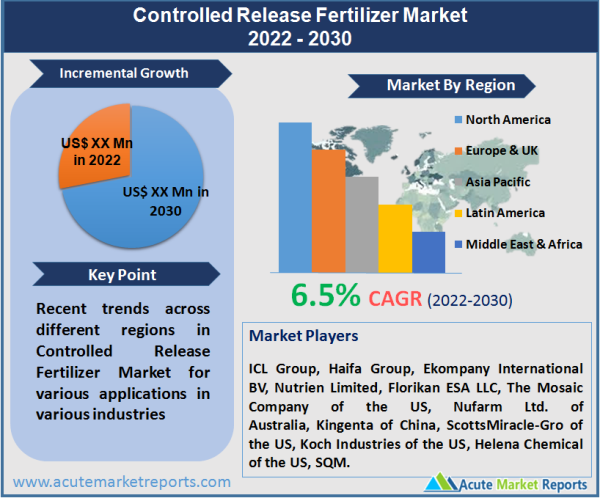

It is anticipated that the size of the global controlled release fertiliser market will grow at a CAGR of 6.5% during the forecast period of 2026 to 2034. There are a number of key factors that are expected to drive the growth of the controlled release fertiliser market during the forecast period. These key factors include the rise in the global population, the growing application rates in developing countries, and the rising demand for high-value crops. According to the International Fertilizer Association, a combination of poor farm economics and logistical disruptions caused by the COVID-19 pandemic and related lockdowns resulted in a fall in demand of nearly 3% from July 2021 to June 2022.

Adverse Impact of Covid-19

The COVID-19 pandemic has had an effect on the fertility of the soil as a result of human activities, specifically the delay among farmers in the application of fertiliser at the appropriate period. In the midst of the COVID-19 epidemic, it is necessary to implement the necessity of further developing existing programmes to boost agricultural input usage efficiency, most notably the use of fertiliser, through the adoption of innovations such as sensor and satellite technology. The most important feature of agriculture that needs to be taken into consideration during the COVID-19 epidemic is the effect that the lack of mineral fertiliser will have on the soil and the production function. Nitrogen (N) and phosphorus (P), both of which are necessary for plant growth, should be subjected to careful scrutiny. Sustainable nutrient management refers to the process of applying fertiliser in order to replace the quantity of nutrients that are removed from the soil as a result of crop harvesting. Fertilizer importation is prevented as a result of the shutdown and closure of borders.

Nitrogen (N), phosphorus (P), and potassium are the three principal elements that are absolutely necessary for the development and production of plants in significant amounts (K). The world's largest exporter of phosphorus fertilisers (5.32 Mt), China is also the world's second-largest exporter of nitrogen fertilisers (5.56 Mt). The crop's ability to mature and produce fruit or vegetables depends on the availability of nutrients in the soil, which the plant can then absorb. Continuous cropping and harvesting results in nutrient mining due to the fact that the plant draws nutrients from the surrounding soil. However, increasing the fertility of the soil and increasing crop output both require applying the appropriate amount of fertiliser at the appropriate time. The majority of African countries, particularly China, are dependent on the importation of fertilisers from wealthy countries. As a consequence of the COVID-19 pandemic and the control mechanisms that were put into place, fertilisers would not be shipped in significant quantities. Unsatisfactory yield in Africa can be directly attributed to inadequate fertiliser production and imports, which is in turn driven by covid 19 logistical restrictions.

Both West and Central African ports and airports continue to function normally and are accessible to non-essential travellers, allowing for unimpeded imports and exports of necessary goods. However, there have been reports of delays in loading, cargo, and unloading at a number of different ports. One of the reasons for the delays that were found was that staff on board the ship was subjected to periodic screening inspections and precautionary procedures. Food and other goods are having a harder time moving around inside countries as a result of travel restrictions imposed by majority of the countries in the region, as well as lockdowns in numerous towns.

Increasing Population Compelling the Need for High Efficiency Fertilizers

The rising need for high-efficiency fertiliser that not only satisfies the crop's nutrient needs but also helps the crop produce more of those nutrients is the primary factor propelling growth in the controlled-release fertiliser market. The controlled-release fertiliser market is anticipated to be driven by the growing population of the world, as well as the growing use of innovative farming goods and practises by farmers. The optimization of nitrogen is of the utmost importance in the production of turfgrass since nitrate deficit can result in the grass turning yellow and losing its vitality, which creates difficulties in terms of the expense of maintenance and replacement. As a consequence of this, the demand for polymer-coated urea and NPK fertilisers for use in the cultivation of turfgrass is anticipated to drive growth in the market throughout the course of the time covered by the forecast. Alternate mechanisms for slow-release fertilisers NPK and urea fertilisers are going to be researched and developed in the near future, which will lead to a number of technological breakthroughs in the market that will take place in the future. Future technologies, such as inverse suspension polymerization, which are mostly in the research stage at the moment, will quickly advance and will soon be put into commercial use by businesses.

