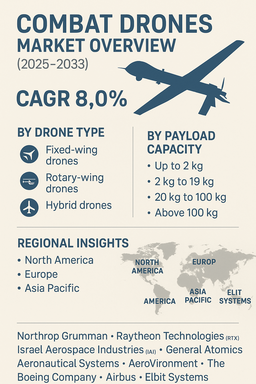

The global combat drones market is projected to grow at a CAGR of 8.0% from 2025 to 2033, driven by rising defense modernization programs, increasing geopolitical tensions, and growing reliance on unmanned aerial systems (UAS) for intelligence, surveillance, reconnaissance, and offensive operations. Combat drones provide advanced capabilities for precision strikes, tactical battlefield support, and long-endurance missions, reducing the risks associated with manned operations. The integration of artificial intelligence, advanced payloads, and autonomous navigation is further enhancing drone efficiency, accuracy, and operational flexibility, making them a critical element of modern military strategies.

Rising Demand for Unmanned Combat Systems

Military organizations worldwide are rapidly adopting combat drones to expand their capabilities in surveillance, target acquisition, and strike missions. Drones provide real-time data and offensive power with reduced personnel risks, making them invaluable for high-risk missions. The demand for drones capable of carrying diverse payloads, including missiles, electronic warfare systems, and intelligence-gathering equipment, is expanding as defense agencies prioritize versatile and multi-role platforms. The ongoing shift towards network-centric warfare and integration of drones with command-and-control systems is further accelerating global adoption.

Challenges: Regulations and Cost Constraints

Despite promising growth, the combat drone market faces challenges such as stringent regulatory frameworks governing unmanned aerial vehicles, especially in international operations. Export restrictions, varying national policies, and ethical concerns about autonomous weapons create hurdles for deployment and trade. High costs associated with advanced drones, particularly those with heavy payload capacity and AI-enabled systems, also limit procurement in budget-constrained defense sectors. However, increasing government funding, technological advancements, and collaborations between defense contractors and startups are expected to gradually address these challenges.

Market Segmentation by Drone Type

By drone type, fixed-wing drones dominate the market due to their long-endurance capabilities, higher payload capacity, and suitability for strategic and tactical missions. Rotary-wing drones are gaining traction for their maneuverability, vertical takeoff and landing (VTOL) capabilities, and effectiveness in close-range and urban combat operations. Hybrid drones are emerging as a growing category, combining endurance with flexibility, making them increasingly relevant for diverse battlefield environments.

Market Segmentation by Payload Capacity

By payload capacity, drones carrying up to 2 kg are mainly used for lightweight surveillance and tactical applications. The 2 kg to 19 kg segment is expanding due to increased demand for medium-payload systems that balance affordability and versatility. Drones in the 20 kg to 100 kg range play a crucial role in delivering weapons and advanced electronic payloads for combat missions. Above 100 kg, heavy combat drones represent a significant market share among leading militaries, supporting long-range strikes, sustained surveillance, and advanced mission capabilities.

Regional Insights

In 2024, North America led the combat drones market, supported by extensive investments from the U.S. Department of Defense and strong R&D pipelines from leading defense contractors. Europe followed, with countries such as the UK, France, and Germany adopting drones as part of their defense modernization strategies. Asia Pacific is the fastest-growing region, driven by rising defense spending in China, India, and Japan, alongside geopolitical tensions and territorial disputes. The Middle East also represents a significant growth hub, with countries such as Israel, Saudi Arabia, and the UAE investing heavily in combat drones for both defensive and offensive operations. Latin America and Africa remain emerging markets where governments are gradually adopting unmanned systems to strengthen surveillance and border security.

Competitive Landscape

The 2024 combat drones market was dominated by leading defense contractors and aerospace companies. Northrop Grumman, Raytheon Technologies (RTX), and General Atomics Aeronautical Systems maintained strong positions with extensive portfolios of combat and reconnaissance drones. Israel Aerospace Industries (IAI) and Elbit Systems continued to lead in innovative drone designs and exports, leveraging Israel’s strong reputation in UAV technology. AeroVironment focused on smaller tactical drones, while The Boeing Company and Airbus strengthened their presence in advanced combat and surveillance drone programs. Leonardo expanded its offerings through European defense collaborations. Competitive differentiation is increasingly being defined by endurance, payload diversity, AI integration, stealth features, and autonomous mission capabilities, shaping the future landscape of unmanned combat systems.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Combat Drones market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Drone Type

| |

|

Drone Type | |

Payload Capacity

| |

Power Source

| |

Technology

| |

|

Technology | |

Application

| |

Launching Mode

| |

End Use Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report