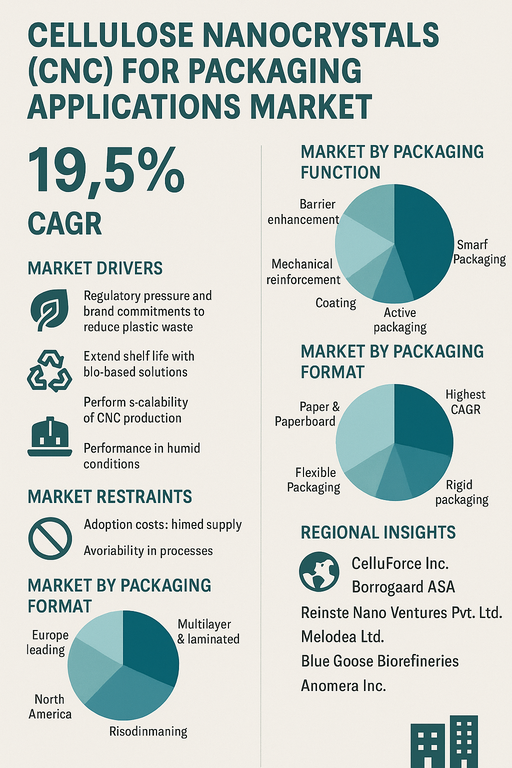

The cellulose nanocrystals (CNC) for packaging applications market is growing at a 19.5% CAGR as brand owners and converters integrate CNCs into films, coatings, and paper structures to improve barrier performance, mechanical strength, and sustainability in next-generation packaging. CNCs offer high aspect ratio, low density, and strong oxygen and grease barrier properties, making them attractive as bio-based additives or layers in plastic and fibre-based packaging. Early adoption is focused on barrier enhancement and mechanical reinforcement in flexible and paper-based formats, with growing interest in active and smart packaging concepts. Within packaging functions, barrier enhancement applications currently generate the highest revenue, while smart packaging functions are expected to record the highest CAGR as brands explore sensor-enabled and responsive packaging concepts using CNC-based structures. By packaging format, paper & paperboard packaging and flexible packaging lead current revenue, whereas multilayer & laminated packaging is expected to post the highest CAGR as CNC layers are integrated into high-performance, downgauged structures.

Market Drivers

Growth is driven by regulatory pressure and brand commitments to reduce plastic waste, lower carbon footprints, and replace fossil-based barrier chemistries with renewable solutions. CNCs provide a bio-based route to improve oxygen and grease barriers in food and beverage packaging, helping to extend shelf life and reduce food waste without relying on aluminium foil or non-recyclable multi-material structures. They can also reinforce thin films and paper, enabling downgauging and material savings while maintaining stiffness and strength. Advances in CNC production from wood pulp, agricultural residues, and industrial side streams improve scalability and reduce cost per kilogram. Converters and brand owners are running pilots where CNC coatings and layers upgrade recyclability of fibre-based packaging or help shift to mono-material structures. Interest in bio-based and compostable packaging further supports CNC adoption as they fit into circular and bioeconomy strategies.

Market Restraints

Adoption is constrained by current CNC production costs, limited large-scale supply, and variability in properties between suppliers and feedstocks. Converters must adapt coating, compounding, and extrusion processes to handle CNC dispersions and avoid aggregation or process instability. Moisture sensitivity and performance under high humidity can limit barrier benefits in some applications without proper formulation. Integrating CNCs into existing packaging lines may require capital expenditure and process validation, especially when moving from lab coating to industrial scale. Regulatory approvals and migration testing for food-contact applications add time and cost. Some customers remain cautious about switching from well-known barrier technologies to new materials without long-term performance data and clear cost–benefit cases.

