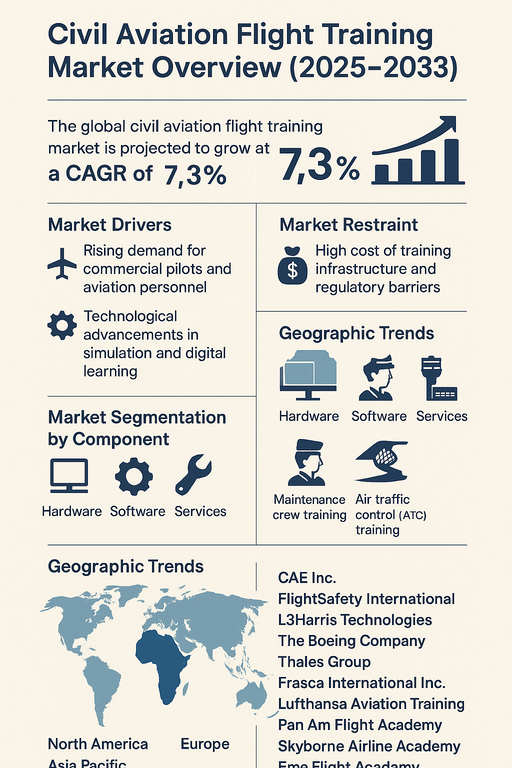

The global civil aviation flight training market is projected to grow at a CAGR of 7.3% from 2025 to 2033, driven by the steady recovery of global air travel, growing demand for skilled aviation professionals, and technological advancements in training systems. The industry is seeing increased investments in simulation-based training, remote learning platforms, and AI-powered performance analytics to ensure training continuity, regulatory compliance, and safety across the aviation value chain. As global air traffic rebounds and pilot shortages intensify, flight training organizations and aviation academies are scaling operations and modernizing curricula to address current and future demand.

Market Drivers

Rising Demand for Commercial Pilots and Aviation Personnel

With global passenger traffic expected to return to pre-pandemic levels by 2026, airlines are ramping up fleet expansion plans, resulting in a surge in demand for trained pilots, cabin crew, and maintenance professionals. The International Air Transport Association (IATA) and aircraft manufacturers such as Boeing and Airbus forecast the need for over 600,000 new pilots and thousands of aviation professionals by 2040. Training organizations are expanding capacity and upgrading simulators to meet this unprecedented demand while maintaining regulatory standards and quality assurance.

Technological Advancements in Simulation and Digital Learning

Technological innovations in flight simulation, virtual reality (VR), and AI-based assessment tools are transforming traditional aviation training models. Next-generation full-flight simulators (FFS), fixed-base simulators, and VR headsets provide realistic and cost-effective pilot and crew training experiences. Cloud-based learning management systems (LMS), remote instructor interfaces, and data-driven trainee monitoring allow flexible, scalable, and consistent training delivery. These tools help address global training bottlenecks while optimizing outcomes and reducing operational costs for training academies and airlines.

Market Restraint

High Cost of Training Infrastructure and Regulatory Barriers

The civil aviation flight training industry faces significant entry barriers due to the high capital investment required for simulators, training aircraft, and certified facilities. Moreover, the certification process for training centers and simulators is lengthy and varies by jurisdiction, often delaying capacity expansion. Smaller academies and regional players struggle with financial and compliance challenges, especially in developing economies. Additionally, access to qualified instructors and standardization of training across borders remain critical hurdles affecting training efficiency.

Market Segmentation by Component

By component, the market is segmented into Hardware, Software, and Services. In 2024, Hardware accounted for the largest share, driven by the widespread deployment of full-flight simulators, cockpit trainers, and maintenance training devices. Software including simulation platforms, learning management systems, and assessment tools is gaining traction due to its role in enabling remote and hybrid learning environments. The Services segment, comprising curriculum development, instructor training, and managed training programs, is expected to witness the fastest growth as airlines and training centers increasingly outsource training operations to third-party providers.

Market Segmentation by Training Type

The market is segmented into Pilot Training, Cabin Crew Training, Maintenance Crew Training, and Air Traffic Control (ATC) Training. Pilot Training remains the dominant segment, accounting for the majority of revenue due to its high complexity, duration, and simulator requirements. Cabin Crew Training is expanding with increasing emphasis on customer safety, crisis management, and multilingual communication. Maintenance Crew Training is becoming more sophisticated with the use of digital twins and augmented reality to train technicians on newer aircraft models. ATC Training is growing in importance with airspace modernization programs and regional infrastructure upgrades.

Geographic Trends

In 2024, North America held the largest market share due to the presence of leading training providers, established aviation infrastructure, and high fleet replacement rates. Europe followed, supported by strong regulatory frameworks, established aviation academies, and cross-border training collaborations. Asia Pacific is expected to register the highest CAGR between 2025 and 2033, led by rapid airline expansion, low-cost carrier growth, and government investments in pilot training infrastructure in India, China, and Southeast Asia. Latin America and the Middle East & Africa are emerging regions where increased air connectivity and aviation-focused economic development are creating opportunities for localized training hubs.

Competitive Trends

The civil aviation flight training market in 2024 featured a mix of global aerospace contractors, independent training providers, and aviation-focused academic institutions. CAE Inc. and FlightSafety International led the global market with full-service training portfolios covering pilots, maintenance, and cabin crew. L3Harris Technologies and Thales Group provided advanced simulation systems and defense-grade training solutions. The Boeing Company offered OEM-integrated training programs for its aircraft platforms. Independent academies such as Pan Am Flight Academy, Skyborne Airline Academy, and Epic Flight Academy served regional airline pipelines. University-affiliated institutions like Purdue University Aviation Program and specialized schools such as Spartan College of Aeronautics and Technology contributed to workforce development pipelines. Startups and tech providers like FLYIT Simulators, Revv Aviation, and Aero Cadet brought innovation in virtual and modular training models. Competitive strategies include hybrid training delivery, simulation-as-a-service (SaaS), global partnerships with airlines, and curriculum enhancements aligned with evolving aircraft technologies and aviation safety regulations.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Civil Aviation Flight Training market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Component

| |

Training Type

| |

Training Device

| |

Platform Type

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report