The destruction of the aquatic ecosystem is caused by the introduction of excess nutrients into the water, which in turn leads to the eutrophication of the water's surface. In recent years, there has been an increase in the concern that is associated with the fertilisers and nutrients that are used on soil. As a result of this, fertiliser industries and associations all over the world have begun promoting Fertilizer Best Management Practices. These practises are the framework for the development of enhanced efficiency fertilisers (EEF), and farmers are encouraged to adopt these fertilisers. These methods are associated with the correct application of fertilisers in the appropriate quantity, at the appropriate time, and in the appropriate location. As a consequence, they are the primary factor driving the market for controlled release fertilisers.

Deteriorating Soil Quality Motivating the Need of Efficient Fertilizers

The excessive deposit of mineral fertilisers in the soil was caused by an increase in the use of mineral fertilisers. A study that was initiated at a conference of the United Nations Convention to Combat Desertification (UNCCD) in the Ordos revealed that the present rate of loss of rich soil is valued at 24 billion metric tonne per year. This information was disclosed by a study that was conducted in the Ordos. The National Academy of Agricultural Sciences (NAAS), which has its headquarters in New Delhi, estimates that the yearly soil loss rate in India is approximately 15.35 tonnes per hectare, which results in a loss of 5.37–8.4 million tonnes of nutrients. Another direct and significant effect that soil erosion has on crop output is decreased quality. Studies conducted in the field have shown that biodegradable polymer coatings are beneficial for the regulated release of nutrients into the soil, the reduction of nutrient losses (such as ammonia volatilization), and the long-term preservation of soil fertility.

In addition, a study that was conducted by the Grantham Centre for Sustainable Futures at the University of Sheffield found that soil degradation has been occurring at such a rapid rate that the rate of erosion is 100 times greater than the rate of soil formation. This is because intensive farming practises and excessive residues of non-biodegradable fertilisers are to blame for this problem. In contrast, the study found that it takes around 500 years to build 2.5 centimetres of topsoil under conditions when biological processes are not impeded, despite the fact that roughly 95 percent of all food production takes place in the soil's topmost layer.

Cost is the Biggest Concern

Due to the need for more complicated production processes, the cost of producing controlled-release fertilisers is significantly higher than that of conventional soil-applied fertilisers. This is because controlled-release fertilisers have a longer time needed for their nutrients to be released into the soil. The International Fertilizer Association (IFA) reports that the price of controlled-release fertilisers has remained four to six times higher than the price of conventional NPK fertilisers (NPK stands for nitrogen, phosphorous, and potassium). This is one of the most significant challenges faced by this market. Because of the programmed and established release pattern of these fertilisers, frequent application of these fertilisers is not required; however, the initial cost that the farmer is required to invest is very expensive. Conventional fertilisers have an unprogrammed release pattern. Because of this, the use of controlled-release fertilisers is restricted to high-value cash crops only; as a result, the growth of the market for other broad-acre crops such as rice and wheat is stifled. This is due to the fact that the rate of return on investment for these crops has historically been quite low for farmers in developing countries.

Lack of Awareness Among the Farmers Limiting the Use of Controlled Release Fertilizers

Farmers in poor nations continue to have a limited understanding of the benefits of specialised fertilisers. Farmers are not aware of how to use specialty fertilisers properly or of the benefits they provide in terms of cost-effectiveness. In underdeveloped nations, people frequently lack a fundamental understanding of the nutrient requirements of the soil. Farmers are accustomed to using main nutrients in a certain way, but the nutrient response ratio of these nutrients is not encouraging due to uneven fertilisation and the absence of use of secondary macronutrients. This is a result of both of these factors. As a result of the market being so heavily fragmented at the regional level, there is also a low level of consumer awareness regarding the brands. In spite of the significant efforts that have been made by agronomists all over the world in recent years, many farmers either do not know about secondary macronutrients or have a limited understanding of how these nutrients can increase output. On the other hand, farmers are not prepared to take chances in terms of production capacity in countries like India and China because agriculture is a key source of income for more than half of the population in these nations. The expensive price of chemical fertilisers is another factor that discourages farmers from utilising them. The mindset of farmers needs to be shifted before they can comprehend the applications and advantages of specialty fertilisers. The expansion of the market for speciality fertilisers faces difficulties as a result of this factor.

