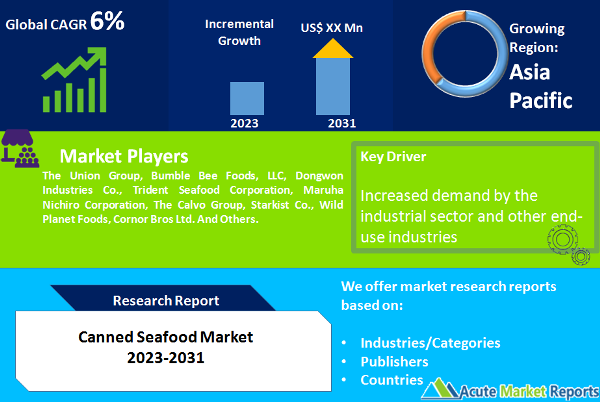

The global market for canned seafood market is expected to grow at a CAGR of 6% during the forecast period of 2026 to 2034. The expansion of the industry is predicted to be driven by the rising demand for ready-to-eat seafood due to the improvement of the distribution infrastructure. According to the United Nations Food and Agriculture Organization, imports of canned tuna into the U.S. climbed by 15% in 2021. In addition, factors such as shifting lifestyles and rising affordability are anticipated to boost the industry's expansion during the next eight years. During the COVID-19 epidemic, the demand for canned fish soared, particularly among consumers who dislike making food. Work-from-home or stay-at-home consumers favored canned food since it is simple to prepare and requires little time. In addition, restaurants curtailed services to prevent an increase in coronavirus infections, so consumers cooked at home and increased their consumption of canned fish.

Increasing Awareness of Health Benefits to Boost Market Expansion

Increasing awareness of the health advantages of canned fish is driving the expansion of the tinned seafood business. Omega-3 fatty acids found in abundance in canned fish are essential for overall health and well-being. According to the Office of Disease Prevention and Health Promotion's Dietary Guidelines, various forms of seafood provide approximately 7 grams of protein per ounce and have a reasonably high protein-to-calorie ratio. Moreover, the increased purchasing power of customers is increasing the desire for unusual and exotic culinary items. The escalating demand for plant-based canned fish is projected to drive the expansion of the tinned seafood market. According to a forecast by Bloomberg Intelligence, the market for plant-based canned seafood would increase from USD 30 billion in 2021 to USD 162 billion by 2034. In addition, due to the rise in demand for plant-based seafood alternatives, scientists and marketers are developing healthy, plant-based alternatives that taste identical to the real thing. For instance, in December 2022, the canned fish manufacturer Karavela introduced a line of yellow pea-based canned seafood items.

Emerging Opportunities in Sustainable and Environment-Friendly Sourced Seafood

Increasing consumer concern for environmentally and socially responsible seafood procurement has resulted in an increase in the demand for sustainably sourced seafood products. This has led to an increase in the number of canned salmon suppliers seeking to acquire raw materials from certified Marine Stewardship Council (MSC) and Aquaculture Stewardship Council (ASC) fisheries in order to be a part of the sustainable initiative and ultimately increase canned seafood sales in the marketplace. Bumble Bee Seafoods L.L.C., for instance, gained The Marine Stewardship Council (MSC) and other certification programs recognized by the Global Sustainable Seafood Initiative (GSSI) for sustainable sourcing in May of 2022.

Increase in Demand for Seafood

Additionally, a surge in demand for seafood with a long shelf life is anticipated to enhance the consumption of canned seafood. In the future years, an increase in disposable income and a shift in customer choice toward ready-to-eat foods are projected to be the key factors driving market expansion. The rising intake of seafood by the population as a result of its numerous health benefits is expected to drive market expansion. A poll performed by the Associated Chamber of Commerce and Industry of India (Assocham) indicated that approximately 79% of households chose quick food as a result of rising incomes, shifting living standards, and a preference for convenience.

