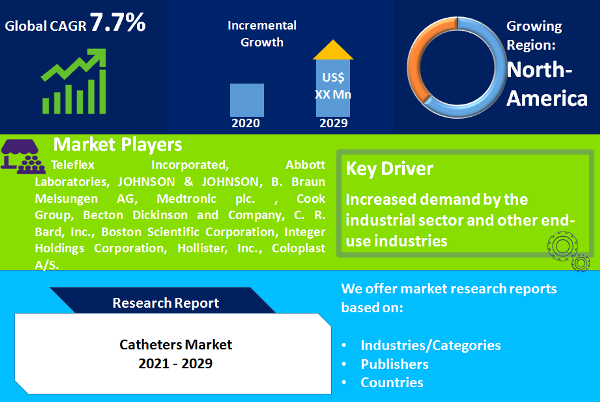

"Catheters Market to Exhibit Productive Growth during the Forecast Period"

The global catheters market is growing productively, was valued at US$ 17.97 Bn in 2021 and expected to reach US$ 34.96 Bn by 2030. Globally increasing surgical procedures, the high prevalence of cardiovascular diseases (majorly congestive heart failure, cardiac arrhythmia, and cardiac arrest), kidney diseases and urinary tract infections has significantly boosted the market growth in the current years.

New product launches in the urology, neurovascular and specialty catheter segment is driving the growth in the developed regions. In the product segment, the cardiovascular catheter is expected to lead the market growth due to its higher consumption globally. As indicated by WHO and American College of Cardiology Foundation, the estimated cost of cardiovascular diseases will be around $1.1 billion by 2034. Moreover, more than 90 Mn U.S citizens carry a diagnosis of cardiovascular disease.

Demand for minimally invasive surgeries along with various catheterization procedures (angioplasty, neurosurgery) is increasing in the hospital settings. Rising medical tourism for surgery, usage of branded catheters with top applications, and adoption of advanced medical devices along with favorable reimbursement policies fuel the demand for catheters market worldwide. However, the risk of catheter-associated infections, the high cost of surgery, poor quality assurance, intense price competition in the domestic market mainly in Latin America and the Asia Pacific are liable for restraining the overall growth of catheters market globally.

"Cardiovascular Catheter Product Segment is expected to Register Higher Growth by the End of 2030"

Adoption of a cardiovascular catheter is high as compared to others in the product segment. New technology assessment in the electrophysiology catheters, PTCA (percutaneous transluminal coronary angioplasty) balloon catheters, and IVUS (Intravascular Ultrasound) catheters is gaining traction during the forecast period. The global demand for cardiovascular catheters is attributed to remain the highest among others, due to the rising prevalence of cardiovascular diseases. According to WHO and American College of Cardiology estimates, cardiovascular diseases account for around 800,000 deaths in the U.S. and on a global level, it accounts for more than 30% of all deaths.

In addition, increased applications in coated catheters, percutaneous transluminal angioplasty catheters, intermittent catheters, and integrated catheters is further going to spur revenue growth during the forecast period. Additionally, rising demand for disposable & sterile catheters, improvement in better reimbursement models, and new technology assessment in catheter technology are few factors driving the growth of the market.

"Increasing Admissions Due to Respiratory Disorders in the Hospital Segment to Witness a Significant CAGR"

Rising heart diseases, cardiovascular, cancer, urinary tract infections, and other chronic diseases are noteworthy variables predictable for the growth & development of the global catheters market. As per, Centers for Disease Control and Prevention (CDC), around 28 Mn individuals in the U.S. were diagnosed with heart disease. Also, around 609,640 individuals in the U.S. are expected to die from cancer in 2022, data by American Cancer Society.

Growing demand for microcatheters, specialty catheters, peripheral venous catheters PTCA balloon catheters, Foley catheters, and dialysis catheter products in hospitals are driving the growth of the market. Growing elderly population along with rising surgical procedures in Europe and the Asia Pacific is a major factor in expanding the growth of the end user segment. In 2021, hospitals segment contributed the maximum revenue share, due to the increasing number of government-run and private hospitals. Moreover, initiatives taken by government activities to decrease the hospital costs support the global catheters market. Additionally, noteworthy development in the ambulatory surgical centers, clinics, and cardiovascular centers has sustained the administrations of catheters due to its ease-of-usage, minimally invasive nature and improved competences. (Others in the end user segment include -specialty clinics, cardiovascular centers)

"Increasing Population, New Product Launches and the Presence of Top Players Holds North America in Dominant Position"

According to WHO, every year more than 17.5 Mn individuals die from cardiovascular diseases (CVDs). In 2021, North America generated maximum revenue share in the global catheters market attributed to the rising prevalence of cardiovascular & kidney disorders, urinary infections, strokes and heart attack. Moreover, increasing minimally invasive surgical procedures, and utilization of branded catheters as a standard of care in hospitals and ambulatory surgical centers are few factors driving the growth of the market. Others factors contributing to the overall growth of the market include, new product launches include the usage of improved materials that have strong biocompatibility. For instance, silicone Foley catheter is favored due to its long lifespan, also reduces the probabilities of infection during the procedure.

Major factors contributing to the overall growth include growing awareness about advanced medical technology, riding hospitalizations, increasing FDA approvals for new products and the presence of top manufacturers in North America & Europe. However, in lower economic nations such as India, China, Brazil, and South Africa, the availability of advanced medical devices is limited. Lack of trained surgeons, less suitability of medical treatment and the high cost of medical devices are restraining the growth of the market during the forecast period.

"Dominance of Multinational Manufacturers with Strong Product Portfolio in the Developed Regions"

Major players in the catheters market are Teleflex Incorporated, Abbott Laboratories, JOHNSON & JOHNSON, B. Braun Melsungen AG, Medtronic plc. , Cook Group, Becton Dickinson and Company, C. R. Bard, Inc., Boston Scientific Corporation, Integer Holdings Corporation, Hollister, Inc., Coloplast A/S, and others.

Top enterprises are executing growth strategies along with new technology development in catheters models, new product launch, merger & acquisitions and partnerships with medical technology organizations. For example, in January 2021, Abbott Laboratories acquired St. Jude Medical (medical device manufacturer) for around US$ 23.5 Bn. In January 2022, Surmodics, Inc. received approval for coronary/peripheral support microcatheter from the U.S. FDA.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Catheters market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

End User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report