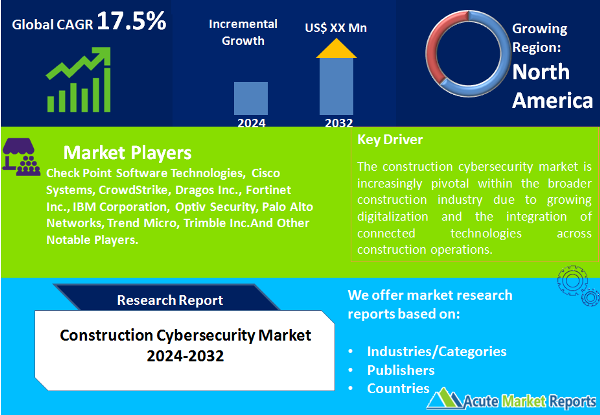

The construction cybersecurity market is expected to grow at a CAGR of 17.5% during the forecast period of 2026 to 2034. Construction cybersecurity market is increasingly pivotal within the broader construction industry due to growing digitalization and the integration of connected technologies across construction operations. This market focuses on protecting critical data and infrastructure in construction projects from cyber threats, including data breaches, cyberattacks, and other security incidents. As the construction industry adopts more Internet of Things (IoT) devices, cloud-based platforms, and other digital tools, the demand for robust cybersecurity solutions escalates to prevent disruptions that can lead to costly delays and loss of sensitive information.

Driver: Increasing Adoption of IoT and Smart Construction Technologies

The surge in adoption of IoT devices and smart technologies in the construction sector drives significant growth in the construction cybersecurity market. IoT devices enhance operational efficiencies in construction projects through real-time data collection, monitoring, and management systems. However, these devices also present new vulnerabilities and entry points for cyberattacks. The integration of technologies such as automated machinery, drones, and building information modeling (BIM) systems increases the complexity of construction networks, necessitating advanced cybersecurity measures. Companies are implementing robust security protocols and solutions to protect these digital assets from unauthorized access and cyber threats, thus driving the cybersecurity market.

Driver

Stringent Regulatory Requirements and Standards

Stringent regulatory requirements and standards for data protection and privacy significantly influence the construction cybersecurity market. Governments and international bodies are enacting regulations that mandate the implementation of cybersecurity measures in construction projects, especially those related to critical infrastructure. For example, regulations such as the General Data Protection Regulation (GDPR) in Europe impose strict guidelines on data handling and privacy, pushing construction companies to adopt cybersecurity solutions. Compliance with these regulations not only helps in avoiding legal penalties but also aids in building trust with clients and stakeholders, further propelling the market growth.

Rising Cyber Threats and Attacks on the Construction Industry

The construction industry is increasingly targeted by cybercriminals due to the vast amounts of sensitive data and the critical nature of construction projects. Cyber threats range from ransomware and phishing attacks to more sophisticated breaches aimed at stealing architectural plans and competitive bids. The repercussions of such attacks include financial losses, project delays, and damage to reputation. In response, there is a heightened demand for cybersecurity solutions that can offer real-time threat detection, risk management, and secure communication channels. Construction firms are investing in cybersecurity infrastructure and personnel to safeguard their projects and data from these evolving threats.

Restraint

High Costs and Complexity of Cybersecurity Solutions

One major restraint in the construction cybersecurity market is the high costs and complexity associated with implementing and managing cybersecurity solutions. The deployment of comprehensive cybersecurity systems involves significant investment in both technology and skilled personnel. Small to medium-sized enterprises (SMEs) in the construction sector often find these costs prohibitive, which can deter them from adopting adequate cybersecurity measures. Additionally, the complexity of these systems requires specialized knowledge, adding to the challenge of maintaining an effective cybersecurity posture. Despite these barriers, the escalating threat landscape and potential financial implications of cyber incidents are compelling companies to prioritize cybersecurity investments, albeit gradually.

