The number of vehicles including taxi fleets in China has grown considerably in recent years, which has resulted in increased air pollution, traffic congestion, and fuel consumption. The new energy vehicles have garnered lot of interest across the globe, especially in China. Their ability to curb carbon emissions, leading to improved air quality and reduced dependence on foreign oil has been instrumental in driving market adoption.

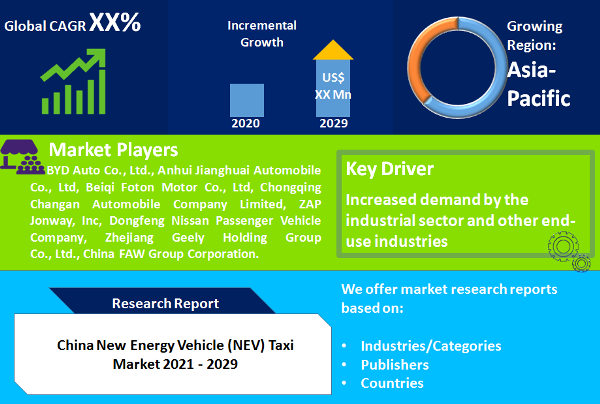

Favorable government initiatives and policies have further fueled market momentum in China. For instance, the central government of China has started ‘Ten Cities- Thousand Vehicles Program’ to promote the development and adoption of new energy vehicles through pilot projects in country’s 10 major cities, centering on the taxi fleets and other government fleet applications. Furthermore, a five year vehicle emission control program (2013 – 2017) initiated in Beijing is majorly targeted towards the promotion of new energy vehicles for public transportation (ex- taxis, buses, sanitation trucks, and postal vehicles among others). The advancements in battery technologies have also had positive impact on the upfront cost of new energy vehicles, fuelling its market adoption. All these factors are expected to collectively contribute towards a double digit compounded annual growth rate (CAGR) during the forecast period 2021 – 2029.

Report Scope

This report analyzes the China new energy vehicle taxi market in terms of ownership, distance range, and geography. On the basis of ownership, the China new energy vehicle taxi market is segmented into company-owned and privately-owned new energy vehicle taxis. Similarly, on the basis of distance range, the market is further classified into short range NEV taxis and long range NEV taxis.

1.1 Report Description

Purpose of the Report

The purpose of this strategic research study titled “China New Energy Vehicle Taxi - Growth, Share, Opportunities, and Competitive Analysis, 2021 – 2029” is to offer industry investors, company executives, and industry participants with in-depth insights to enable them make informed strategic decisions related to the opportunities in the China new energy vehicle taxi market.

Target Audience

USP and Key Offerings

The report titled “China New Energy Vehicle Taxi Market- Growth, Share, Opportunities, and Competitive Analysis, 2021 – 2029” offers strategic insights into the global China new energy vehicle taxi market along with the market size and estimates for the duration 2019 to 2029. The said research study covers in-depth analysis of multiple market segments based on ownership and distance range. In order to help strategic decision makers, the report also includes competitive profiling of the leading China new energy vehicle taxi manufacturers, their SCOT (Strength, Challenges, Opportunities, and Weaknesses) analysis, market positioning, and key developments. Other in-depth analysis provided in the report includes:

Overall, the research study provides a holistic view of the China new energy vehicle taxi market, offering market size and estimates for the period from 2019 to 2029, keeping in mind the above mentioned factors.

Based on distance covered in a single charge, the China new energy vehicle taxi market is classified into two major categories, namely-

Taxis that can travel distance between 80 kilometers to 150 kilometers in a single charge are covered under the short-range segment. Similarly, taxis capable of travelling distance in excess of 150 kilometers in a single charge are considered under the long-range segment.

In terms of revenue, short-range NEV taxis dominated the China new energy vehicle taxi market in 2020. The segment is presumed to witness comparatively slower growth during the forecast period 2021 - 2029. The slow growth in the short-range segment is expected to be offset by the growing demand in the long-range segment. On an average, public taxis in China travel around 400-450 kilometers per shift, which necessitates frequent (at least thrice per shift) charging in case of short range taxis. The limited charging infrastructure in the country means that the taxi drivers are required to wait for hours at charging stations, reducing their productivity. On the other hand, long range NEV taxis with more battery capacity enable taxi drivers to avoid frequent charging stops. Thus, the market for new energy vehicle taxis in China is expected to be shaped by the growing demand for long range NEV taxis.

Based on ownership, the new energy vehicle (NEV) taxi market in China is categorized into two major categories, namely Commercial

As of 2020, government-owned taxis led the China new energy vehicle (NEV) taxi market in terms of both revenue and volume. The segment accounted for over 85% of the China new energy vehicle (NEV) taxi market revenue in the same year. The dominance can be credited to the government’s plan to target government-owned taxi fleets in its initial phase of electric vehicle program. The segment is expected to exhibit steady growth during the forecast period 2021 - 2029. Growing preference for private taxi ownership due to the availability of private financing schemes is also expected to have positive impact on the overall market growth in the privately-owned segment.