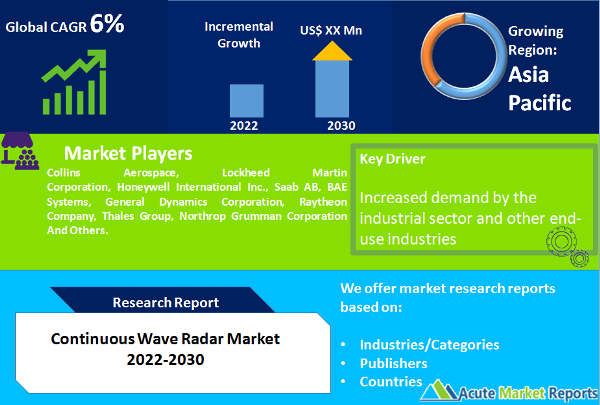

The size of the Global Continuous Wave Radar Market is expected to grow at a CAGR of 6% during the forecast period of 2026 to 2034. Continuous Wave Radar (CWR) is a form of radar that employs constant or almost constant electromagnetic waves. It can detect things from 200 meters to 100 kilometers distant with an accuracy of approximately 0.001% of the distance traveled over longer ranges. This type of radar has the capacity to detect things with the same degree of precision over land and water. Unlike pulsed radar systems, it does not require a return pulse, and its resolution (distance between two similar spots) is superior to that of pulsed Doppler radars. This growth will be driven by factors such as the rising demand for environmental monitoring systems in emerging economies as a result of rapid industrialization and urbanization, the rising demand for military applications as a result of rising social unrest across the globe, and the rising demand for resource detection systems as a result of mounting concerns about global warming.

New Product Introductions to Boost the Market

Leading important players in the continuous wave radar market implement the essential approaches to enhance the precision and operational performance of reconnaissance, assault, and security for the worldwide customer base. Longbow LLC, a Northrop Grumman and Lockheed Martin joint venture, will launch the 500th APG-78 LONGBOW Fire Control Radar for the AH-64 Apache helicopter in June 2021. The APG-78 LONGBOW FCR provides automatic target identification, localization, classification, and prioritizing, allowing for quick, multi-target engagement in difficult weather conditions, diverse terrain types, and battlefield obscurants. Version6 FCR software is implemented, which enables new operational capabilities such as maritime, single target track, and 360-degree surveillance mode, as well as extended detection range against the land, air, and sea targets. The Apache Fire Control radar system is comprised of electro-optical sensors and radar technologies that offer aircrews heightened situational awareness and better survivability.

Increased use in the Automotive and Industrial Sectors

The military and defense utilize CW-radar systems for air traffic control, radar astronomy, the detection of spacecraft and aircraft missiles, and the measurement of distance and velocity with greater precision than optical or ultrasound systems. In addition, these gadgets are utilized in smart automobiles' sophisticated driver assistance systems, adaptive cruise control, lane-keeping, and parking aid systems. Lockheed Martin, a worldwide security and aerospace corporation, introduced the first Q-53 Radar outfitted with Gallium Nitride in April 2021, allowing security forces to upgrade and increase system capabilities to suit evolving mission requirements. The Q-53 defends troops in combat by detecting, categorizing, and tracking the position of 90 or 3600 kinds of enemy indirect fire. GaN transmitter-receiver modules provide more power, reliability, and a longer range to radar, enabling simultaneous acquisition of counterfire targets and air surveillance. These solid-state radar devices are mobile and capable of operating in severe situations.

APAC Promising Significant Opportunities During the Forecast Period

The advancement of technology and the increased need for high-tech weaponry, equipment, and artillery are among the other major factors driving the growth of the continuous wave radar market. In response to the rising demand for cutting-edge artillery systems, the continuous wave radar market is expected to expand significantly throughout the forecast period. Emerging economies in APAC and the Middle East, such as India, China, Israel, and South Korea, are modernizing their fleets of ships with cutting-edge technology and capabilities, driving the demand for cutting-edge radar systems. Defense agencies all over the world are placing a great deal of attention on developing programs that will assist corporations in developing surveillance systems.

Different defense groups are increasingly employing unmanned aerial vehicles (UAVs) to monitor national boundaries, and radar systems have proven to be highly effective at establishing effective communication with UAVs. Defense agencies increasingly include the provision for inspection, testing, and support & maintenance services when granting contracts for UAV radar system procurement.

The efforts of suppliers to capitalize on the rising demand for airborne and space-based radar systems are also positive for the expansion of the continuous wave radar market. To gain a sustainable competitive advantage, vendors are focusing on alliances and collaborations with national military groups. Frequently, such agreements for the delivery of radar equipment involve maintenance and R&D tasks.

The Asia-Pacific region is anticipated to profit from the development of radar systems due to the presence of numerous small and medium-sized enterprises (SMEs) and manufacturing facilities, as well as the growing acceptance of radar technology and marine trade. The rise of the regional continuous wave radar market is anticipated to be aided by the availability of funds and investments. Research and development in the defense industry is an important, ongoing trend in the Asia-Pacific area. China, for instance, has developed military radars capable of detecting any type of fighter or bomber aircraft.

Territorial disputes around the world motivate governments to deploy very effective monitoring systems across their international borders, particularly in these fragile regions. Consequently, several nations are increasing their military budgets. Emerging economies in APAC and the Middle East are propelling the demand for cutting-edge radar systems.

In North America, radar systems are anticipated to be in high demand. Canada is developing quantum radar in an effort to enhance the detection of stealth aircraft. This technology allows for more precise item recognition compared to conventional methods.

Market to Remain Profitable to Established Market Players

Collins Aerospace, Lockheed Martin Corporation, Honeywell International Inc., Saab AB, BAE Systems, General Dynamics Corporation, Raytheon Company, Thales Group, and Northrop Grumman Corporation are prominent competitors in the continuous wave radar market. Major manufacturers make and deploy the radars utilized in aviation and ground traffic monitoring systems. Due to the need to control air traffic in numerous nations and the demand for precise information regarding aircraft movements, it is projected that market participants in the continuous wave radar industry will witness growth.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Continuous Wave Radar market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

Component

|

|

Range

|

|

Application

|

|

Industry

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report