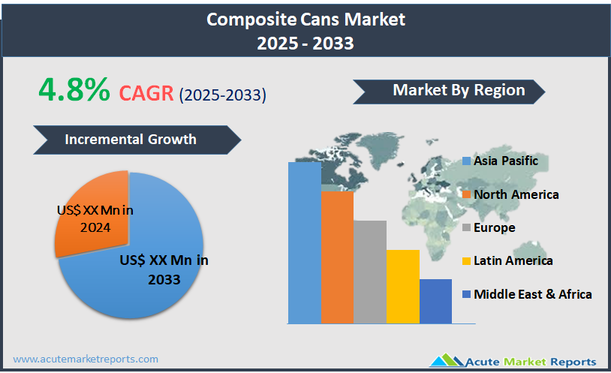

The composite cans market encompasses the production and distribution of cylindrical paper tubes that are made from a combination of paperboard, aluminum, and plastic layers. These cans are used primarily for packaging a variety of products, including dry and granular materials such as spices, nuts, tea, and coffee, as well as non-food items like detergents and industrial adhesives. Composite cans are favored for their light weight, robustness, and barrier properties that protect contents from moisture, air, and light. The design of these cans often includes a resealable lid, making them a practical choice for products requiring extended shelf life after opening. The composite cans market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.8%, driven by increasing consumer demand for convenient, sustainable packaging solutions.

Growing Demand for Sustainable and Eco-Friendly Packaging

A major driver for the composite cans market is the increasing global demand for sustainable and eco-friendly packaging solutions. Consumers and brands alike are becoming more conscious of environmental impacts associated with packaging waste, particularly from plastic and non-recyclable materials. Composite cans, typically made from paperboard and other recyclable components, offer a lower environmental footprint compared to traditional plastic or metal containers. They are easily recyclable and often biodegradable, aligning with government regulations and corporate sustainability goals aimed at reducing single-use plastics and promoting circular economy practices. Brands across food and beverage, personal care, and household product sectors are adopting composite cans to enhance their green credentials and appeal to environmentally aware consumers. Additionally, composite cans are lightweight, reducing transportation emissions and overall supply chain carbon footprint, which is another attractive feature driving their adoption across industries.

Rising Customization and Branding Opportunities

An important opportunity in the composite cans market lies in the growing trend toward packaging customization and premium branding. Composite cans offer excellent printability and design flexibility, enabling companies to create visually appealing packaging that stands out on retail shelves. As competition intensifies across retail sectors, brands are leveraging innovative packaging designs to attract and retain customers. Composite cans can be easily customized in terms of size, shape, finish, and closure mechanisms, offering marketers a powerful tool for brand differentiation and consumer engagement. Moreover, with the rising trend of personalized and limited-edition products, composite cans provide an ideal medium for creative and seasonal packaging campaigns, further strengthening brand loyalty and market penetration. The ability to offer premium-looking packaging at a cost-effective rate positions composite cans as a strategic choice for companies aiming to combine aesthetics, functionality, and sustainability.

Fluctuating Raw Material Prices

A significant restraint in the composite cans market is the volatility in the prices of raw materials such as paperboard, adhesives, and aluminum foil. These materials are critical to the structure and performance of composite cans, and any fluctuations in their costs directly impact the overall production expenses. Global supply chain disruptions, environmental regulations on raw material sourcing, and changes in demand dynamics can cause price instability, leading to unpredictable manufacturing costs. Smaller manufacturers, in particular, may find it challenging to absorb these fluctuations without passing on the costs to consumers, potentially impacting the affordability and competitiveness of composite cans. Additionally, the increasing demand for sustainable raw materials may further strain supply chains and contribute to pricing pressures, making cost management a persistent challenge for companies operating in the composite cans market.

Technical Challenges in Barrier Properties

A primary challenge faced by the composite cans market is achieving optimal barrier properties to protect contents from moisture, oxygen, and light without compromising the recyclability and sustainability of the packaging. While composite cans offer good basic protection, certain highly sensitive products such as dairy powders, nutraceuticals, and premium teas require superior barrier performance traditionally provided by multilayer plastics or metals. Enhancing the barrier properties of composite cans often requires additional layers or coatings, which can complicate the recycling process and increase production costs. Balancing the need for effective protection with the demands for environmental responsibility and manufacturing efficiency remains a complex technical challenge. Innovations are ongoing to develop biodegradable barrier coatings and improved material blends, but until such solutions become commercially viable at scale, this remains a critical limitation for expanding the use of composite cans into more sensitive product categories.

