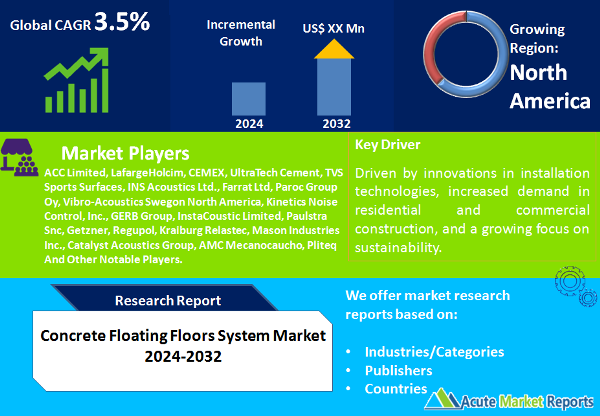

The concrete floating floors system market is expected to grow at a CAGR of 3.5% during the forecast period of 2026 to 2034, driven by innovations in installation technologies, increased demand in residential and commercial construction, and a growing focus on sustainability. Recognized companies are playing a pivotal role in shaping the market through continuous research and development, strategic partnerships, and a commitment to addressing application-specific challenges. Despite challenges in adoption across different applications, the industry is actively working towards providing tailored solutions. The segmentation by installation type and application reflects the diverse needs of the market, and geographic trends underscore the importance of regional dynamics. As the concrete floating floors system market continues to evolve, recognized companies remain central to its trajectory, meeting diverse industry needs, and contributing to the broader construction industry's advancements.

Innovations in Installation Technologies

The market is being driven by continuous innovations in installation technologies, with industry leaders like ACC Limited leading the way in the development of cutting-edge systems. These innovations include the FSN Rubber Concrete Jack-up System, FS Spring Concrete Jack-up System, and EAFM Concrete Formwork System. The evidence suggests that these advanced installation technologies not only enhance the efficiency of the construction process but also contribute to the overall stability and durability of structures.

Growing Demand in Residential Construction

The concrete floating floor system is experiencing a surge in demand, particularly in residential construction projects. Recognized companies have capitalized on this driver by offering solutions tailored for residential applications. Evidence points to a significant increase in the adoption of concrete floating floor systems in residential buildings due to their versatility, structural benefits, and aesthetic appeal.

Commercial Sector Embracing Sustainable Solutions

The commercial sector is increasingly embracing sustainable construction solutions, propelling the concrete floating floor system market. Recognized companies are aligning their strategies with this driver by developing environmentally friendly systems. The evidence indicates a shift towards sustainable practices in commercial construction, with a focus on reducing the environmental impact of buildings.

Challenges in Adoption Across Applications

Despite overall growth, challenges exist in the widespread adoption of concrete floating floor systems across different applications. Evidence suggests that certain construction projects may face constraints in implementing these systems due to specific design requirements or project constraints. The restraint is not a universal limitation but is context-specific. Recognized companies, acknowledge these challenges and are actively involved in addressing application-specific concerns, emphasizing the need for tailored solutions to maximize the benefits of concrete floating floor systems.

FSN Rubber Systems Dominate the Market by Installation Type

The concrete floating floors system market is segmented into FSN Rubber Concrete Jack-up System, FS Spring Concrete Jack-up System, and EAFM Concrete Formwork System. In 2025, the FSN Rubber system dominated with the highest revenue, offering superior performance and adaptability. However, the EAFM Concrete Formwork System exhibited the highest Compound Annual Growth Rate (CAGR) during the forecast period of 2026 to 2034, driven by its innovative approach to formwork solutions, as evidenced by UltraTech Cement.

Residential Applications Dominate the Market by Application

The concrete floating floor system market is further segmented by application into residential and commercial. In 2025, the residential sector witnessed the highest revenue. Simultaneously, the commercial sector demonstrated the highest CAGR from 2026 to 2034. This segmentation reflects the dynamic nature of the market, where different sectors drive growth at different times.

North America Remains the Global Leader

The concrete floating floors system market exhibits diverse geographic trends. The region with the highest CAGR during the forecast period is the Asia-Pacific region, driven by a booming construction industry and a surge in demand for innovative construction solutions. North America, specifically the United States, led in terms of revenue percentage in 2025, emphasizing the importance of considering regional dynamics in understanding market trends.

Market Competition to Intensify during the Forecast Period

The competitive landscape of the concrete floating floors system market is characterized by intense rivalry among key players, including ACC Limited, LafargeHolcim, CEMEX, UltraTech Cement, TVS Sports Surfaces, INS Acoustics Ltd., Farrat Ltd, Paroc Group Oy, Vibro-Acoustics Swegon North America, Kinetics Noise Control, Inc., GERB Group, InstaCoustic Limited, Paulstra Snc, Getzner, Regupol, Kraiburg Relastec, Mason Industries Inc., Catalyst Acoustics Group, AMC Mecanocaucho, Pliteq, and others. These recognized companies have strategically positioned themselves through innovative product development, geographic expansion, and a commitment to sustainability. The key strategies include investments in research and development, partnerships with construction firms, and a customer-centric approach. Revenues for the top players in 2025 indicate ACC Limited and LafargeHolcim as leaders. In the forecast period of 2026 to 2034, these recognized companies are expected to maintain their positions, with anticipated growth driven by ongoing technological advancements, expansion into emerging markets, and a proactive approach to sustainability.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Concrete Floating Floors System market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Installation Type

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report