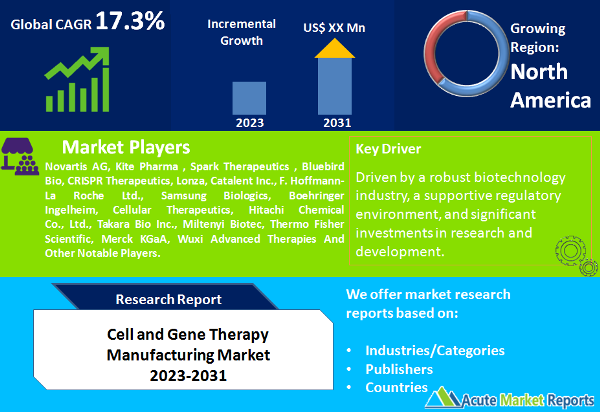

The cell and gene therapy manufacturing market is expected to grow at a CAGR of 17.3% during the forecast period of 2026 to 2034. The market has emerged as a groundbreaking sector within the biopharmaceutical industry, revolutionizing medical treatment through personalized therapies. The cell and gene therapy manufacturing market is driven by advancements in cellular engineering, rising disease prevalence, and a supportive regulatory environment. Complex manufacturing processes pose challenges that need to be addressed to ensure consistent product quality and reproducibility. Established players are poised to drive innovation and collaboration to bring transformative therapies to patients, ultimately reshaping the landscape of medical treatment and patient outcomes. As the market continues to evolve, cell and gene therapies are expected to play a pivotal role in addressing unmet medical needs and providing hope for patients with previously untreatable diseases.

Advancements in Cellular Engineering and Biotechnology

The cell and gene therapy manufacturing market is driven by remarkable advancements in cellular engineering and biotechnology. Scientists and researchers are leveraging cutting-edge techniques to modify and engineer cells, enabling them to target and treat specific diseases at the genetic level. Techniques such as CRISPR-Cas9 gene editing have paved the way for precise modifications, resulting in innovative therapies. These advancements have allowed the development of therapies that were once considered science fiction, leading to the emergence of treatments that address unmet medical needs, such as rare genetic disorders. The Journal of Clinical Investigation reports successful outcomes in clinical trials using CRISPR-based therapies, showcasing the potential of gene editing in disease treatment.

Rising Prevalence of Chronic and Genetic Diseases

The increasing prevalence of chronic and genetic diseases, particularly oncology diseases and genetic disorders, has fueled the demand for cell and gene therapies. Traditional treatment options for such diseases often provide limited efficacy, leading to the exploration of novel therapies. Cell and gene therapies offer the promise of targeted and personalized treatment approaches that address the root causes of these diseases. For instance, the American Cancer Society highlights that cancer remains a significant global health concern, and advancements in gene therapy are enabling the development of therapies that target specific cancer mutations, increasing treatment efficacy and reducing side effects.

Supportive Regulatory Environment

The evolving regulatory landscape and support from regulatory authorities have played a crucial role in driving the cell and gene therapy manufacturing market. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) have introduced expedited pathways for the approval of regenerative and gene therapies, recognizing the potential of these therapies to address unmet medical needs. These pathways facilitate faster development and approval of innovative therapies, fostering investment and collaboration in the field. The FDA's approval of various cell and gene therapies, including CAR-T cell therapies, illustrates the agency's commitment to advancing these treatments.

Complex Manufacturing Processes

A notable restraint in the cell and gene therapy manufacturing market is the complexity of manufacturing processes. Cell and gene therapies often involve intricate processes for isolating, modifying, and culturing cells, as well as ensuring their safe delivery to patients. Achieving consistent product quality, and scalability, and maintaining regulatory compliance pose challenges. Additionally, cell and gene therapies are highly individualized and require close coordination between healthcare providers, manufacturers, and regulatory bodies. Addressing these challenges to streamline manufacturing processes and ensure reproducibility is critical to advancing the field.

Oncology Diseases Segment Dominates the Market by Indication

The market is segmented by indication into Oncology Diseases, Cardiovascular Diseases, Orthopedic Diseases, Ophthalmology Diseases, Central Nervous System Disorders, Infectious Diseases, and Other Indications. In 2025, the Oncology Diseases segment recorded the highest revenue due to the significant research and development efforts focused on cancer therapies. During the forecast period of 2026 to 2034, the cardiovascular diseases segment is expected to achieve the highest CAGR. This growth can be attributed to the increasing prevalence of cardiovascular diseases and the exploration of gene therapies to address genetic cardiovascular disorders.

Clinical Manufacturing dominated Dominates the Market by Application

The market is segmented by application into Clinical Manufacturing and Commercial Manufacturing. In 2025, Clinical Manufacturing dominated the market due to the emphasis on research and development activities. However, from 2026 to 2034, Commercial Manufacturing is projected to exhibit the highest CAGR. This growth is driven by the progression of promising cell and gene therapies from clinical trials to commercialization, as therapies gain regulatory approvals and enter the market.

North America Remains as the Global Leader

In terms of geographic trends, North America held the highest revenue share in 2025, driven by a robust biotechnology industry, a supportive regulatory environment, and significant investments in research and development. However, the Asia-Pacific region is expected to exhibit the highest CAGR during the forecast period. This growth can be attributed to increasing healthcare infrastructure, rising prevalence of chronic diseases, and growing investments in regenerative medicine and biotechnology.

Market Competition to Intensify during the Forecast Period

Prominent players in the cell and gene therapy manufacturing market include Novartis AG, Kite Pharma , Spark Therapeutics , Bluebird Bio, CRISPR Therapeutics, Lonza, Catalent Inc., F. Hoffmann-La Roche Ltd., Samsung Biologics, Boehringer Ingelheim, Cellular Therapeutics, Hitachi Chemical Co., Ltd., Takara Bio Inc., Miltenyi Biotec, Thermo Fisher Scientific, Merck KGaA, and Wuxi Advanced Therapies. These companies are at the forefront of developing innovative cell and gene therapies, particularly in the oncology and genetic disorders segments. Their key strategies involve partnerships with research institutions, academia, and regulatory agencies to advance clinical trials and accelerate product development. As of 2026, these players have contributed to the growth of the market, with several therapies receiving regulatory approvals. From 2026 to 2034, these companies are expected to continue focusing on expanding their therapy portfolios and enhancing manufacturing capabilities to meet the increasing demand for advanced therapies.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Cell and Gene Therapy Manufacturing market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Indication

|

|

Application

|

|

End User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report