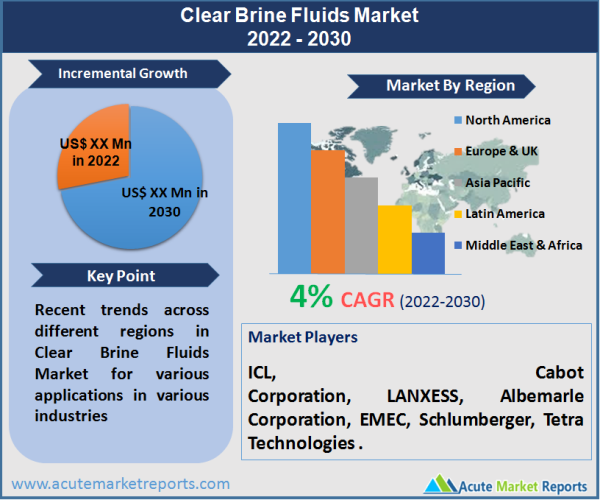

The global market for clear brine fluids is expected to grow at a CAGR of 4% during the forecast period of 2025 to 2033. Increasing product utilization in the oil and gas industry around the globe as a result of its acceptable physiochemical qualities is the primary factor that will lead to an increase in market share over the course of the anticipated timeframe. Because fossil fuels constitute the dominant source of energy, there has been an upward trend in the demand for energy in recent years, which has, in turn, increased the requirement for the production of oil and gas. The growth of the industry will be primarily driven by the proliferation of the oil and gas sector, together with an increase in the number of drilling rigs used for gas extraction. The production capacity of oil and gas manufacturers is being increased in order to meet the ever-increasing demand of consumers, which is expected to drive market share growth for clear brine fluids.

Demand for Crude Oil & Natural Gas Segment Serving as the Strongest Driver for Clear Brine Fluids Market

The primary element that is driving the utilization of clear brine fluids is the continuous growth in the worldwide demand for crude oil and natural gas. In both established and emerging economies, the primary source of energy is crude oil, specifically products derived from crude oil such as gasoline, diesel fuel, and natural gas. Therefore, the entire oil and gas business, beginning with upstream operations, is essential for economies all over the world that are both emerging and already developed. The search for new oilfields and natural gas deposits is an ongoing process that always results in the discovery of new oilfields. After the completion of the geographical survey on these fields, they are then prepared for drilling and any other activities linked to the production process. As a result, during the period covered by this projection, demand for clear brine fluids is anticipated to be driven primarily by the building of new onshore and offshore wells in the regions of Asia-Pacific and the Middle East. Additionally, the utilization of clear brine fluids is essential for the reduction of operational costs and the enhancement of oilfield production. Clear brine fluids are utilized in the drilling process, as well as in the completion of wells and workover operations. The growth of the clear brine fluids market is driven by all of the aforementioned reasons, which in turn leads to an expansion of the clear brine fluids market.

Transition in Energy Segment to Renewable Sources is to be the Most Significant Restraint

The oil and gas business faces a significant challenge from the growing attention paid to alternative energy sources like solar and wind power. For instance, Europe has been an active seeker of alternate forms of energy generation, and countries within the European Union (EU), such as Germany and France, are transitioning toward energy produced from solar, wind, and tidal energy sources. This has resulted in a decrease in the consumption of both petroleum and natural gas. As a result of this transition toward the generation of renewable energy by nations, it is anticipated that the demand for oilfield chemicals will decrease over the course of the projection period. During the time frame covered by the forecast, it is anticipated that this factor would serve as a barrier for buyers in the global market for clear brine fluids.

The Potassium Chloride Brine Fluids Products Segment Promising Opportunities During the Forecast Period

During the final stage of the extraction process, fluids containing potassium chloride brine are utilized for the purpose of stabilizing water-sensitive clays. It is the clear brine fluid that is utilized the most in a variety of end-use industries because it aids in managing the formation damage and pressure in reservoirs during the extraction process. Between the years 2025 and 2033, it is anticipated that the market for potassium chloride brine fluids would develop at a compound annual growth rate (CAGR) of 4.5%.

In the years to come, it is anticipated that the calcium chloride brine fluids products market would have the second fastest growth overall. Because calcium chloride brine fluids only contain a single salt, they are an efficient component that may be utilized in the process of producing brine completion and workover fluids. As a result of the rising demand for calcium chloride brine fluids in the oil and gas industry to avoid clay hydration during drilling, it is anticipated that this particular product segment will expand at a consistent rate over the course of the next several years.

Onshore Oil & Gas Production Remains as the Key End User

More than 70% of the world's crude oil comes from onshore oilfields, and the market for clear brine fluids was led by the onshore oil and gas production segment. This segment accounted for the biggest revenue share in the overall market in 2021. With a compound annual growth rate of 4.1 percent, the offshore oil and gas production market is the one that is expanding at the quickest rate.