Market Segmentation by Can Diameter

In the composite cans market, the 50 mm-100 mm diameter segment recorded the highest revenue in 2024 and is also projected to achieve the highest CAGR from 2025 to 2033. This segment is favored due to its versatility across a wide range of applications, particularly in the food and beverage industry, where products like snacks, powdered drinks, confectioneries, and tea commonly utilize this size for optimal consumer convenience and shelf efficiency. The medium diameter provides an ideal balance between portability and storage capacity, making it a preferred choice for brands seeking practical yet attractive packaging solutions. Less than 50 mm diameter cans, although important for packaging small items such as spices, mints, and specialty cosmetic products, represent a smaller revenue share and a slower growth rate, primarily because their limited volume restricts broader application across multiple industries. Meanwhile, the above 100 mm diameter segment caters to niche markets including bulk food packaging, industrial goods, and specialty products like promotional gift sets, contributing a modest share but showing stable growth due to the specific storage needs of large-volume items. However, the production costs associated with larger diameters and relatively lower demand compared to mid-sized cans limit the faster expansion of this segment, making 50 mm-100 mm the core growth driver for the overall market.

Market Segmentation by Closure Type

Segmenting by closure type, Lids dominated the composite cans market with the highest revenue in 2024 and are forecasted to exhibit the highest CAGR from 2025 to 2033. Lids, often made from plastic, metal, or composite materials, are widely preferred due to their resealability, ease of use, and better protection of product freshness and quality after the initial opening. Their enhanced functionality supports consumer trends favoring convenience and multi-use packaging, especially for food, pet food, personal care, and household product applications. As consumers increasingly seek packaging that enables resealing for prolonged product use, lids provide an added value proposition that manufacturers leverage for brand differentiation. Caps, although still significant in the market, are generally utilized for specific product types where a simple opening mechanism is sufficient, such as powdered nutritional supplements and specialty oils. Caps often appeal to products requiring controlled dispensing but lack the broader resealability advantage of lids, limiting their expansion compared to the latter. With technological improvements leading to the development of innovative and sustainable lid designs, and the growing demand for user-friendly, protective packaging across various industries, the lid segment is expected to drive much of the market's future growth, offering manufacturers new opportunities to enhance functionality while maintaining a sustainable packaging footprint.

Geographic Segment

In 2024, Europe dominated the composite cans market in terms of highest revenue owing to its strong emphasis on sustainable packaging solutions, stringent environmental regulations, and high consumer awareness regarding eco-friendly alternatives. Countries like Germany, the United Kingdom, France, and Italy have been at the forefront of adopting recyclable and biodegradable packaging, which significantly boosted the demand for composite cans across multiple industries such as food and beverage, personal care, and household products. Meanwhile, the Asia Pacific region is projected to record the highest CAGR from 2025 to 2033, driven by rapid industrialization, expanding middle-class population, rising disposable incomes, and growing demand for convenient, attractive, and sustainable packaging formats in countries such as China, India, Japan, and Australia. The growing preference for Western-style packaged foods and beverages, coupled with the strengthening presence of global brands in the region, is expected to fuel substantial demand for composite cans. North America held a substantial share of the global market in 2024, benefiting from robust food processing and consumer goods industries, along with increasing investment in innovative, sustainable packaging solutions. However, growth in North America is expected to be moderate compared to the dynamic expansion anticipated in Asia Pacific. Latin America and the Middle East & Africa showed emerging potential but accounted for smaller revenue shares, with market growth expected to pick up pace gradually over the forecast period as awareness of sustainable packaging trends continues to rise.

Competitive Trends and Key Strategies

In 2024, the competitive landscape of the composite cans market was characterized by active participation from key players such as Smurfit Kappa Group plc, Mondi Group, Sonoco Products Company, Ace Paper Tube, Irwin Packaging Pty Limited, Halaspack Packaging Bt., Nagel Paper, Corex Group, Quality Container Company, Hangzhou Qunle Packaging Co., Ltd., PTS Manufacturing Co. Ltd., Heartland Products Group, LLC, Bharath Paper Conversions, CANFAB PACKAGING INC., and Shetron Group. These companies focused on strengthening their market positions through a combination of capacity expansions, mergers and acquisitions, product innovations, and regional diversification strategies. Smurfit Kappa Group plc and Mondi Group emphasized developing sustainable, fully recyclable composite cans by investing heavily in R&D and offering customized, innovative packaging solutions to meet brand-specific needs. Sonoco Products Company maintained its leadership through strategic acquisitions and by expanding its presence in emerging markets, particularly in Asia Pacific. Corex Group and Halaspack Packaging Bt. concentrated on enhancing manufacturing capabilities to provide cost-effective, high-quality composite cans to a broader customer base. Smaller players such as Quality Container Company and PTS Manufacturing Co. Ltd. focused on niche markets, offering tailor-made solutions for premium brands requiring unique design flexibility. From 2025 to 2033, key players are expected to continue prioritizing sustainability by introducing composite cans with improved barrier properties using biodegradable and renewable materials. Companies will likely invest in smart packaging innovations, such as QR codes and tamper-evident features, to meet evolving consumer expectations. Expansion into high-growth regions like Asia Pacific and Latin America will remain a key strategy, alongside collaborations with food and beverage brands aiming to enhance their green packaging initiatives. Competitive intensity is expected to rise as new entrants offer disruptive sustainable packaging technologies, prompting existing players to accelerate innovation cycles and operational efficiency to retain market share.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Composite Cans market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Can Diameter

| |

Closure Type

| |

Production Type

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report