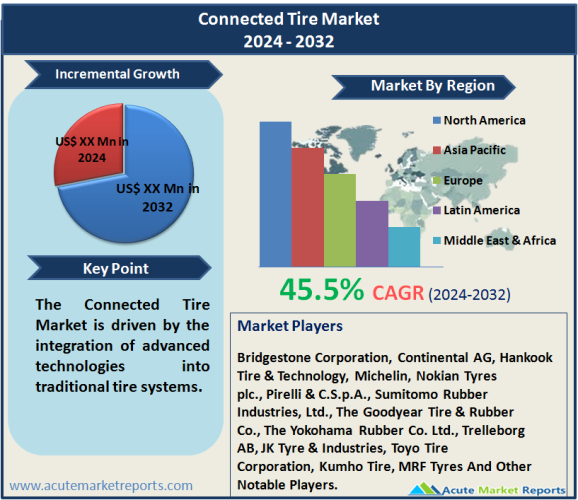

The connected tire market is experiencing a paradigm shift, which is expected to lead to a very strong CAGR of 45.5% during the forecast period of 2026 to 2034, driven by the integration of advanced technologies into traditional tire systems. This transformative trend is reshaping the automotive industry, enhancing safety, performance, and overall driving experience. The connected tire market is driven by the integration of IoT for real-time monitoring, advancements in tire sensor technologies, and the overarching goal of enhancing vehicle safety and performance. However, the market faces the restraint of cybersecurity concerns and data privacy issues that necessitate comprehensive solutions to ensure the secure and responsible implementation of connected tire technologies. The connected tire market presented a promising landscape in 2025, with North America leading in revenue percentage and the Asia-Pacific region exhibiting the highest CAGR. Established players employ strategic initiatives to strengthen their positions, focusing on technological innovation and collaboration. The market's upward trajectory is expected to continue, driven by global trends in automotive connectivity and a rising awareness of the benefits offered by connected tire solutions. As the automotive industry evolves towards increased connectivity and smart functionalities, the connected tire market is poised for sustained growth, presenting opportunities for both existing and new players to thrive in this dynamic sector.

Key Market Drivers

IoT Integration for Real-time Monitoring and Analysis

The integration of Internet of Things (IoT) technology into tire systems represents a significant driver for the connected tire market. IoT-enabled sensors embedded in tires provide real-time data on crucial parameters such as tire pressure, temperature, tread wear, and overall performance. This data is instrumental in preventing accidents, optimizing fuel efficiency, and extending the lifespan of tires. Evidence supporting this driver lies in the increasing adoption of connected tire solutions by automakers and fleet operators. For instance, major automotive manufacturers like Tesla and BMW have incorporated IoT sensors in their vehicles to enable continuous monitoring of tire health, ensuring safety and efficiency.

Advancements in Tire Sensor Technologies

The rapid advancements in tire sensor technologies contribute substantially to the market's growth. Innovative sensor technologies, including pressure sensors, temperature sensors, and tread depth sensors, are enhancing the capabilities of connected tires. These sensors provide accurate and comprehensive data, allowing for precise monitoring and analysis. The evidence for this driver is evident in the continuous research and development efforts by tire manufacturers and technology companies. For instance, companies like Bridgestone and Continental are investing in sensor technologies to introduce smart tire solutions that go beyond basic pressure monitoring, offering advanced features such as real-time tread wear analysis and predictive maintenance alerts.

Enhanced Vehicle Safety and Performance

The focus on enhancing vehicle safety and performance acts as a compelling driver for the adoption of connected tires. The integration of advanced sensors and connectivity enables vehicles to dynamically adjust to changing road conditions, optimize tire pressure for different terrains, and provide alerts for potential issues. This driver is substantiated by the increasing emphasis on automotive safety standards and regulations worldwide. For example, the European Union has mandated the inclusion of tire pressure monitoring systems (TPMS) in all new vehicles, driving the demand for connected tire solutions that offer a more comprehensive approach to safety and performance optimization.

Restraint: Cybersecurity Concerns and Data Privacy

While the connected tire market is experiencing significant growth, cybersecurity concerns and data privacy issues pose a notable restraint. The integration of IoT technology and connectivity exposes tires to potential cyber threats, raising concerns about unauthorized access to vehicle data. The evidence for this restraint is observed in instances of cybersecurity vulnerabilities in connected vehicles reported globally. The risk of unauthorized access to sensitive data, such as tire performance metrics and vehicle location, highlights the importance of robust cybersecurity measures. Addressing these concerns is essential to foster consumer trust and ensure the widespread adoption of connected tire solutions.

Market Segmentation By Offering

In 2025, the connected tire market witnessed the highest revenue and the highest CAGR in both Hardware and Software segments. The Hardware segment, encompassing physical components such as sensors and connectivity modules embedded in tires, leads in revenue, driven by the widespread adoption of advanced tire sensor technologies. Simultaneously, the Software segment, comprising the intelligent algorithms and platforms facilitating data analysis and real-time monitoring, exhibits the highest CAGR. This growth is attributed to the increasing emphasis on data-driven insights and analytics in the automotive industry, propelling the demand for sophisticated software solutions to complement connected tire hardware.