Tuna Segment to Lead the Market by Product

The tuna sector held the greatest market share in 2025 with 40%, and it is predicted to maintain its dominance during the forecast period due to the prevalence of ready-to-eat meals among working-class people worldwide. According to a National Fisheries Institute article published in 2021, almost 88% of all American families had ingested tuna in a can. Nearly half of all families serve tuna in a can monthly, and 17% offer it weekly or more frequently. In addition, the segment is anticipated to expand due to the introduction of new products. For example, in August 2022, Mind Fish Company introduced the first Fair Trade Certifieda canned tuna product for sale in North America.

However, sardines are anticipated to grow at a CAGR of 8% during the forecast period of 2026 to 2034. Since they do not require cooking, tinned sardines are more popular than fresh ones as portable snacks. In accordance with this, manufacturers are introducing new product varieties in an effort to diversify their portfolio and attract a large consumer base. For example, in January 2026, Minnow, a seafood canning company, introduced its first line of products. Initially, the private-label line of shelf-stable canned seafood includes Alaskan salmon, Icelandic cod liver, and Spanish sardines.

Retail Segment Dominated the Market by Distribution Channel

In 2025, retail was the largest distribution channel, accounting for around 60.0% of global revenue. This distribution channel consists of supermarkets, hypermarkets, convenience stores, grocery stores, and local shops. There has been an increase in the distribution of canned seafood on the market due to the growing number of these stores in various regions. According to a February 2022 article published by Supermarket News, convenience stores are the primary drivers of canned seafood, while the retail sector retains approximately 48% of the distribution market. In addition, the global availability of these products in brick-and-mortar stores is anticipated to maintain the segment's momentum in the coming years. From 2026 to 2034, the food service distribution channel is projected to develop at a compound annual growth rate (CAGR) of 6.5%. During the projection period, this industry is expected to become a reliable source of income. Increased consumption of seafood in cans in restaurants and hotels is anticipated to spur expansion. Due to the growing awareness of food safety among consumers, restaurants, cafes, diners, and hotels provide canned seafood. In addition, the increase in the number of food services suggests the expansion of seafood in cans distributed through the food service distribution channel.

APAC remains the Global Leader

Asia-Pacific contributed the most to the global market in 2025, with a 45% revenue share. Due to the availability of a big quantity of raw materials and a high number of canneries for aquaculture, there has been a surge in the consumption of canned seafood products. According to the Marine Products Export Development Authority (MPEDA), India exported 12,8 lakh metric tons of seafood worth $6.68 billion in 2019; this number is anticipated to increase by 12.6% by the end of 2034. In addition, the market in the region is primarily driven by the rising demand for fish in a can in emerging nations.

The Middle East is anticipated to grow at a CAGR of 6% between 2026 and 2034. Due to its multiple health benefits, the rising demand for sustainably sourced seafood is driving the expansion of the market in the region. Moreover, due to increased demand and possible growth prospects in the canned seafood business, some retail distributors have introduced private-label canned seafood brands. For instance, Woolworths, a multinational retailer established in South Africa, distributes its vast selection of canned seafood goods in retail stores and via online delivery. The region's market is projected to expand due to the presence of a rising number of competitors. Oceana Group Limited, Saldanha, Goody, and Al-Alali, among others, are among the most prominent companies producing canned seafood goods in the region.

Market Competition to Intensify during the Forecast Period

The market for canned seafood is highly fragmented, with numerous global participants. The market participants confront tremendous competition, particularly from the leading market manufacturers, who have a huge consumer base, great brand awareness, and extensive distribution networks. To remain competitive, businesses have implemented numerous expansion methods, such as collaborations and new product releases. The Union Group, Bumble Bee Foods, LLC, Dongwon Industries Co., Trident Seafood Corporation, Maruha Nichiro Corporation, The Calvo Group, Starkist Co., Wild Planet Foods, and Cornor Bros Ltd. are the leading participants in the global market for canned seafood.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Canned Seafood market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Distribution channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report