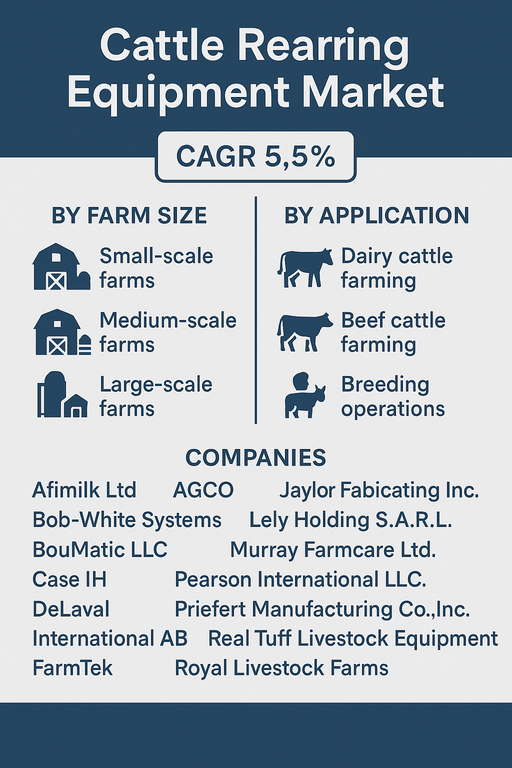

The global cattle rearing equipment market is projected to grow at a CAGR of 5.5% from 2025 to 2033, driven by increasing global demand for dairy and meat products, rising mechanization of livestock operations, and the adoption of precision livestock farming technologies. Advancements in feeding systems, milking equipment, housing solutions, and health monitoring devices are improving operational efficiency and animal welfare, making cattle rearing more scalable and sustainable across different farm sizes.

Market Drivers

Rising Demand for Dairy and Beef Products Globally

Growing population, dietary shifts, and increasing urban consumption of milk, cheese, yogurt, and beef are fueling the need for efficient and scalable cattle farming. In response, farmers are investing in modern rearing equipment to enhance productivity, reduce labor dependency, and ensure quality control. Additionally, government initiatives and subsidies supporting dairy infrastructure and rural livestock development are contributing to equipment market expansion, especially in emerging economies.

Adoption of Smart Farming and Automation in Livestock Management

Farmers are increasingly integrating IoT, sensors, automated feeding systems, and smart milking parlors to streamline cattle management. These technologies allow real-time monitoring of animal health, reproduction cycles, and feed efficiency, which reduces veterinary costs and enhances breeding outcomes. This shift toward data-driven cattle rearing practices is driving demand for advanced and connected equipment, particularly among medium- and large-scale farms seeking higher returns and sustainability.

Market Restraint

High Capital Investment and Maintenance Requirements

Despite its benefits, cattle rearing equipment involves significant upfront costs, especially for automated and technologically advanced systems. Small-scale farmers often face financial barriers and require government or cooperative support to access modern tools. Additionally, regular maintenance, spare parts availability, and equipment downtime concerns may discourage adoption, particularly in rural and low-income farming regions. The variability in farm infrastructure also limits standardization and scalability in certain geographies.

Market Segmentation by Farm Size

By farm size, the market is segmented into Small-scale farms, Medium-scale farms, and Large-scale farms. In 2024, Medium-scale farms held the largest share, as these operations typically balance capacity and automation needs while accessing moderate funding or cooperative support. Large-scale farms are projected to register the highest CAGR from 2025 to 2033, due to their ability to invest in integrated milking robots, automated feeders, and environmental control systems. Small-scale farms remain significant in developing markets and are gradually transitioning from manual to semi-automated setups with cost-effective solutions.

Market Segmentation by Application

By application, the market is divided into Dairy Cattle Farming, Beef Cattle Farming, and Breeding Operations. In 2024, Dairy Cattle Farming dominated the market due to high equipment requirements for milking, feeding, cooling, and waste handling. Beef Cattle Farming follows, with growing investment in mechanized feeding systems and cattle handling equipment. Breeding Operations are increasingly adopting fertility monitoring, heat detection, and specialized housing to improve productivity and reduce calving intervals, contributing to steady market growth in this segment.

Geographic Trends

In 2024, North America led the cattle rearing equipment market, supported by large commercial farms, high mechanization rates, and technology adoption in the U.S. and Canada. Europe followed closely, with advanced dairy farming infrastructure and growing focus on sustainable animal husbandry in countries like Germany, the Netherlands, and France. Asia Pacific is expected to experience the fastest CAGR from 2025 to 2033, driven by increasing livestock population, dairy development programs, and modernization efforts in India, China, and Southeast Asia. Latin America and Middle East & Africa are emerging regions, where beef exports, government incentives, and climate-adapted equipment demand are shaping market expansion.

Competitive Trends

In 2024, the cattle rearing equipment market was dominated by global agricultural machinery companies, livestock equipment manufacturers, and specialty dairy solution providers. GEA Group AG, DeLaval International AB, and Lely Holding S.A.R.L. led in robotic milking, automated feeding, and smart barn systems. AGCO and Case IH offered mechanized handling, feeding, and tractor-integrated equipment for large-scale farms. Afimilk Ltd specialized in precision dairy technologies including cow monitoring, fertility tracking, and herd management software. BouMatic, FarmTek, and Jaylor Fabricating Inc. provided modular solutions catering to medium-sized and regional farms. Companies like Priefert, Real Tuff Livestock Equipment, and Murray Farm Care Ltd. focused on affordable and durable equipment for beef handling and smaller farms. Strategic focus areas include automation, IoT integration, sustainability, and customer-specific equipment customization.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Cattle Rearing Equipment market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Equipment Type

| |

Farm Size

| |

Application

| |

End Use

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report