Coated and Encapsulated Segment Remains Most Dominant During the Forecast Period

In the controlled release fertiliser market, coated and encapsulated segment accounted to the largest share in 2022. The use of these fertilisers has been steadily increasing over the past few years. This can be attributed to the growing awareness about the advantages that come with using coated fertilisers, as well as the support given by the government of the nation in the form of subsidies and policy amendments. These types of government rules and regulations that are clearly outlined play an important role as a driving force in the expansion of this market on a global scale.

Because of their widespread use and accessibility, coated and encapsulated fertilisers have emerged as the most effective type of controlled-release fertiliser on a global scale. This is due to the fact that coated and encapsulated fertilisers are widely used in both developed and developing economies. Because of the highly regulated nutrient release properties that they possess, controlled release fertilisers with polyolefin resin coating are quickly becoming increasingly popular across the world's agri-dominant economies. The use of various organic and synthetic polymer coatings to encapsulate fertilisers has emerged as a crucial method of increasing nutrient uptake in plants and promoting healthy growth within them. This conclusion was reached as a result of the findings of a number of studies that were carried out over the course of the previous few years.

Additionally, the expanding research on the manufacture of biodegradable and cost-effective coating polymers for fertilisers is anticipated to further drive the expansion of the segment. This is due to the fact that these two characteristics are both desirable in fertiliser coatings. It is anticipated that in the years to come, an increased focus will be placed on the development of controlled-release fertilisers employing zeolites because these fertilisers are more cost-effective and have superior environmental performance.

Fertigation Remains as the Fastest Growing Application Mode During the Forecast Period

Within the application segment, it is anticipated that the fertigation segment will register the highest CAGR during the forecast period of 2026 to 2034. This is primarily caused by a number of causes, including increased productivity and improved yields. This method of administration is becoming increasingly significant as a result of its dependability and effectiveness. The higher effectiveness of the fertigation mode of application results in a cost reduction of anywhere from 30% to 80% percent of the total application. The incorporation of fertiliser into irrigation water and its subsequent application through various systems is an approach known as "fertigation," which has gained popularity in many developed nations. This method has a greater potential for applicability than broadcasting or placing items below the surface.

Non Agri Segment Dominating the Revenues, Fruits and Vegetable Segment to Dominate the Growth

Non-agriculture segment of the controlled release fertiliser market accounted for the greatest share of the market in terms of revenues in 2022. There has been an increase in the demand for CRFs in non-agricultural sectors as a result of both the growth in purchasing power and the rise in environmental concerns. In spite of this, the use of controlled-release fertilisers on agricultural crops has greatly increased not just in developed nations but also in developing nations as a result of the regulations that regulate such fertilisers. The market is being driven by an increase in the application of controlled-release fertilisers for turf and ornamental grass. CRF has been utilised for the maintenance of turf and ornamental grass in the United States for more than a decade; nevertheless, its demand in poorer countries has been expanding recently. Therefore, the convenience of using controlled-release fertilisers on ornamental plants is a primary driver that is driving the demand for these products. During the forecast period, it is anticipated that the use of controlled-release fertilisers will experience significant growth in the production of high-value fruit and vegetable crops as well as cereals. This is expected to occur as a direct result of rising concerns regarding food security as well as an increase in demand for fertilisers that are both efficient and intelligent.

Asia Pacific Remains as a Global Leader

Asia Pacific accounted for the biggest share of the controlled release fertiliser market in 2022.There is likely to be additional room for market expansion as a result of the expanding production of high-value crops and the rising knowledge among farmers regarding the environmental benefits of controlled-release fertilisers. The major driving forces behind the expansion of this market in the Asia Pacific region are the government policies that have been implemented in those countries as well as the substantial subsidies that have been provided on fertilisers. These subsidies can reach up to one hundred percent for farmers working in marginal areas. APAC region is expected to grow at a CAGR of 7.1% during the forecast period of 2026 to 2034. This can be due to the substantial development in the population of Asian nations such as China and India, which is contributing to increasing food demand in the region. This is causing prices of food to rise. Because of its widespread application in the cultivation of ornamental plants as well as high-value crop production, such as strawberries, lilies, and a variety of other plants, the market for controlled-release fertilisers is exhibiting encouraging signs of expansion in western markets as well. Both production and consumption of controlled-release fertilisers are high in the Asia Pacific region, with China and Japan being the two largest markets for controlled-release fertilisers. China is expected to grow at a CAGR of 7.3% during the forecast period 2026 to 2034 and is currently holding about 25% of market share in 2022. The presence of market players such as Kingenta International and Hangfeng Evergreen, amongst others, in the country can be credited with the growth of the product in China. Increasing research and innovation of agricultural products is also a contributing factor to the growth of the product in China. In addition to this, the countries mentioned above have policies in place that are encouraging the use of intelligent fertilisers, which is also contributing to their expansion.

