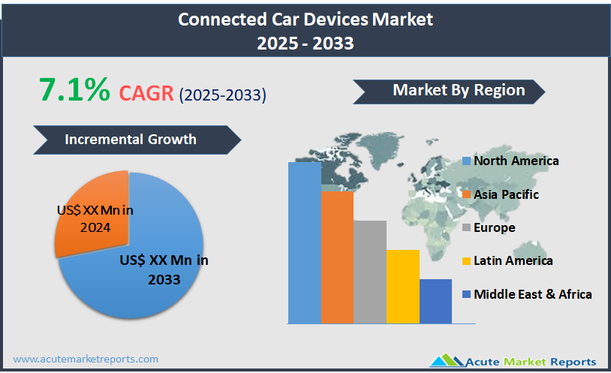

The connected car devices market encompasses all devices and technologies that enable vehicles to connect with various external networks and services. These devices enhance the functionality of a car by integrating it with the internet, allowing for features such as real-time navigation, remote diagnostics, on-board entertainment, enhanced safety features, and autonomous driving capabilities. This market includes both built-in solutions that are pre-installed into vehicles and aftermarket devices that can be added to enhance existing vehicles. The connected car devices market is witnessing rapid growth, driven by advancements in automotive technology and increasing consumer demand for safer, more efficient, and more connected driving experiences. As connectivity solutions become more sophisticated, incorporating features like LTE, Wi-Fi, Bluetooth, and 5G, the utility and appeal of connected car devices continue to expand. Considering a compound annual growth rate (CAGR) of 7.1%, the market is projected to grow significantly from 2025 to 2033. This growth is fueled by the automotive industry's shift towards digitalization, with manufacturers and consumers alike prioritizing technological enhancements that improve vehicle safety, navigation, and maintenance through seamless connectivity. The integration of these technologies is not only enhancing the user experience but also paving the way for future developments in autonomous driving.

Increasing Demand for Enhanced Vehicle Safety and Security

The demand for enhanced vehicle safety and security is a significant driver in the connected car devices market. As road safety concerns continue to rise globally, consumers are increasingly seeking advanced safety features such as automatic emergency braking, electronic stability control, and collision detection systems that connected car technologies can provide. Governments and regulatory bodies are also supporting this trend by mandating the inclusion of advanced safety systems in new vehicles. For instance, the European Union has introduced regulations that require all new cars to be equipped with eCall systems that automatically dial emergency services in the event of a serious accident. This growing emphasis on safety is not only a response to consumer demand but also aligns with global efforts to reduce traffic accidents and fatalities, thus driving the adoption of connected car devices that enhance vehicle safety and security features.

Advancements in Autonomous Driving Technologies

The rapid advancements in autonomous driving technologies present a significant opportunity for the connected car devices market. As automotive companies and tech giants invest heavily in developing self-driving vehicles, the need for sophisticated connected devices that facilitate autonomous operations is escalating. These technologies rely on seamless vehicle-to-vehicle (V2V) and vehicle-to-infrastructure (V2I) communications, which are enabled by connected car devices. The progression towards fully autonomous vehicles is expected to boost the demand for high-performance sensors, AI algorithms, and onboard computing systems, thereby opening new growth avenues for market players. The integration of these technologies into mainstream vehicles over the next decade is anticipated to transform the automotive landscape, enhancing the driving experience and increasing the market penetration of connected car devices.

High Cost of Implementation and Maintenance

A major restraint facing the connected car devices market is the high cost associated with the implementation and maintenance of these technologies. The integration of advanced connectivity and sensor technologies significantly increases the overall cost of vehicles, which can limit market growth, particularly in developing regions where cost sensitivity is higher. Additionally, the maintenance and updating of connected car systems require continuous investment, which can be a financial burden for consumers. This cost factor can deter potential buyers, especially when the economic benefits of investing in connected car technologies are not immediately apparent or understood. Moreover, the need for specialized services and updates to keep these systems running efficiently adds to the total cost of ownership, potentially slowing down the adoption rates of connected car devices.

