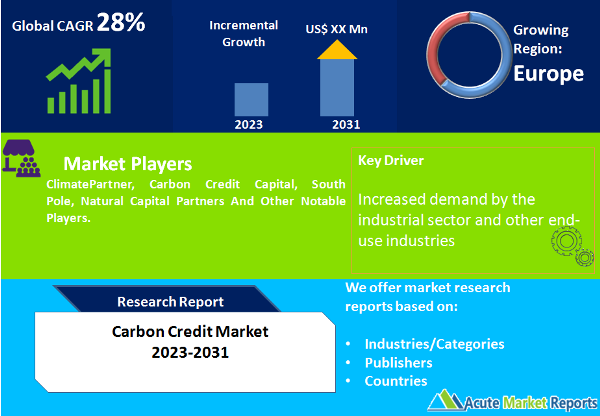

The carbon credit market is expected to witness strong growth with an expected CAGR of 28% during the forecast period of 2026 to 2034. Carbon credits, also known as carbon offsets, are financial instruments that represent a reduction or removal of greenhouse gas emissions from the atmosphere. These credits can be bought and sold in the market, allowing companies and organizations to offset their carbon footprint and contribute to global emission reduction goals. The market revenue of the carbon credit market has been steadily increasing over the years. The growing global recognition of the need for environmental sustainability, coupled with stricter regulatory frameworks and initiatives such as the Paris Agreement, has propelled the demand for carbon credits. The market revenue is expected to continue its upward trajectory as more businesses and governments commit to reducing their carbon emissions and achieving carbon neutrality. This growth is driven by various factors, including the rise in corporate social responsibility, the integration of sustainable practices into business strategies, and the emergence of innovative carbon offset projects and technologies. The carbon credit market operates on the principle of creating a financial value for carbon reductions. Organizations and countries that exceed their emissions targets can sell their excess reductions as carbon credits to entities seeking to offset their emissions. These credits can be generated through projects that focus on renewable energy, energy efficiency, afforestation, reforestation, or other emission reduction activities.

Government Regulations and Initiatives

Government regulations and initiatives play a crucial role in driving the carbon credit market. Many countries have implemented regulatory frameworks that require companies and industries to reduce their carbon emissions. For example, the European Union's Emissions Trading System (EU ETS) is one of the largest carbon markets globally, covering various industries and sectors. The EU ETS sets a cap on carbon emissions and issues allowances that can be traded among participants. This regulatory framework has led to increased demand for carbon credits as companies strive to meet their emission reduction targets. Similarly, other governments worldwide, including China and Canada, have introduced carbon pricing mechanisms and emissions reduction targets, which encourage businesses to invest in carbon credits.

Corporate Sustainability and ESG Commitments

Corporate sustainability and Environmental, Social, and Governance (ESG) commitments have become key drivers for the carbon credit market. Many businesses are incorporating sustainability goals into their corporate strategies and are committed to reducing their carbon footprint. These companies voluntarily purchase carbon credits to offset their emissions and demonstrate their environmental responsibility. For instance, multinational corporations like Microsoft and Apple have made significant commitments to becoming carbon neutral and have invested in renewable energy projects and carbon offset initiatives. These proactive sustainability efforts by corporations fuel the demand for carbon credits and drive market growth.

Investor Demand for ESG Investments

Investor demand for Environmental, Social, and Governance (ESG) investments is a significant driver of the carbon credit market. Investors are increasingly recognizing the importance of sustainable and responsible investment practices. They seek companies that demonstrate a commitment to ESG factors, including carbon emissions reduction. As a result, investment funds and financial institutions are incorporating ESG criteria into their investment strategies. This trend has created a growing market for carbon credits, as companies with robust carbon offset strategies become attractive investment opportunities. The demand for ESG-focused investments is expected to continue growing, driving the carbon credit market.

Lack of Global Standardization and Verification Challenges

One significant restraint in the carbon credit market is the lack of global standardization and verification challenges. While there are various carbon offset projects and methodologies, there is no universally accepted standard for carbon credits. This lack of standardization creates complexity and confusion in the market, making it difficult to compare and evaluate the quality and legitimacy of carbon credits across different projects and regions. Additionally, the verification process for carbon credits can be challenging and time-consuming, requiring rigorous monitoring, reporting, and third-party verification. The absence of a streamlined and standardized verification process raises concerns about the credibility and transparency of carbon credits, potentially leading to instances of greenwashing or false claims. Furthermore, verification challenges can hinder the liquidity and tradeability of carbon credits, as buyers may hesitate to invest in credits that are not adequately verified. These issues pose a restraint to the carbon credit market's growth and effectiveness, as they undermine confidence and trust in the market. Efforts are being made to address these challenges through the development of international standards and accreditation bodies, such as the Verified Carbon Standard (VCS) and the Gold Standard, which aim to provide guidelines and assurance for high-quality carbon credits. However, achieving global standardization and streamlining the verification process remains an ongoing challenge for the carbon credit market.