Market Segmentation By Propulsion

The segmentation based on Propulsion reveals that in 2025, both the Electric and Internal Combustion Engine (ICE) categories contributed significantly to the connected tire market's revenue, with Electric propulsion leading in CAGR. The rising adoption of electric vehicles (EVs) worldwide drives the demand for connected tires, especially those equipped with advanced sensors to optimize performance and enhance safety. Meanwhile, the ICE segment, representing traditional combustion engine vehicles, maintains a substantial market share in terms of revenue in 2025. The highest CAGR in the Electric category reflects the accelerating shift towards electric mobility and the integration of connected tire solutions to augment the capabilities of electric vehicles.

Market Segmentation By Rim Size

The Rim Size segmentation unveils that the market experiences the highest revenue in the 18-22 Inches category, while the 12-17 Inches category demonstrates the highest CAGR. In 2025, larger rim sizes contribute significantly to the overall market revenue, driven by the preference for bigger wheels in premium and high-performance vehicles. On the other hand, the 12-17-inch category, encompassing standard and smaller-sized rims, exhibits the highest CAGR. This growth is fueled by the increasing adoption of connected tire solutions in mainstream and entry-level vehicles, reflecting a broader market penetration across diverse vehicle segments.

Market Segmentation By Sales Channel

The segmentation based on Sales Channels reveals that both Original Equipment Manufacturer (OEM) and Aftermarket channels contribute substantially to the market's revenue in 2025. The OEM channel, involving the integration of connected tire solutions during vehicle manufacturing, leads in revenue due to widespread adoption by automakers. Simultaneously, the Aftermarket channel, offering retrofitting options for existing vehicles, demonstrates the highest CAGR. This growth is fueled by the increasing consumer awareness of connected tire benefits, leading to aftermarket installations for enhancing safety and performance in vehicles already on the road.

Market Segmentation By Component

In 2025, the market segmentation based on Components indicates that Tire Pressure Monitoring Systems (TPMS), Accelerometer sensors, Strain gauge sensors, RFID chips, and other sensors all contribute to the market's revenue. TPMS dominates in revenue, reflecting its widespread adoption for monitoring tire pressure and enhancing safety. However, the highest CAGR is observed in the Accelerometer sensors category, indicating the increasing importance of precise acceleration data for advanced driver-assistance systems and overall vehicle performance.

Market Segmentation By Vehicle Type

The segmentation based on Vehicle Type illustrates that both Passenger Cars and Commercial Vehicles significantly contribute to the market's revenue in 2025, with Passenger Cars leading in CAGR. The high revenue from Passenger Cars is attributed to the large volume of connected vehicles in the consumer market. Meanwhile, Commercial Vehicles, including trucks and buses, maintain a substantial market share due to fleet-wide adoptions. The highest CAGR in the Passenger Cars category reflects the growing integration of connected tire solutions in personal vehicles, driven by increasing consumer demand for advanced safety and performance features.

North America Remains the Global Leader

In 2025, North America emerged as the region with the highest revenue percentage, driven by the early adoption of connected vehicle technologies and a mature automotive market. The presence of key players, coupled with favorable regulatory initiatives promoting vehicle safety technologies, contributes to the region's substantial market share. However, the Asia-Pacific region showcases the highest CAGR, emphasizing the increasing demand for connected tire solutions in emerging economies like China and India. Factors such as rapid urbanization, a growing middle class, and a surge in automotive sales contribute to the robust CAGR in the Asia-Pacific region.

Market Competition to Intensify during the Forecast Period

The competitive landscape of the connected tire market in 2025 is characterized by the presence of established players employing key strategies to maintain and enhance their market positions. Top players include Bridgestone Corporation, Continental AG, Hankook Tire & Technology, Michelin, Nokian Tyres plc., Pirelli & C.S.p.A., Sumitomo Rubber Industries, Ltd., The Goodyear Tire & Rubber Co., The Yokohama Rubber Co. Ltd., Trelleborg AB, JK Tyre & Industries, Toyo Tire Corporation, Kumho Tire, and MRF Tyres major tire manufacturers and technology companies collaborating to offer comprehensive connected tire solutions. Key strategies encompass partnerships, collaborations, technological innovations, and mergers and acquisitions. These players focus on developing advanced sensor technologies, enhancing data analytics capabilities, and expanding their global footprint. Strategic collaborations with automotive manufacturers are pivotal, as they facilitate the integration of connected tire solutions directly into new vehicle models. Additionally, investments in research and development drive continuous innovation, ensuring that market leaders stay at the forefront of technology.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Connected Tire market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Offering

|

|

Propulsion

|

|

Rim Size

|

|

Sales Channel

|

|

Component

|

|

Vehicle Type

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report