Data Privacy and Security Concerns

A critical challenge in the connected car devices market is addressing data privacy and security concerns. As vehicles become increasingly connected, they generate and store vast amounts of data related to user behavior, location, and vehicle usage patterns. This data is invaluable for improving vehicle functionalities and user experience but also poses significant privacy risks if not properly managed. Consumers are becoming more aware of these risks and are often hesitant to adopt connected car technologies that could compromise their personal information. Furthermore, the potential for hacking and unauthorized access to vehicle systems is a serious concern that manufacturers must address. Ensuring robust cybersecurity measures are in place and transparently communicating these protections to consumers is crucial for overcoming this challenge and fostering trust in connected car technologies.

Market Segmentation by Technology

In the connected car devices market, the technology segment is divided into Advanced Driver Assistance Systems (ADAS), Telematics, and Others, which includes IoT, AI, and Cloud platforms. ADAS is currently the leading segment in terms of revenue, driven by widespread adoption due to its direct impact on improving vehicle safety and driving efficiency. Systems like emergency braking, lane-keeping assistance, and adaptive cruise control are becoming standard in new vehicles, supported by regulatory mandates in several regions that bolster their implementation. On the other hand, Telematics is projected to exhibit the highest CAGR from 2025 to 2033. This surge is attributed to its critical role in transforming vehicle dynamics through real-time monitoring, fleet management, and enhanced navigation solutions that contribute to more efficient vehicle operations. The expansion of IoT and AI technologies within the market is also notable, as these technologies enhance vehicle connectivity and automation, contributing to the evolution of smarter, more interactive vehicles.

Market Segmentation by Communication

Regarding communication types within the connected car devices market, the segments include Vehicle to Vehicle (V2V), Vehicle to Infrastructure (V2I), and Vehicle to Everything (V2X). V2V communication currently accounts for the highest revenue, with its ability to enhance road safety by allowing vehicles to communicate their position, speed, and direction with each other, thereby preventing accidents and improving traffic flow. However, V2X is expected to witness the highest CAGR over the forecast period. This growth is driven by its comprehensive connectivity scope, which includes V2V and V2I, and extends to communication with pedestrians and network grids, facilitating broader integration of vehicles into the overall transportation ecosystem. V2X technology is pivotal in advancing toward fully autonomous driving and smart city development, as it enables more efficient, safe, and coordinated vehicle operations across diverse environments. This technology's adoption is likely to accelerate with advancements in 5G networks, which significantly enhance the reliability and speed of vehicle communications.

Geographic Segment

The connected car devices market shows distinct geographic trends, with North America historically generating the highest revenue due to advanced technological infrastructure, high consumer adoption rates, and supportive regulatory frameworks that encourage the deployment of connected vehicle technologies. Europe follows closely, with stringent safety regulations and a strong automotive industry driving the adoption of connected car devices. However, the Asia Pacific region is expected to exhibit the highest CAGR from 2025 to 2033, fueled by rapid urbanization, increasing investments in automotive technology, and expanding consumer electronics industries in countries like China, Japan, and South Korea. The growing middle-class population and increasing disposable incomes in this region are also critical factors contributing to the accelerated market growth, as they lead to higher demand for vehicles equipped with advanced connectivity features.

Competitive Trends

In 2024, major players in the connected car devices market included Robert Bosch GmbH, ZF Friedrichshafen AG, Continental AG, Autoliv Inc., Faurecia, Delphi Technologies PLC, Azcom, DENSO Corporation, Valeo SA, Harman International Industries Inc., TE Connectivity, and WiTricity Corporation. These companies dominated the market by leveraging their R&D capabilities, broad product portfolios, and strong global distribution networks. Bosch, Continental, and DENSO were particularly noted for their innovations in ADAS and telematics systems, which contributed significantly to their revenues in 2024. Moving forward, from 2025 to 2033, these companies are expected to focus on expanding their technological capabilities in V2X and autonomous driving solutions to maintain a competitive edge. Strategies such as mergers and acquisitions, collaborations with technology companies, and partnerships with automotive manufacturers are anticipated to be prevalent as companies aim to enhance their product offerings and expand their market reach. The integration of AI and IoT technologies is also expected to be a key strategy, enabling these companies to offer more personalized and predictive connectivity solutions in vehicles. This strategic focus is likely to address the evolving consumer demands and regulatory requirements, ensuring sustained growth in the global market.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Connected Car Devices market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Technology

| |

Communication

| |

Connectivity

| |

Car Type

| |

Propulsion

| |

Sales Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report