Middle East & Africa Remain as Global Leaders

In 2021, the Middle East led the market in terms of revenue, with more than 30% of the market share. Onshore and offshore oil drilling activities are expected to be driven forward by a combination of factors, including a rise in the demand for energy and steps supported by the government to reduce reliance on oil imports. On the other hand, stringent regulations on oil pollution are anticipated to have an effect on the need for effective hydrocarbon exploration and production formulas in the relatively near future.

The oil and gas sector throughout the world places a significant emphasis on the Middle East and Africa as the most important locations. Now, drillers from this region are capable of drilling distinct, multiple, pressure-isolated, and accessible laterals from any single initial wellbore with the same level of proficiency as before. As a result, this will result in expanded growth opportunities for the completion and drilling fluids industry.

The major contributors to the oil and gas industry on the African continent are the countries of Nigeria, Angola, Kenya, and Mozambique. Despite this, the oil and gas business in Africa has been experiencing a decreasing trend, and players in the industry have shifted their focus to geologies that provide more promising returns with more appealing fiscal terms.

The economy of Saudi Arabia is heavily dependent on oil, and the government has tight control over most of the country's key economic operations. The nation is one of the main producers of oil and gas and is estimated to contain around 17 percent of the world's proven oil reserves. This is true despite the fact that prices have dropped. Even during the most recent oil crisis, Saudi Aramco, a significant player in the market, managed to keep 220 rings operational. The corporation has increased the number of funds coming from its own resources for ongoing investments by capitalizing on the low manufacturing costs.

There has been a significant increase in the amount of crude oil and natural gas that was produced in North America. This increase in the number of drilling operations in North America has had a significant impact on the demand for clear brine fluids. There is a possibility that high oilfield chemicals sector penetration is to blame for rising oil and natural gas production in the region, in addition to major oilfield development, particularly in the tight oil deposits of the United States and Canada. The growth of the market for clear brine fluids is anticipated to be driven by a variety of factors over the course of the forecast period. Some of these factors include the shale boom, an increase in offshore drilling operations in the Gulf of Mexico, and the need to investigate potential undiscovered oil and gas reserves.

Significant oilfield development in Texas, the Gulf of Mexico, and North Dakota, together with government laws that are favorable to the development of unconventional hydrocarbon resources, is likely to significantly promote sector expansion. In light of the obvious drawing as a result of the importance that fluids play in today's drilling technology, the market for brine solutions has been experiencing consistent expansion in the drilling operations and basins of the United States.

In terms of consumption volume, it is anticipated that the Asia Pacific area will experience the greatest rate of growth during the forecast period of 2025 to 2033. It may be said that China, India, and Indonesia dominate the regional petroleum business in practically every facet. In addition, it is projected that some forthcoming innovations will have important strategic and commercial repercussions for the market for E&P operations, goods, and equipment.

Large, established oil fields may be found mostly in China's northern region, which accounts for the country's lion's share of the nation's total oil production. The Daqing field, operated by PetroChina, is one of the largest oil-producing oilfields in China and is situated in the north-eastern region of the country. Other significant oilfields in the country include the Shengli field owned by Sinopec and the Changqing field owned by PetroChina. The provinces in China's interior, particularly those in the country's north, center, and northwest, are home to the country's gas fields. Large gas fields that aren't related to each other are the primary component of the Sichuan Basin, which is one of the other important gas-producing regions in the country and is known as the Sichuan Basin. The ChangqingSulige gas field, which belongs to PetroChina, is the most important gas field in China. It is anticipated that these oilfield activities will lend support to the clear brine fluids market in China.

It is anticipated that Asia-Pacific will expand at the highest compound annual growth rate of 4.5%. During the time period covered by the forecast, the demand for drilling and completion fluids will be driven by the discovery of new oil and gas in countries such as India, China, Vietnam, Indonesia, and Thailand.

Consolidated Market Characterized by Fierce Competition

The market is competitive with respect to products and technologies offered in the market. Some of the strategies that players in the business have implemented to enhance their market penetration include developing new products, forming partnerships and collaborations, and participating in joint ventures. Product quality, the reputation of the brand, reasonable prices, and an effective distribution network are some of the most important aspects of competition. The most important players have already implemented sustainable solutions, taking into account the benefits that would accrue over the long run and the ease with which raw materials may be obtained. The idea of placing operations in close proximity to raw material sources or chemical hubs and using methods that are authenticity certified for incoming raw materials is becoming increasingly popular among businesses. ICL, Cabot Corporation, LANXESS, Albemarle Corporation, EMEC, Schlumberger, and Tetra Technologies are only a few of the well-known companies that fall under the category of major vendors.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Clear Brine Fluids market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

End User

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report