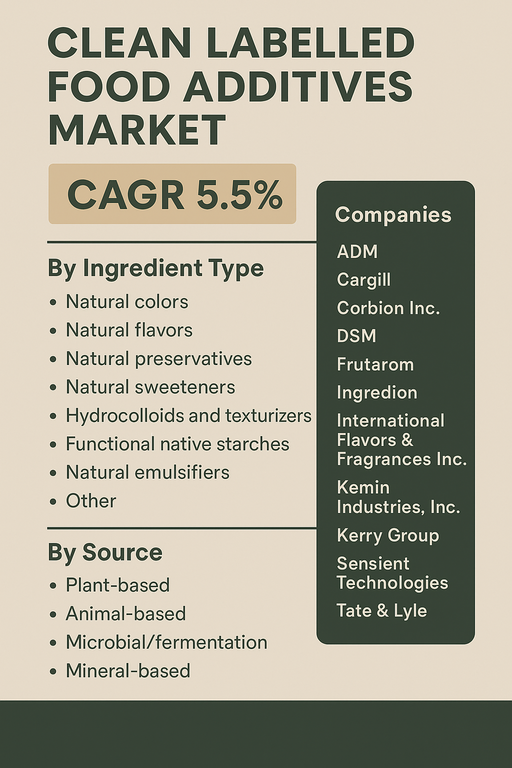

The global clean labelled food additives market is expected to grow at a CAGR of 5.5% from 2025 to 2033, driven by increasing consumer preference for natural, transparent, and minimally processed ingredients in packaged foods and beverages. Rising health consciousness, demand for label transparency, and growing scrutiny of synthetic ingredients are encouraging manufacturers to reformulate products with clean label additives. Clean labelled food additives refer to naturally derived substances used to enhance flavor, appearance, texture, preservation, and nutritional value while complying with clean label claims such as “free from artificial colors or preservatives,” “non-GMO,” and “organic.”

Growing Demand for Natural, Functional Ingredients

Consumers globally are seeking food products that align with wellness, sustainability, and minimal processing. This has led to the rapid adoption of natural additives such as plant-based colors, botanical extracts, fermentation-based preservatives, and alternative sweeteners. Manufacturers are replacing synthetic additives with recognizable, kitchen-cupboard ingredients to enhance brand trust and marketability. Clean labelled hydrocolloids, functional starches, and natural emulsifiers are increasingly used in dairy, bakery, meat, confectionery, and ready-to-eat (RTE) applications where clean labels serve as key purchase drivers.

Regulatory Support and Label Transparency Initiatives

Regulatory bodies in the U.S., EU, and APAC are tightening labeling norms and ingredient disclosures, encouraging clean label compliance. Initiatives such as EU’s “E-number” avoidance, U.S. FDA’s GRAS (Generally Recognized As Safe) classifications, and “free from” certifications (e.g., gluten-free, no MSG) are accelerating the reformulation trend. Major food brands are investing in transparent supply chains and clean label verification processes, while retailers are adopting private-label standards promoting clean and simple ingredients. As front-of-pack labeling gains traction, demand for plant-based, organic, and fermentation-derived additives is set to rise.

Market Challenges Related to Cost, Shelf Life, and Functionality

Despite growing interest, clean labelled additives present challenges in terms of formulation complexity, cost competitiveness, and shelf-life performance. Natural colors and flavors may be less stable under heat or light, requiring advanced microencapsulation or blending techniques. Clean label preservatives often have a narrower antimicrobial spectrum compared to synthetic options. Additionally, the availability and consistency of raw materials (especially plant-based or microbial sources) can affect scalability. Companies must balance clean label aspirations with sensory quality, food safety, and affordability to maintain consumer satisfaction.

Market Segmentation by Ingredient Type

By ingredient type, the market includes natural colors, natural flavors, natural preservatives, natural sweeteners, hydrocolloids and texturizers, functional native starches, natural emulsifiers, and others. In 2024, natural colors and flavors accounted for the largest share, particularly in beverages, confectionery, and dairy products. Hydrocolloids such as guar gum, pectin, and locust bean gum are seeing increased use in clean label texture and mouthfeel applications. Functional native starches are gaining popularity for viscosity and stabilization roles in clean label soups, sauces, and bakery items. Natural preservatives derived from rosemary, citrus, or fermentation are gaining regulatory favor across multiple markets.

Market Segmentation by Source

By source, clean labelled food additives are derived from plant-based, animal-based, microbial/fermentation, and mineral-based origins. Plant-based sources dominated the market in 2024 due to their widespread acceptance among vegan and vegetarian consumers and broad functional applications. Microbial and fermentation-derived additives such as enzymes, probiotics, and fermentation-based antimicrobials are rapidly gaining traction for their stability, label friendliness, and functional benefits. Animal-based additives (e.g., gelatin, collagen peptides) maintain niche uses in confectionery and dietary supplements. Mineral-based additives like calcium or magnesium salts are used in clean label fortification and pH balance solutions.

Regional Market Insights

North America led the clean labelled food additives market in 2024, supported by widespread clean eating trends, regulatory guidance on natural labeling, and large-scale reformulation across major food brands. Europe followed closely, with the UK, Germany, France, and the Nordics actively promoting natural additives and E-number reduction. Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2033, fueled by rising urban health awareness, regional clean label certification standards, and innovation in fermented and plant-derived ingredients across China, Japan, and India. Latin America and the Middle East & Africa are emerging markets, where clean label demand is expanding among urban and premium consumers, particularly in snacks, beverages, and dairy segments.

Competitive Landscape

The clean labelled food additives market in 2024 was dominated by ingredient giants and specialty food tech companies focused on natural and functional formulations. ADM, Cargill, and Tate & Lyle led in natural sweeteners, hydrocolloids, and plant-based starches. DSM, Kemin Industries, and Corbion Inc. developed advanced preservation systems and functional emulsifiers with clean label attributes. Ingredion, International Flavors & Fragrances Inc. (IFF), and Sensient Technologies invested heavily in plant-extracted colors and flavor systems. Frutarom and Kerry Group provided integrated clean label ingredient portfolios for food manufacturers across regions. Competitive focus areas include botanical sourcing, clean extraction technologies, cost optimization, and regional flavor customization. Mergers, partnerships, and clean label certification initiatives remain key strategies for differentiation.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Clean Labelled Food Additives market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Ingredient Type

| |

Source

| |

Form

| |

Certification

| |

End Use

| |

Functionality

| |

Consumer End

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report