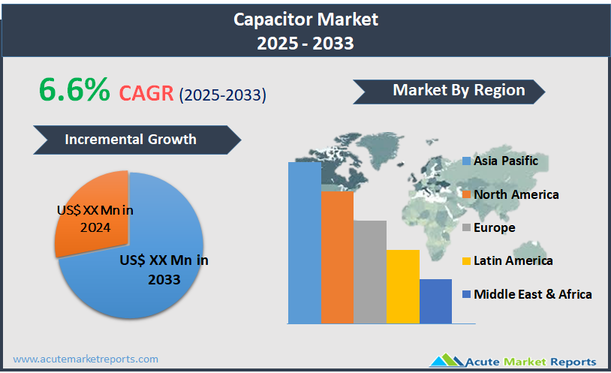

Capacitors are electronic components that store and release electrical energy, functioning as a passive element in electronic circuits. These devices are essential for various applications, including energy storage, power conditioning, signal filtering, and frequency tuning. Capacitors come in many forms, such as ceramic, electrolytic, film, and supercapacitors, each suited to different applications based on their energy density, stability, and frequency characteristics. The capacitor market is projected to grow at a compound annual growth rate (CAGR) of 6.6% over the forecast period.

Rising Demand in Automotive Electronics as a Driver

The increasing complexity and electrification of automotive systems serve as a primary driver for the capacitor market. Modern vehicles, especially electric and hybrid models, require a vast array of capacitors to manage power effectively and ensure the reliability of electronic functions. These components are integral in applications ranging from powertrain control systems to infotainment systems, facilitating smooth energy transitions and supporting rapid switching speeds. As automotive manufacturers continue to innovate towards more sustainable and efficient vehicles, the integration of capacitors that can perform under high temperatures and fluctuating power levels becomes crucial. The growth in electric vehicle production, driven by global efforts to reduce carbon emissions, directly translates to a heightened demand for advanced capacitors, thereby propelling the market forward.

Opportunity in Renewable Energy Systems

The expanding renewable energy sector represents a significant opportunity for the capacitor market. Capacitors are vital in solar and wind energy systems where they perform essential functions such as energy storage, voltage regulation, and power conversion. The shift towards renewable energy, driven by the global need to reduce reliance on fossil fuels, is prompting increased investments in energy infrastructure capable of integrating multiple renewable sources. This development necessitates the use of high-performance capacitors designed to enhance the efficiency and stability of renewable energy systems. As governments and private sectors continue to invest in renewable technologies, the demand for capacitors suited for these applications is expected to rise, offering lucrative opportunities for growth in the market.

Cost Sensitivity and Raw Material Prices as a Restraint

One of the significant restraints in the capacitor market is the sensitivity to raw material prices and the associated costs of capacitor production. Key materials used in capacitor manufacturing, such as tantalum, aluminum, and ceramics, are subject to price volatility, which can significantly impact the overall production costs. These fluctuations can arise from geopolitical tensions, trade policies, and supply chain disruptions, affecting manufacturers' ability to maintain stable pricing and production schedules. The high cost of specialized materials for advanced capacitors further complicates pricing strategies, especially in competitive markets where cost efficiency is crucial. This cost sensitivity can restrain market growth as manufacturers struggle to balance between innovation, performance, and affordability in capacitor technologies.

Challenge of Technological Evolution and Miniaturization

The rapid pace of technological evolution and the trend towards miniaturization in electronics present ongoing challenges in the capacitor market. As electronic devices become smaller, lighter, and more integrated, the capacitors used within them must also evolve to meet these new demands. This miniaturization requires capacitors to have higher performance standards, greater reliability, and smaller sizes, all while maintaining or improving their energy efficiency and cost-effectiveness. Keeping up with these evolving technological requirements demands constant research and development efforts from manufacturers, as well as agile manufacturing processes capable of quickly adapting to new market trends. This challenge is compounded by the increasing complexity of electronic systems, which places additional performance demands on capacitors, requiring innovations that can sometimes push the limits of existing material sciences and engineering capabilities.

Market Segmentation by Product Type

The capacitor market is segmented by product type into Multilayer Ceramic Capacitor, Silicon Capacitor, Vacuum Capacitor, Paper/Film Capacitor, Tantalum Capacitor, and Others. Multilayer Ceramic Capacitors (MLCCs) generate the highest revenue within this segment, primarily due to their widespread use in a variety of electronic devices such as smartphones, tablets, and other consumer electronics. MLCCs are favored for their high reliability, excellent frequency characteristics, and ability to be produced in small sizes, making them indispensable in compact electronic devices. On the other hand, Silicon Capacitors are expected to exhibit the highest CAGR from 2025 to 2033. The growth in Silicon Capacitors is driven by their increasing applications in high-frequency and high-temperature environments like those found in automotive and aerospace electronics, where traditional capacitors fail to perform effectively. Silicon Capacitors offer superior performance in these challenging conditions due to their stable electrical properties and robustness.

Market Segmentation by Mounting Type

Regarding mounting type, the capacitor market is categorized into Surface Mounted and Through-Hole. Surface Mounted capacitors lead in terms of revenue due to their dominance in the manufacturing of modern electronics, where they are preferred for their compact size and ease of assembly on printed circuit boards (PCBs). The trend towards miniaturization and higher circuit density in electronic devices supports the continued prevalence of Surface Mounted capacitors. Meanwhile, Surface Mounted capacitors are also projected to register the highest CAGR throughout the forecast period. The growth of this segment is supported by advancements in PCB technology and the ongoing shift towards more densely packed electronic assemblies, which require capacitors that can be efficiently integrated into increasingly smaller spaces without sacrificing performance.

Geographic Segment

The capacitor market is characterized by dynamic geographic trends. As of 2024, Asia Pacific held the highest revenue percentage in the market, driven by the presence of major electronics manufacturing hubs in countries such as China, Japan, South Korea, and Taiwan. These regions host a vast ecosystem of OEMs and component manufacturers, making them central to the production and innovation in the capacitor industry. Additionally, the high concentration of consumer electronics, automotive, and industrial equipment manufacturing in Asia Pacific fuels the demand for capacitors. Looking forward, the region is also expected to register the highest CAGR from 2025 to 2033, propelled by continued growth in these sectors, further expansion of manufacturing capabilities, and increasing investments in telecommunications and renewable energy projects.

Competitive Trends and Key Strategies

In 2024, the capacitor market was highly competitive with key players including Alcon Electronics Private Limited, Evans Capacitor Company, Jinzhou Kaimei Power Co., Ltd., KEMET Corporation, Kendeil Srl, KYOCERA Corporation, Murata Manufacturing Co., Ltd., NICHICON CORPORATION, Nippon Chemi-Con Corporation, Omni Pro Electronics, Panasonic Industry Co., Ltd., Rubycon Corporation, SAMSUNG ELECTRO-MECHANICS, TAIYO YUDEN CO., LTD., TDK Electronics AG, and Vishay Intertechnology, Inc. dominating the market. These companies focused on technological advancements, strategic partnerships, and expanding their production capacities to meet the growing demand. For instance, companies like Murata and TDK Electronics AG leveraged their R&D capabilities to innovate and improve the performance of their capacitors, particularly in applications requiring high reliability and efficiency. From 2025 to 2033, these companies are expected to intensify their efforts in innovation, particularly in developing capacitors that are smaller, more efficient, and capable of handling higher voltages and temperatures.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Capacitor market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Mounting Type

| |

Voltage

| |

End-use Industry

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report