Market by Packaging Function

Barrier enhancement applications form the core of current CNC usage in packaging. CNCs are used as coatings or internal layers to improve oxygen, grease, and aroma barriers in films, paper, and paperboard, often enabling replacement of aluminium or high-barrier polymers; within packaging functions this segment currently generates the highest revenue. Mechanical reinforcement applications use CNCs as fillers in biopolymers and conventional polymers to increase stiffness, toughness, and puncture resistance, supporting downgauging and performance upgrades in films, trays, and paper-based structures. Coating applications cover surface treatments that improve printability, gloss, and surface strength on paper and board, as well as primers for metallization or further functional layers. Active packaging functions leverage CNCs as carriers for antimicrobials, antioxidants, or oxygen scavengers to extend shelf life in meat, dairy, and bakery applications. Smart packaging functions are emerging, with CNC-based films and coatings used in combination with pigments, indicators, or conductive inks to enable freshness indicators, tamper-evidence, or environmental sensing; within packaging functions smart packaging is expected to record the highest CAGR as brands test pilot projects in premium and high-value segments.

Market by Packaging Format

Flexible packaging, including films, pouches, and wraps, is a major use area where CNCs upgrade barrier performance, improve mechanical stability of thin layers, and support shifts to mono-material or bio-based constructions. Rigid packaging, such as trays, cups, and lids, benefits from CNC-reinforced polymers and barrier coatings but currently accounts for a smaller share of CNC volumes. Paper & paperboard packaging is a key early adopter, using CNC coatings to improve barrier and surface properties in cartons, cups, and foodservice formats; together with flexible packaging this segment contributes the highest revenue today. Multilayer & laminated packaging is expected to post the highest CAGR as converters integrate CNC layers into composite structures to replace aluminium foil or reduce the thickness of high-barrier polymers, while maintaining performance in high-demand applications such as snack, dairy, and ready-meal packaging. Over time, CNC-enabled multilayer structures are expected to support both recyclability and downgauging strategies.

Regional Insights

Europe currently leads revenue due to strong regulation on single-use plastics, high interest in fibre-based and bio-based packaging, and active R&D programs connecting pulp and paper producers, CNC suppliers, and brand owners. North America follows with pilot and early commercial use in specialty packaging segments, supported by access to forestry-based feedstocks and established players developing CNC production at scale. Asia Pacific is expected to record the highest CAGR as packaging demand grows in China, India, and Southeast Asia and regional governments encourage sustainable materials and bioeconomy initiatives. Latin America and the Middle East & Africa are at an earlier stage but show interest in CNCs through collaborations around agro-residue valorization and export-oriented packaging that must meet international sustainability requirements. Regions with established pulp and paper sectors and supportive bioeconomy policies are positioned to scale CNC packaging applications faster.

Competitive Landscape

CelluForce Inc. is among the early commercial producers of cellulose nanocrystals, supplying CNCs for barrier coatings, reinforcement, and specialty packaging applications, with focus on large-scale production and formulation support. Borregaard ASA integrates CNCs into its biorefinery-based specialty cellulose and lignin portfolio, targeting high-value packaging, barrier, and functional coating markets. Reinste Nano Ventures Pvt. Ltd. serves as a supplier and development partner in India, providing nanomaterials including CNCs for packaging and functional coatings to converters and research institutions. Melodea Ltd. develops CNC-based barrier solutions for paper and packaging, offering ready-to-use coatings that improve oxygen and grease barriers and support fibre-based packaging substitution for plastics. Blue Goose Biorefineries and FiberLean Technologies work on cellulose-based additives and composites, with CNCs and microfibrillated cellulose used to enhance paper and board performance. Anomera Inc. commercializes cellulose-based performance particles that can be adapted for coatings and functional layers in packaging, while Kruger Inc. and GranBio leverage their biomass and pulp assets to explore CNC and nanocellulose production for industrial applications including packaging. Nanoverse participates as a technology and materials player focusing on nano-enabled functional materials.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Cellulose Nanocrystals for Packaging Applications market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Packaging Function

|

|

Packaging Format

|

|

End Use Packaging Sector

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report