensive clinical data on the long-term effects of cannabinoid use and interactions with other medications presents ongoing challenges for healthcare providers and consumers alike. Addressing these issues requires rigorous regulatory standards, reliable product testing, and transparent consumer education to maintain high safety standards and support sustainable market growth.

Market Segmentation by Product Type

In the cannabinoids market, segmentation by product type includes Cannabidiol (CBD), Tetrahydrocannabinol (THC), Cannabinol (CBN), and others. CBD holds the highest revenue share due to its widespread legality and increasing acceptance in the medical community and general populace for its therapeutic benefits without the psychoactive effects that THC carries. CBD is utilized in a broad range of products from pharmaceuticals to wellness and consumer goods, reflecting its versatility and broad market appeal. THC, known for its psychoactive properties, is expected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033. This growth is primarily driven by increasing legalization of cannabis for recreational use as well as medicinal applications where its potent effects are deemed beneficial for conditions such as severe pain and nausea.

Market Segmentation by Application

The cannabinoids market is also segmented by application into medicinal use and non-medical use. The medicinal use segment accounts for the highest revenue, supported by growing legalization and acknowledgment of the medical benefits of cannabinoids across various regions. Medicinal cannabinoids are increasingly prescribed for chronic pain, mental health disorders, and as adjunct therapy in cancer treatments, among other applications. Meanwhile, the non-medical use segment is expected to register the highest CAGR through the forecast period. This surge is fueled by the expanding legalization of recreational cannabis use in several countries and states, coupled with a growing consumer inclination towards natural and plant-based products for personal wellness and recreational activities.

Geographic Segment

In 2024, North America dominated the cannabinoids market in revenue terms, driven by progressive legalization, particularly in the United States and Canada, and a high level of market acceptance and consumer demand. The region's established regulatory frameworks and developed cannabis industry infrastructure, including advanced production, extraction technologies, and well-developed distribution channels, contribute to its leading position. However, Europe is expected to experience the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033, due to changing legislation in countries like Germany, the UK, and Italy, which are increasingly recognizing the medical benefits of cannabis and moving towards a more regulated cannabis market. This shift is expected to drive substantial growth in the European cannabinoids sector, as new markets open up and existing markets expand.

Competitive Trends and Top Players

In 2024, the competitive landscape of the cannabinoids market featured strong activities from key players such as Mylan N.V. (Viatris, Inc.), Alkem Labs, GW Pharmaceuticals plc, Tilray, Inc., Aurora Cannabis, Inc., Canopy Growth Corporation, and The Cronos Group. These companies focused on strategic collaborations, mergers, and acquisitions to enhance their market positions and expand their geographic reach. For example, GW Pharmaceuticals continued to pioneer in the field of prescription cannabinoid medicines, while companies like Canopy Growth and Aurora Cannabis expanded their product offerings and distribution networks to capitalize on both medicinal and recreational markets. From 2025 to 2033, these players are expected to continue their emphasis on research and development to introduce more refined products with specific health benefits. The focus will likely also be on enhancing production efficiencies and expanding into new international markets, especially in regions where legalization trends are favorable. Strategic partnerships with healthcare providers and investments in consumer education about the benefits and safe use of cannabis will be crucial for maintaining and expanding market presence in a competitive and rapidly evolving industry.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Cannabinoids market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Application

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report