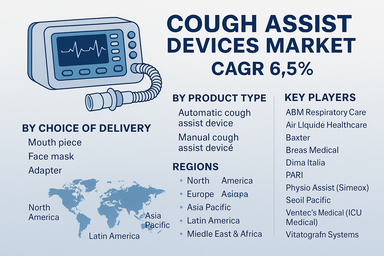

The global cough assist devices market is projected to grow at a CAGR of 6.5% from 2025 to 2033, driven by the rising prevalence of chronic respiratory diseases, neuromuscular disorders, and increasing demand for non-invasive airway clearance therapies. Cough assist devices are essential in patients with compromised respiratory function who cannot generate effective coughs to clear mucus or secretions. Growing awareness of respiratory health, technological advancements in automatic cough assist devices, and the expansion of home healthcare services are key factors fueling market adoption.

Rising Demand for Non-Invasive Respiratory Care

The rising incidence of conditions such as amyotrophic lateral sclerosis (ALS), muscular dystrophy, spinal cord injuries, and chronic obstructive pulmonary disease (COPD) is driving demand for cough assist devices. These devices reduce the risk of respiratory infections, improve oxygenation, and enhance patient quality of life. Increasing adoption in homecare settings, coupled with physician recommendations for non-invasive care, is strengthening global uptake. Automatic cough assist devices with adjustable pressure settings and integrated monitoring features are becoming more widely preferred, offering greater convenience and improved outcomes compared to manual devices.

Challenges: High Costs and Limited Awareness

Despite the promising outlook, the market faces challenges such as high costs associated with advanced devices and limited awareness in developing economies. Inadequate reimbursement frameworks and lack of trained healthcare professionals in certain regions restrict adoption. Furthermore, patient compliance can be a barrier, particularly in homecare use. However, expanding reimbursement coverage, rising investments in respiratory care training, and increasing focus on affordable portable devices are expected to mitigate these challenges and sustain steady growth.

Market Segmentation by Product Type

By product type, automatic cough assist devices dominate the market due to their effectiveness, advanced features, and widespread use in both hospitals and homecare environments. Manual cough assist devices remain relevant in resource-limited settings and among patients who require basic functionality at lower costs.

Market Segmentation by Choice of Delivery

By delivery method, mouthpieces are the most commonly used, offering convenience and ease of application in clinical and home settings. Face masks are widely adopted in pediatric and elderly populations, ensuring effective therapy for patients with difficulty holding a mouthpiece. Adapters are increasingly utilized to provide flexibility in device integration with existing respiratory systems, enhancing patient comfort and adaptability.

Regional Insights

In 2024, North America led the cough assist devices market, driven by high prevalence of respiratory disorders, strong reimbursement support, and the presence of leading healthcare technology companies. Europe followed, supported by government-backed healthcare systems and growing investments in homecare respiratory devices. Asia Pacific is the fastest-growing region, propelled by rising awareness of respiratory care, increasing healthcare expenditure, and expanding distribution networks in China, India, and Southeast Asia. Latin America and the Middle East & Africa remain emerging markets, where growing healthcare modernization and increasing demand for cost-effective respiratory solutions are creating new opportunities.

Competitive Landscape

The 2024 cough assist devices market was characterized by the presence of global medtech companies and specialized respiratory care innovators. Philips, Baxter, Smith’s Medical (ICU Medical), and Air Liquide Healthcare remain dominant players with strong product portfolios and global distribution. Breas Medical, ABM Respiratory Care, and Physio Assist (Simeox) are strengthening positions with advanced technology and patient-centric designs. PARI, Dima Italia, Seoil Pacific, Ventec Life Systems, Vitalograph, and West Care Medical contribute significantly to regional and niche markets. Competitive differentiation is being shaped by automation, portability, integration with monitoring solutions, and expansion into home healthcare delivery models.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Cough Assist Devices market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Choice of Delivery

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report