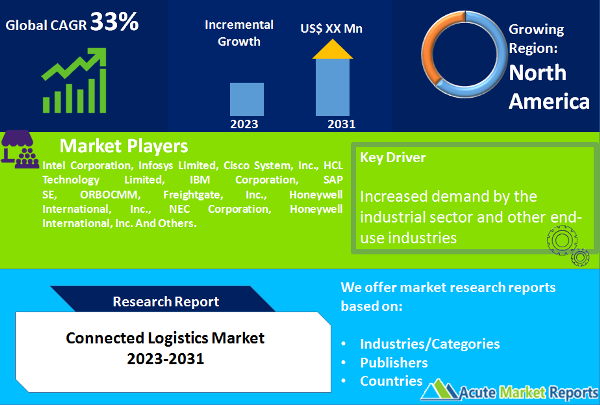

The connected logistics market is projected to develop at a CAGR of 33% during the forecast period of 2026 to 2034. Connected logistics is a combination of interdependent communication devices, joints, and Internet of Things (IoT) technologies that transform critical logistical operations to be more customer-centric by sharing data, information, and facts with supply chain partners. The market for connected logistics is still in its infancy and can be defined as interconnected devices that logistics and IoT solution providers use to gain greater visibility within the warehouse, transportation, and related logistics processes, including order processing, financial transactions, shipping, and dispatching & picking. Identifying the major bottlenecks, enables more effective business decisions and facilitates essential decision-making.

Increasing Adoption of IoT-Enabled Connected Devices to Drive Market Expansion

The rising cost of energy and related environmental concerns, such as carbon emissions and pollution, encourage the transition from conventional transportation techniques to IoT-enabled, linked logistics solutions. Utilizing sensors, cloud technologies, and Internet of Things connectivity, they remotely manage, monitor, and control supply chain processes. The implementation of IoT has increased the efficiency of the logistics and transportation industry's supply chain platform. It delivers total network visibility and speedier network problem detection, enabling effective and prompt decision-making. Enhanced supply chain visibility also results in long-term cost reductions. Consequently, the need for IoT-enabled solutions is increasing across numerous industrial sectors, such as manufacturing, transportation, and automotive.

The Emergence of High-Tech Vehicles to Drive Market Expansion

Multiple businesses that are struggling to meet the need for quicker delivery times can profit from autonomous trucks and vehicles in numerous ways. Consequently, the demand for connected logistics technologies is fueled by the increasing demand for these vehicles across industries such as food and beverage, healthcare and pharmaceuticals, and manufacturing, for the transportation of goods. The increasing need for transportation has heightened issues such as volatile oil prices, significant investments, and pollution management. Therefore, important actors are engaged in the development of high-tech vehicles that can satisfy the future needs of the economy and society. The employment of high-tech vehicles in the supply chain and logistics contributes to the improvement of transportation efficiency, safety, and environmental sustainability. In addition, the expanding availability of linked drones is boosting this desire for an increasing number of high-tech cars.

Insufficiency in Logistics Standardization

Due to disparities in corporate practices, infrastructure, culture, and government legislation, the standardization of logistics may present a number of obstacles. In addition, in order to maintain a high degree of global competitiveness, the countries must cut their logistical costs by adopting global standards comparable to European Union (EU) and ISO norms. Compared to the United States and the European Union, the amount of logistics standardisation in China and Korea is minimal. This is a result of the Chinese and Korean governments' lack of promotion and enforcement, as well as the absence of regional organizations that may actively launch and unify multi-national logistics standardization activities. These efforts include the creation and implementation of both domestic and international standards for logistics equipment, tools, packaging, storage, transportation, loading/unloading, and information and communications technology (ICT) that are compatible with widely adopted international logistics standards, such as ISO standards. Consequently, a lack of logistics standardization raises the costs associated with the entire supply chain process, impeding the expansion of the market for linked logistics.

Hardware Dominated the Market by Component

The market is categorized by component into hardware, solutions, and services. In 2025, the hardware category dominated the market and is anticipated to grow at the highest CAGR over the forecast period. The market is further divided by hardware into RFID tags, sensors, communication devices, tracking devices, and others. Due to the growing demand for asset tracking, the sensors category is predicted to have a substantial market share. In addition, Internet of Things (IoT)-based connected sensing technology helps preserve temperature stability, reduce food waste, and enhance supply chain visibility.

In addition, it is predicted that the software category would record a significant CAGR throughout the forecast period. The warehouse management software automates and optimizes a number of warehouse procedures, such as inventory tracking, receiving, storage, and workload planning. The fleet management software provides a broad array of vehicle management functions to owners of cargo ships, aircraft, trucks, and other modes of transportation worldwide. Asset tracking and management provide for the monitoring of fixed assets, inventory tools, and other significant physical assets. Data management and analytics provide options for enhancing and measuring the performance of end-to-end logistics.