Avoidance/Reduction Projects Dominates the Market by Project Type

The Avoidance/Reduction projects segment generated substantial revenue in 2025, due to the wide range of emission reduction activities involved. This growth can be attributed to the increasing recognition of the importance of nature-based solutions and carbon sequestration for achieving climate change mitigation goals. Avoidance/Reduction projects focus on minimizing greenhouse gas emissions by implementing measures that reduce or avoid carbon-intensive activities. These projects include renewable energy installations, energy efficiency initiatives, waste management systems, and sustainable transportation practices. On the other hand, the Removal/Sequestration projects segment, though relatively smaller in terms of revenue, is expected to experience the highest CAGR during the forecast period of 2026 to 2034. Removal/Sequestration projects involve activities aimed at capturing and storing carbon dioxide from the atmosphere, thereby reducing the overall concentration of greenhouse gases. Examples of Removal/Sequestration projects include afforestation and reforestation initiatives, carbon capture and storage projects, and ecosystem restoration efforts.

Compliance Market Dominates the Market by Type

The type segment of carbon credit market consists of two main categories: the Compliance Market and the Voluntary Market. The Compliance Market involves the trading of carbon credits to meet regulatory requirements and adhere to mandatory emission reduction targets set by governments and regulatory bodies. This segment is driven by the implementation of cap-and-trade systems and carbon pricing mechanisms, such as the European Union Emissions Trading System (EU ETS) and similar programs worldwide. The Compliance Market generated the highest revenue in the carbon credit market in 2025 due to the large-scale emission reduction commitments mandated by industries. On the other hand, the Voluntary Market represents the segment where organizations and individuals voluntarily purchase carbon credits to offset their carbon footprint beyond regulatory requirements. It is driven by the increasing focus on corporate sustainability, environmental responsibility, and the desire to support carbon-neutral initiatives. The Voluntary Market is expected to demonstrate a higher CAGR during the forecast period of 2026 to 2034, as it is influenced by the growing demand for eco-friendly products and services, consumer awareness, and sustainability goals set by businesses.

Europe Remains the Global Leader

Europe has emerged as a prominent market for carbon credits in 2025, driven by its well-established cap-and-trade system and stringent emission reduction targets. The region has been at the forefront of carbon market development and has witnessed substantial revenue generation from the trading of carbon credits. Additionally, Europe has shown a consistent commitment to renewable energy and sustainable practices, contributing to the high demand for carbon credits. North America is another key market for carbon credits, with the United States and Canada leading the way. The region has witnessed increased adoption of carbon pricing mechanisms and carbon trading platforms, resulting in significant revenue generation. Furthermore, initiatives like the California Cap-and-Trade Program and the Regional Greenhouse Gas Initiative (RGGI) have bolstered the carbon credit market in North America. In terms of the highest CAGR during the forecast period of 2026 to 2034, the Asia-Pacific region is projected to witness significant growth due to rapid industrialization, growing environmental awareness, and the implementation of carbon mitigation strategies.

Market Competition to Intensify during the Forecast Period

The carbon credit market is characterized by intense competition among various players striving to capitalize on the growing demand for carbon credits. The market includes a mix of established players, emerging startups, financial institutions, and specialized carbon credit trading platforms. These players employ different strategies to gain a competitive edge and offer innovative solutions to meet the diverse needs of buyers and sellers in the market. Some of the top players in the carbon credit market include companies like ClimatePartner, Carbon Credit Capital, South Pole, and Natural Capital Partners. These companies have established themselves as leaders in the industry by providing comprehensive carbon credit solutions, including carbon offsetting projects, verification services, and trading platforms. They have built strong partnerships with project developers, governments, and corporations to ensure a steady supply of high-quality carbon credits. Looking ahead, the carbon credit market is expected to witness continued growth and innovation. As governments and organizations worldwide intensify their efforts to combat climate change, the demand for carbon credits is likely to increase. This presents opportunities for existing players to expand their offerings and for new entrants to enter the market. Technology advancements, such as blockchain, can also enhance transparency and streamline carbon credit trading processes.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Carbon Credit market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Project Type

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report