Many nations and states in the developed markets of North America and Europe have their own agriculture policies, which may or may not include fertilisers. However, proper rules on controlled-release fertilisers are still awaited in a number of the developed economies. Regulations for controlled-release fertilisers have been established as part of the EU Fertilizing Products Regulation. In addition to this, the authority has established some particularly stringent guidelines for the use of controlled-release fertilisers in the future across the EU. For instance, beginning in the year 2027, it will become mandatory to encase or coat fertilisers in polymers that meet the requirements for biodegradability, and the use of polymers that are chemically synthesised is likely to become illegal.

Because of the extensive use of controlled-release fertilisers in the horticulture industries of the United States, Canada, and Mexico, North America currently holds the largest market share for slow-acting fertilisers. This is due to the fact that these countries all produce a significant amount of their own food. The growing demand for smart and specialty fertilisers is another factor that can be ascribed to the presence of a large number of key market players in the North American industry. These market players include Pursell Agri-Tech, Nutrien, LESCO, and others.

The market for controlled-release fertilisers in the United States is showing signs of robust growth from one year to the next, thanks in large part to the outstanding sales performance that has been achieved by companies such as Koch Agronomic Services, Kugler Company, Nutrien, and Lebanon Seaboard Corp. Before, the use of these fertilisers was primarily restricted to the cultivation of high-value crops and ornamental plant species; however, over the past few years, the demand for these fertilisers from the agricultural sector in the United States has increased for the production of cereals and oilseeds. Because of the aforementioned aspect, it is expected that this region will continue to bring in a high income from the market for delayed-release fertilisers during the course of the forthcoming time period.

Market Remains Highly Consolidated Compelling Players to Focus on Product Innovation

Controlled-release fertiliser industry on a global scale is now consolidated. The leading participants in the global market include the ICL Group, the Haifa Group, Ekompany International BV, Nutrien Limited, and Florikan ESA LLC. The greater market share that these companies hold is primarily attributable to their widespread presence and production capabilities in a variety of developed and developing countries, including the Netherlands, Japan, and China and Malaysia, as well as their numerous products in a variety of market subsectors, including turf, horticulture, agriculture, and nurseries. In addition, these companies have a larger number of products in each of these market subsectors. Product innovation and collaboration are the primary strategies that are followed by companies in order to grow their market share and improve their production capacities utilising innovative technology. Yara International ASA of Norway, Nutrien Ltd. of Canada, The Mosaic Company of the United States, ICL Group of Israel, Nufarm Ltd. of Australia, Kingenta of China, ScottsMiracle-Gro of the United States, Koch Industries of the United States, Helena Chemical of the United States, and SQM are the key players in this market (Chile). These firms in this industry are working on increasing their presence through agreements and collaborations. These companies have a major presence in North America, Asia Pacific and Europe. In addition, they possess manufacturing facilities in addition to robust distribution networks spread throughout these regions.

Private label and regionally dominating players like SQM, ICL, and Pursell have established new benchmarks for the research and development of cost-effective specialist fertilisers. These new standards have been created by these companies. Agriculture giants are receiving further encouragement as a result of this development to speed up the introduction of their products and broaden the product lines they provide in the near future. Due to the potentially promising expansion of the product, key giants in the fertiliser product sector in the United States, China, and Japan are increasing their willingness to enter the market. In recent years, several of the largest companies in the specialty fertiliser industry, including Kingenta, Haifa Chemicals, and Agrium, have expanded their product lines through mergers and acquisitions in order to increase their controlled-release fertiliser market share and broaden their product offerings. Due to the fact that there are only a few local manufacturers, the global market for controlled and slow-release fertilisers is highly competitive and consolidated. In spite of this, it has been claimed that major manufacturers in the controlled and slow-release fertilisers market possess approximately a quarter of the global controlled and slow-release fertilisers market share.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Controlled Release Fertilizer market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Type

|

|

End Use

|

|

Mode of application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report