Market Segmentation by Component

In the construction cybersecurity market, segmentation by component encompasses Solutions and Services, each playing a crucial role in addressing the diverse cybersecurity needs of the construction industry. Solutions, which include hardware and software designed to protect networks, devices, and data, dominate the segment in terms of revenue generation. This category is propelled by an increasing demand for integrated cybersecurity suites that offer comprehensive protection against a wide array of threats. These solutions typically include firewalls, intrusion detection systems (IDS), antivirus software, and other critical cybersecurity tools. On the other hand, Services are projected to experience the highest Compound Annual Growth Rate (CAGR) from 2026 to 2034, driven by the growing complexity of cyber threats and the need for specialized expertise in implementing, managing, and updating cybersecurity measures. Services such as consulting, training, support, and managed security are becoming increasingly vital as construction companies look to stay ahead of cyber threats while focusing on their core business operations. The demand for services is particularly pronounced in small to medium-sized enterprises (SMEs) that often lack in-house cybersecurity capabilities.

Market Segmentation by Deployment Model

The construction cybersecurity market is further segmented by the deployment model into On-premises and Cloud-based solutions. On-premises solutions currently command the highest revenue share due to their widespread adoption in larger construction firms that prioritize control over their cybersecurity infrastructure and data. These solutions are favored for their ability to offer enhanced security measures, customized to the specific needs and regulatory requirements of the business. However, the Cloud-based deployment model is expected to register the highest Compound Annual Growth Rate (CAGR) from 2026 to 2034. The shift towards cloud-based solutions is driven by their cost-effectiveness, scalability, and ease of integration with existing IT infrastructures. Small to medium-sized construction firms find cloud solutions particularly attractive as they allow for robust cybersecurity measures without the need for significant upfront investment in hardware and specialized personnel. Cloud services also facilitate remote monitoring and management of cybersecurity practices, which is crucial for construction projects that often span multiple locations and require coordination between various stakeholders.

Geographic Trends

The construction cybersecurity market demonstrates varied growth patterns across different global regions, reflecting the uneven adoption of digital technologies and cybersecurity practices within the construction industry. North America leads in terms of both revenue generation and technological advancements due to a robust technological infrastructure and stringent regulatory landscape that drives the adoption of cybersecurity solutions. The region's dominance is further supported by the presence of a significant number of cybersecurity vendors and ongoing investments in smart construction projects which require sophisticated cyber protection measures. Meanwhile, the Asia-Pacific region is anticipated to exhibit the highest Compound Annual Growth Rate (CAGR) from 2026 to 2034, fueled by rapid urbanization, industrialization, and digital transformation in countries like China, India, and Japan. The region's growth is also propelled by increasing awareness of cybersecurity threats and rising government initiatives aimed at improving the cybersecurity framework within the construction sector. Europe also remains a key player with strong growth potential, driven by GDPR compliance and heightened security measures around critical infrastructure construction projects.

Competitive Trends and Key Strategies

In the competitive landscape of the construction cybersecurity market, prominent players include Check Point Software Technologies, Cisco Systems, CrowdStrike, Dragos Inc., Fortinet Inc., IBM Corporation, Optiv Security, Palo Alto Networks, Trend Micro, and Trimble Inc. These companies collectively form a dynamic ecosystem, competing on technological innovations, strategic alliances, and market expansion strategies. In 2025, these firms demonstrated a strong focus on developing advanced cybersecurity solutions tailored to the unique needs of the construction industry, such as secure remote access, network security, and threat detection and response capabilities. Looking ahead from 2026 to 2034, these players are expected to intensify their focus on integrating artificial intelligence and machine learning technologies to enhance their offerings. This integration aims to provide proactive threat intelligence and automated security protocols to effectively address the increasingly sophisticated cyber threats targeting construction operations. Strategic partnerships and collaborations with construction firms and IT providers are also anticipated to be a key strategy, enabling these cybersecurity vendors to expand their reach and customize their solutions based on specific client requirements and regional threats. Moreover, investments in research and development are expected to remain a cornerstone strategy, as companies strive to stay ahead of the curve in a rapidly evolving cybersecurity landscape. These strategies not only aim to bolster their product portfolios but also enhance their competitive positioning globally, catering to a broad spectrum of construction clients from small contractors to multinational enterprises.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Construction Cybersecurity market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Component

|

|

Deployment Model

|

|

Enterprise Size

|

|

Functional Area

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report