The services market category is expected to grow at the highest CAGR during the forecast period. The ongoing rise of the market is primarily attributable to the growing demand for managed services in linked logistics. The leading players offer services such as consultancy, integration and deployment, support and maintenance, and managed services. Consulting services provide assistance to shippers through specialized and knowledgeable solutions.

Highways Dominated the Market by Transportation Mode

In terms of modes of transportation, highways dominated the market in 2025. It is expected to grow at the highest CAGR throughout the projection period. This is due to the increasing demand for road-based transportation to convey retail items across vast distances, especially for last-mile delivery. In addition, this form of transportation has a great carrying capacity, making it an attractive option for logistics. Increasing efforts by governments around the world to promote road transport also contribute to the segment's expansion.

The government of India, for instance, has implemented a national logistics policy to enhance corporate efficiency and cut transportation costs. As part of this program, the government is creating a highway network from the port area to the most remote region of the country in order to reduce fuel consumption, which is the most cost-intensive aspect of freight transit.

During the projection period, the railway segment is anticipated to expand at a significant CAGR. This mode of transportation has the inherent advantage of less frictional resistance, allowing wagons and carriages to carry greater loads. Increasing government activities to boost rail freight transport are also anticipated to contribute to the segment's expansion. For example, the United States Department of Transportation has initiated the Rail Program. Under this scheme, the government intends to double the number of freight rail routes.

Retail and e-commerce Dominated the Market through Vertical

The market is segmented by industry vertical into retail & e-commerce, automotive, aerospace & military, healthcare, energy, electronics & semiconductors, and others. In 2025, the retail and e-commerce segments dominated the market. Connected logistics solutions are utilized by the retail industry to suit rising company expectations. Connected logistics enhances reliability via IoT solutions, which fits with the interests of the retail and e-commerce industries.

The automotive category is estimated to account for a sizeable portion of the market throughout the forecast period. Connected logistics systems for the automobile sector provide real-time infographics depending on the position of the vehicle, the condition of the cargo, and the driver's conduct. Market leaders provide niche solutions for the automobile sector. For example, Alibaba Cloud offers robust automobile management and monitoring solutions to vehicle makers and goods owners in order to facilitate accurate and efficient vehicle monitoring.

North America Remains as the Global Leader

In 2025, North America dominated the global market. Due to the region's highly developed rail and road infrastructure, the region's growth can be credited. In addition, the presence of key industry players enables the region to be the leading contributor to worldwide market revenue throughout the forecast period. Modern infrastructure enables a quicker adoption of contemporary technologies. Due to the development of new technologies, the increase in working capital, and the rapid expansion of the e-commerce industry, it is anticipated that the United States will maintain its supremacy during the projected period.

The Asia-Pacific region is anticipated to experience the highest CAGR during the projection period. Asia-Pacific is anticipated to have faster economic growth than other regions and to serve as the logistical hub for all investment and expansion. In addition, increased technological breakthroughs in transportation and expanding investment in megacity projects are anticipated to contribute to regional growth over the forecast period. The rapid expansion of the region's e-commerce and manufacturing industries fuels the expansion of the target market. China and India are the region's most important markets.

Competition to Intensify During the Forecast Period

The market for linked logistics is highly competitive and fragmented due to the existence of numerous global and regional players. Intel Corporation, Infosys Limited, and SAP SE, among others, are market leaders. All of the market's key companies are concentrating on new product development to remain competitive and expand their market share. For example, Cisco Systems Inc. provides solutions for many forms of transportation, such as aviation, rail, and roads. The company offers solutions such as Cisco IE 2000 and 3000 series switches for connected maritime. Market leaders are investing extensively in research and development to integrate new technology into linked logistics for safer, more efficient transportation. In order to achieve a competitive advantage, corporations also collaborate and form partnerships with their competitors and end-users.

In February 2026, for instance, Oracle and RHI Magnesita inked a contract in which RHI Magnesita chose Oracle's fusion cloud transportation management. This agreement will assist RHI Magnesita in unifying its whole transport management system, thereby reducing costs and optimizing service levels. SAP SE strengthened its partner ecosystem in September 2021 by extending its ties with Project44, ClearMetal, and Shippeo. Through these collaborations, licensed members of SAP Logistics Business Network have access to the expected time of arrival, precise location, and status updates for road and ocean carrier transports. Intel Corporation, Infosys Limited, Cisco System, Inc., HCL Technology Limited, IBM Corporation, SAP SE, ORBOCMM, Freightgate, Inc., Honeywell International, Inc., NEC Corporation, and Honeywell International, Inc. are some of the major participants in the worldwide connected logistics market.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Connected Logistics market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Software

|

|

Platform

|

|

Service

|

|

Transportation Mode

|

|

Verticals

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report